Bitcoin hits a fresh record high above $30,000 AUD on Thursday, extending a wild rally for the cryptocurrency that has seen it more than triple in value this year.

The world’s most valuable digital currency surged +15% to $30,902 AUD according to crypto market data provider Coin Metrics, taking its year-to-date gains to more than +200%.

What is Bitcoin?

Bitcoin is a decentralized cryptocurrency originally described in a 2008 whitepaper by a person, or group of people, using the alias “Satoshi Nakamoto” It was launched soon after, in January 2009.

Bitcoin is a peer-to-peer online currency, meaning that all transactions happen directly between equal, independent network participants, without the need for any intermediary to permit or facilitate them. Bitcoin was created, according to Nakamoto’s own words, to allow “online payments to be sent directly from one party to another without going through a financial institution.”

Bitcoin Quick Stats

| SYMBOL: | BTC |

| Global rank: | 1st |

| Market cap: | $551,313,622,271 AUD |

| Current price: | $30,124 AUD |

| All time high price: | $30,902 AUD |

| 1 day: | +15.96% |

| 7 day: | +24.53% |

| 1 year: | +241.59% |

Bitcoin Price Analysis

At the time of writing, Bitcoin is ranked 1st cryptocurrency globally and the current price is $30,124 AUD. This is a +24.53% increase since 11th December 2020 (7 days ago) as shown in the chart below.

After looking at the above 8-hour candle chart, we can clearly see that Bitcoin was trading inside the rising wedge pattern on the BTC/USDT pair. The first resistance was on the $26,151 AUD price levels which BTC broke with a strong bullish trend buying volume and made a new all-time high above +$30k AUD. Seeing that the whole crypto market is waking up bullish today, Bitcoin is likely to continue the uptrend to make new all-time high prices.

“A rising wedge is a technical indicator, suggesting a reversal pattern frequently seen in bear markets. This pattern shows up in charts when the price moves upward with pivot highs and lows converging toward a single point known as the apex.”

The cryptocurrency rose by more than +15% on Thursday to reach $30,472 against the AUD, extending a winning streak this year amid growing interest among big investment companies attracted to its potential for quick gains.

The price of bitcoin has surged by more than +400% this year from a low point of around $4,718 AUD in March when the coronavirus pandemic triggered a deep sell-off in financial markets around the world.

Analysts said that unlike in previous surges, a major price driver appeared to be more institutional investors buying into the cryptocurrency.

What do the Technical Indicators say?

