Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Uniswap (UNI)

Uniswap UNI is a popular decentralised trading protocol known for its role in facilitating automated trading of decentralised finance (DeFi) tokens. Uniswap aims to keep token trading automated and completely open to anyone who holds tokens, while improving the efficiency of trading versus that on traditional exchanges. Uniswap creates more efficiency by solving liquidity issues with automated solutions, avoiding the problems which plagued the first decentralised exchanges.

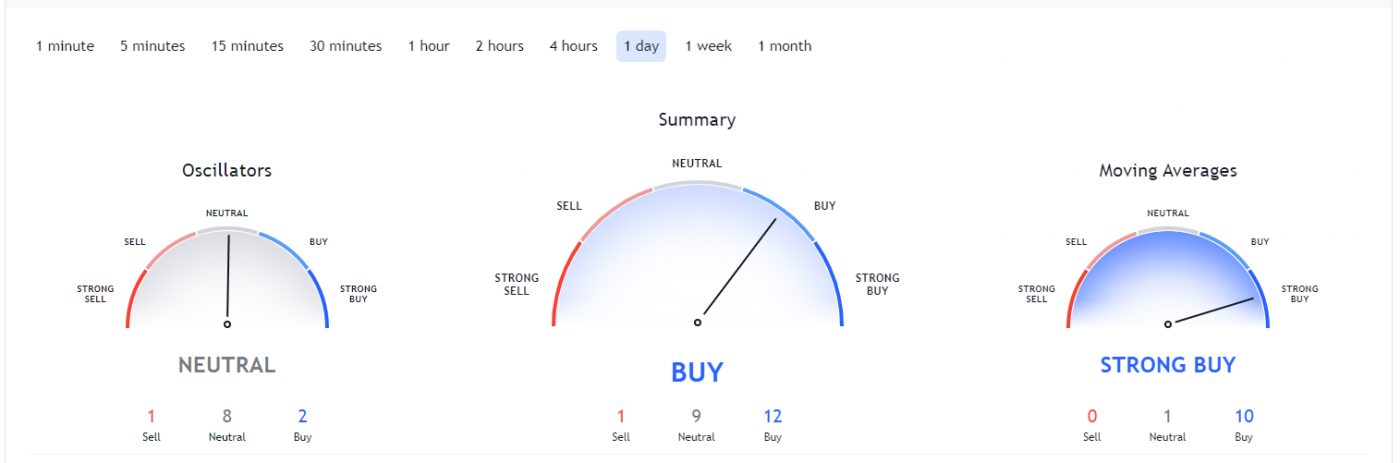

UNI Price Analysis

At the time of writing, UNI is ranked the 11th cryptocurrency globally and the current price is A$41.28. Let’s take a look at the chart below for price analysis:

UNI‘s nearly 55% retracement from its early May high found a low near A$23.89 in late June before July’s bullish trend began. The price is currently approaching resistance at a swing high near A$43.57. If this level breaks, bulls might target the swing highs near A$47.19, A$48.67, and potentially up to A$50.22. Resistance near A$53.12 and A$56.81 could cap this move.

If the market remains bullish for the near term, bulls might buy at A$45.33. However, a stop run into A$37.74 could offer a higher probability entry. A steeper drop could reach below the swing low into possible support near A$34.17.

2. Tezos (XTZ)

Tezos XTZ is a blockchain network that’s based on smart contracts, in a way that’s not too dissimilar to Ethereum. However, there’s a big difference: Tezos aims to offer infrastructure that is more advanced – meaning it can evolve and improve over time without there ever being a danger of a hard fork. This is something both Bitcoin and Ethereum have suffered since they were created. People who hold XTZ can vote on proposals for protocol upgrades that have been put forward by Tezos developers.

