The Australian Tax Office (ATO) may put more pressure on Aussie crypto-traders and investors this year – as cryptocurrencies become more popular among the general Aussie population.

As recently reported by Yahoo Finance, the ATO could be targeting up to 1 million Australians who have invested in cryptocurrencies and have failed to report their profits in their tax returns.

The ATO to Collect Data From Exchanges

Likewise, the agency is collecting data directly from crypto-exchanges in Australia, and using an intelligent data-matching program they can detect which users are not paying their taxes.

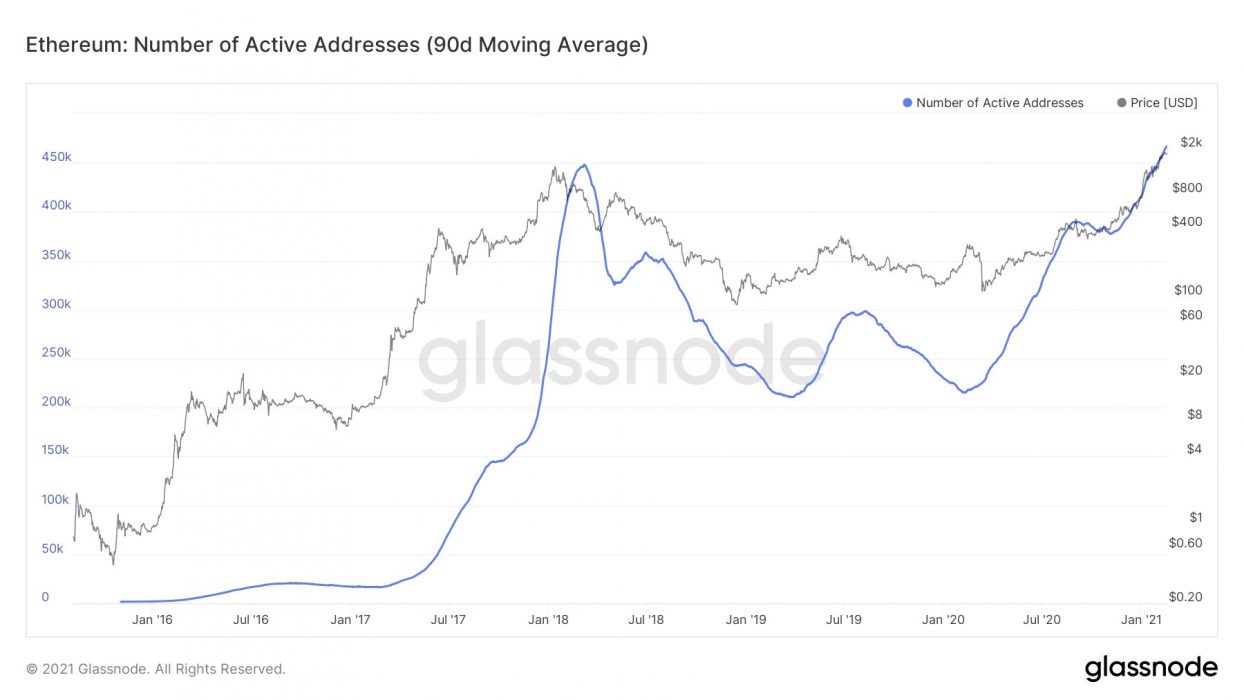

The demand for crypto in Australia has increased so much that the ATO may focus more than ever on cryptocurrencies, especially as Bitcoin has skyrocketed in price this year and most people are in profits. The demand for cryptocurrencies even surpassed the popularity of precious metals in the country according to our sources.

Even Australians over 50 years old are using their SMSFs to invest in cryptocurrencies, and younger traders are HODLing cryptos in their portfolios – some with no plans to sell anytime soon.

“Crypto Money” Laundering Schemes

The ATO’s interests may also be sparked by so-called “money laundering schemes” in the country. An IRS – Internal Revenue Services Criminal Investigation Unit – agent was sent to Australia as a joined effort to tackle schemes related to cryptocurrencies.