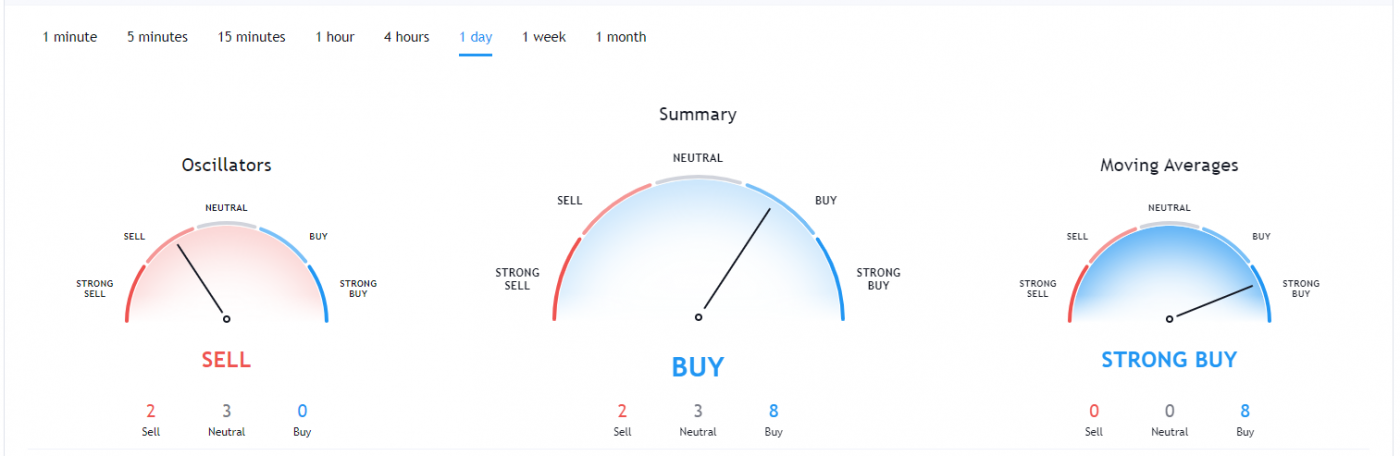

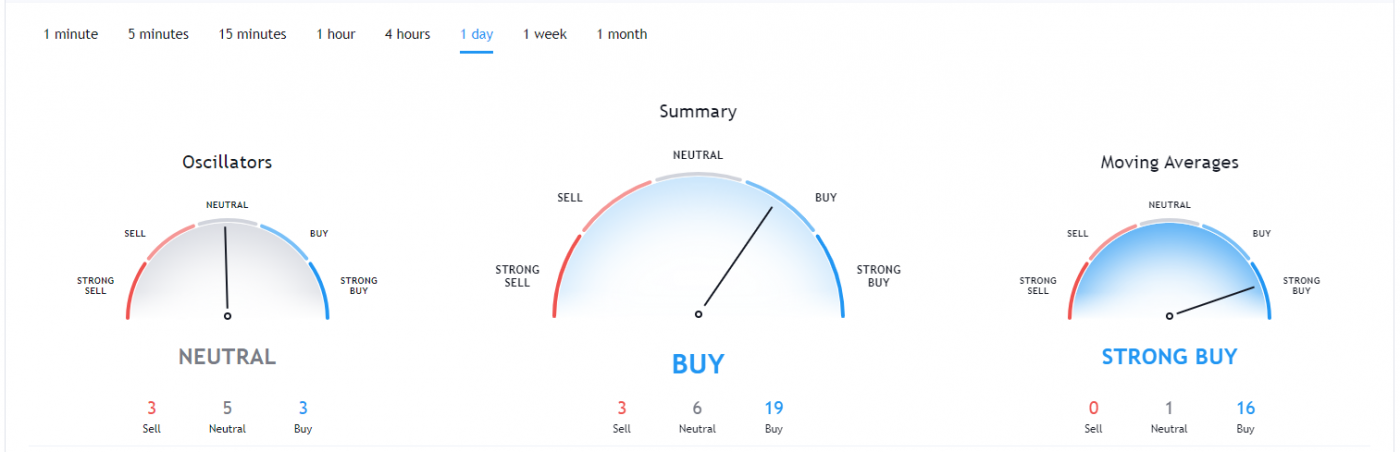

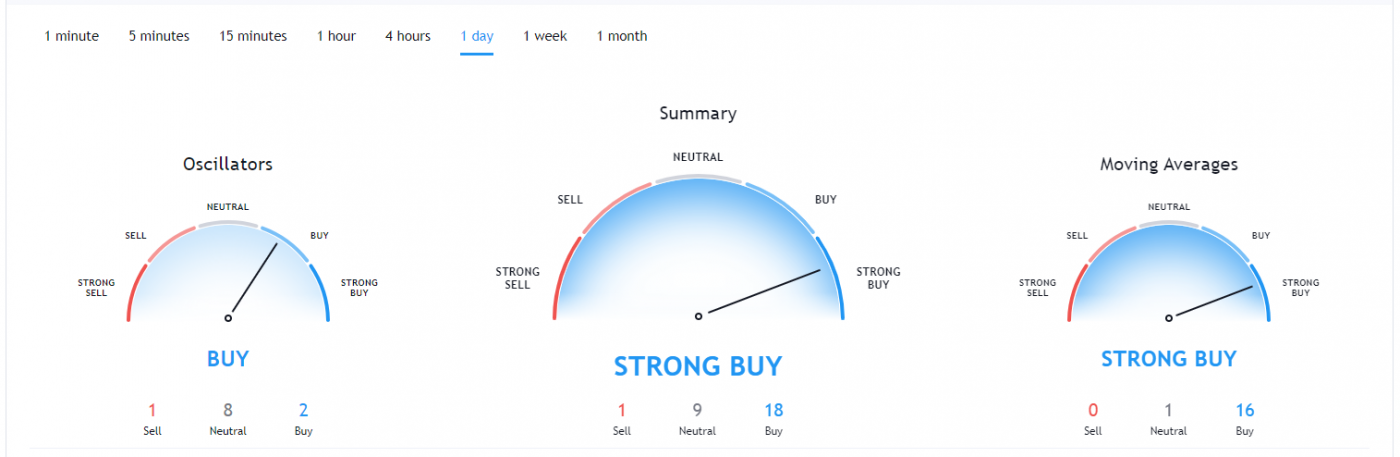

