Investment giant Morgan Stanely has filed with the Securities and Exchange Commission (SEC) to allow Bitcoin exposure into multiple funds.

The bank filed the request on Thursday. According to the document, all institutional funds may gay exposure to Bitcoin indirectly through investments in Grayscale Bitcoin Trust (GBTC) or cash-settled futures.

Certain Funds may engage in futures contracts based on bitcoin. The only bitcoin futures in which a Fund may invest are cash settled bitcoin futures traded on futures exchanges registered with the CFTC.

Morgan Stanley SEC file

Investors Demanding Bitcoin

A few weeks ago, Morgan Stanley offered three Bitcoin funds to its wealthiest investors. Giving the inherent volatility of BTC, the bank will allow its clients to invest only 2.5% of their capital.

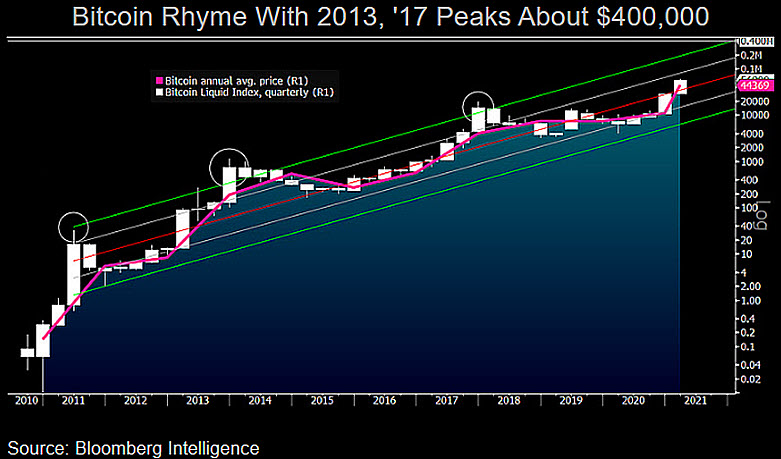

The bank has outlined that Bitcoin is a risky investment, and it will allow clients with a high tolerance for risk. Although this didn’t discourage investors from demanding more exposure to BTC as it rallies again to $60k.

Rumours were circulating that the investment giant was behind Bithumb, South Korea’s largest crypto-exchange. As reported, the bank could be negotiating with Bithumb Holdings to acquire 10% of shares — and even placing a $2 billion bid for the exchange.

At the time of writing, Bitcoin is trading at $59,000, down 0.50% in 24 hours, with technicals pointing at a strong buying sentiment.