95% of major Bitcoin (BTC) pools have briefly signalled for Taproot activation, an upgrade that could boost BTC’s network with higher scalability, more security, and cheaper gas fees.

What is Taproot?

Taproot is an upgrade of the Bitcoin network. It integrates Schnorr Signatures, which is an alternative signature algorithm to the current ECDSA (Elliptic Curve Digital Signature Algorithm) implemented on the BTC network.

Taproot is a long-awaited update because it would bring many benefits to the BTC network, like lower fees, faster transactions, and scalability. Besides, the integration of Schnorr Signatures would make multi-signature multi-input transactions (UTXI) faster and more efficient.

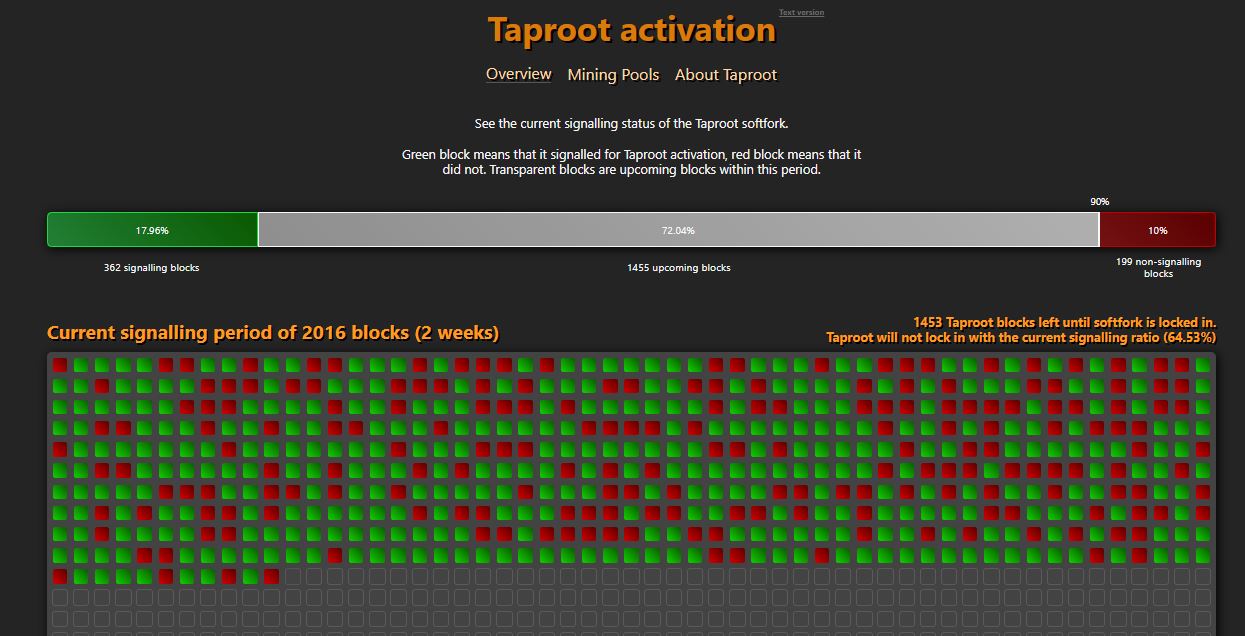

A Two-Week Period To Reach 90%

According to Taproot.watch, 9 out of 10 mining pools signalled for Taproot. However, there are still almost 200 non-signalling blocks at the time of writing.

The most recent mining pool that included an activation signal was the last pool of the top 10, BTC.Top, which represents 4.14% of the entire network’s hash power. The pool did so on block number 683,945.

While most miners have briefly shown support for Taproot, the upgrade seems unlikely for November 2021 considering the difficulty epoch for Bitcoin. The current signalling ratio is approximately over 64%, and a 90% consensus needs to be reached to move forward with the upgrade.

There is a two week period to reach 90% out of 2016 mined blocks with an activation signal. If reached, this could be one of the most innovative upgrades for the Bitcoin network since 2017, when block size was increased.