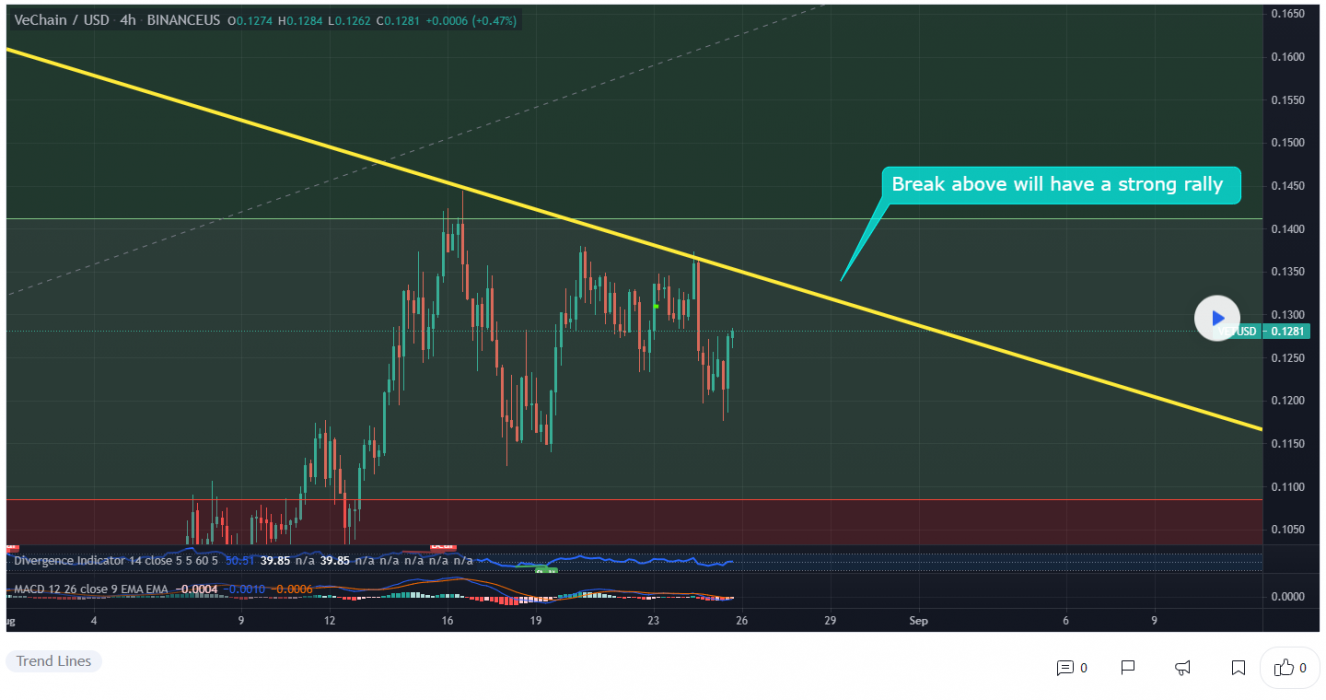

XTZ Price Analysis

At the time of writing, XTZ is ranked the 34th cryptocurrency globally and the current price is A$7.24. Let’s take a look at the chart below for price analysis:

XTZ‘s chart paints a different picture to many other altcoins, with May’s high leading to a massive range before setting a low near A$3.15 in July.

The near 82% spike within two weeks at the beginning of August makes immediate bids questionable. However, the price may be finding support near A$6.89 and possibly near A$6.23. Since the price swept the impulse’s high at A$6.50, bulls might be waiting to enter near the swing low and gap near A$5.88, or slightly lower near A$5.12.

Little resistance lies overhead, although some might exist between A$7.55 and approximately A$7.79, just above the current price. A sweep and rejection of the high near A$8.27 would make most areas of possible support highly suspect and could mark the end of the bullish trend.

3. Band Protocol (BAND)

Band Protocol BAND is a cross-chain data oracle platform that is able to take real-world data and supply it to on-chain applications, while also connecting APIs to smart contracts to facilitate the exchange of information between on-chain and off-chain data sources. BAND is the native token of the Band Protocol ecosystem and is used as collateral by validators involved in fulfilling data requests, as well as being the main medium of exchange on BandChain, used to paying for private data.

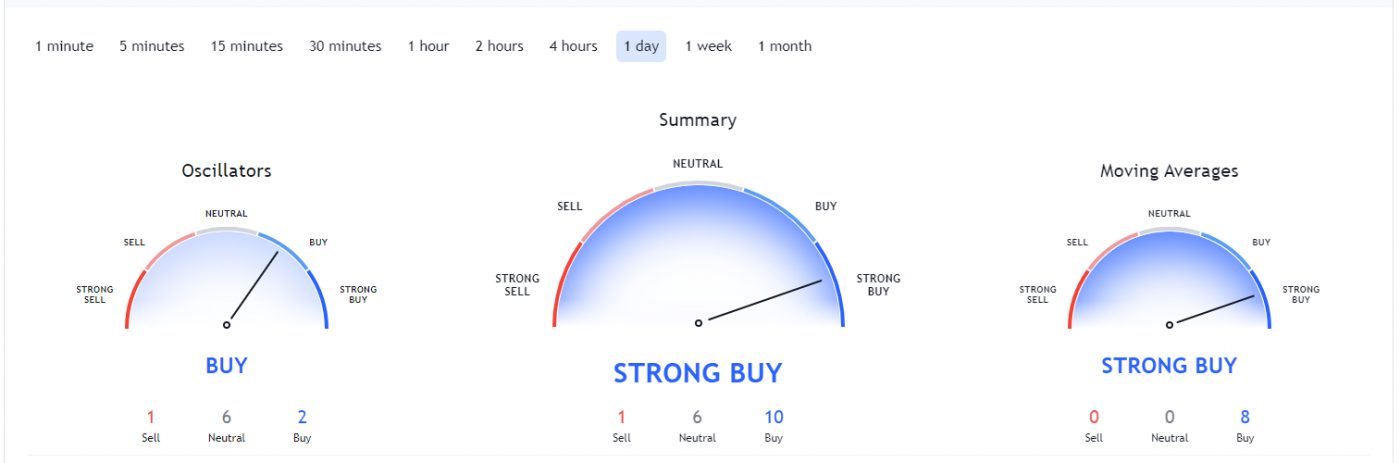

BAND Price Analysis

At the time of writing, BAND is ranked the 156st cryptocurrency globally and the current price is A$13.29. Let’s take a look at the chart below for price analysis:

Like many other altcoins, BAND set a high around mid-April before retracing 83% to the low at A$7.89 in June.

Price broke through resistance near A$11.48, which may mark an area of possible support on a retracement. If this support fails, bulls might also step in near A$11.26. However, a drop this far increases the chances of a stop run to A$10.91 and possibly into support near A$10.23. For now, continuing bullish market conditions could help A$12.37 become support.

The swing high around A$15.66 gives bulls a reasonable first target, with A$15.84 also likely to draw the price upward. Higher-timeframe resistance beginning near A$16.58 or A$17.00 could cap the move or trigger consolidations. If bullish market conditions continue, bulls might test probable resistance near A$17.52.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.