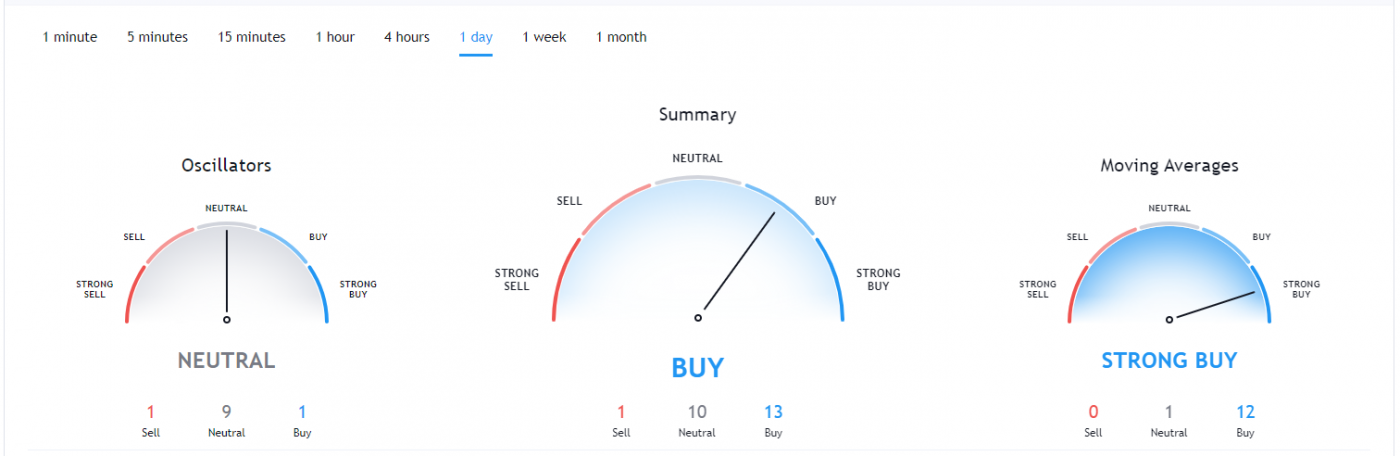

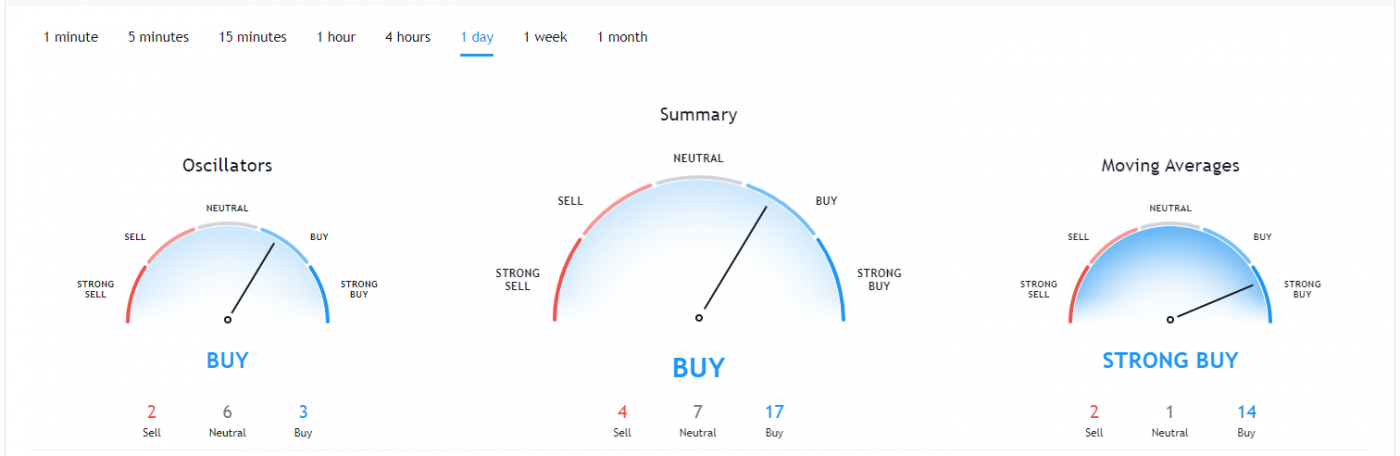

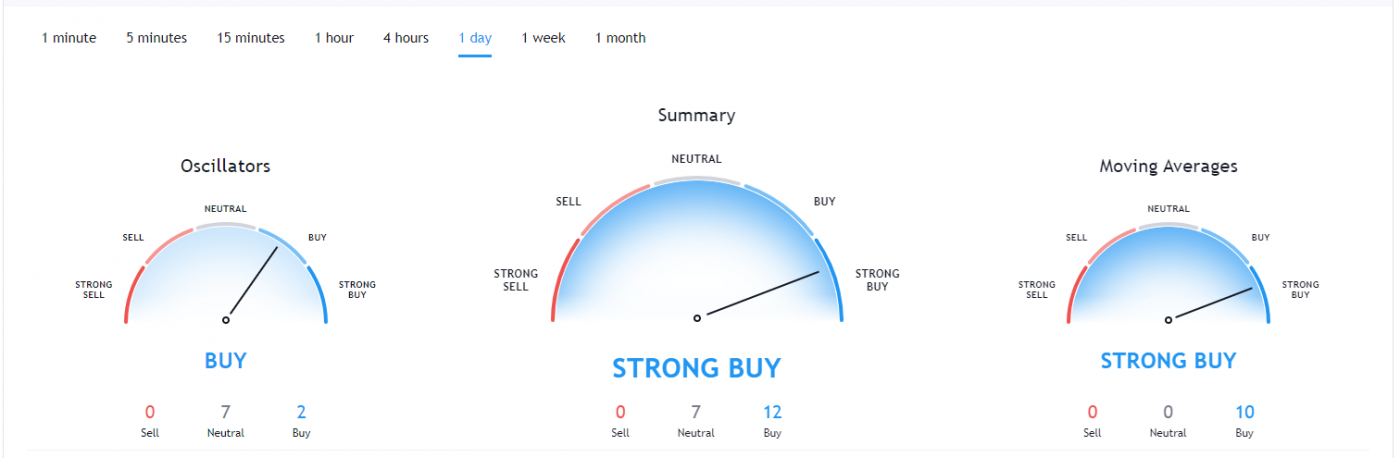

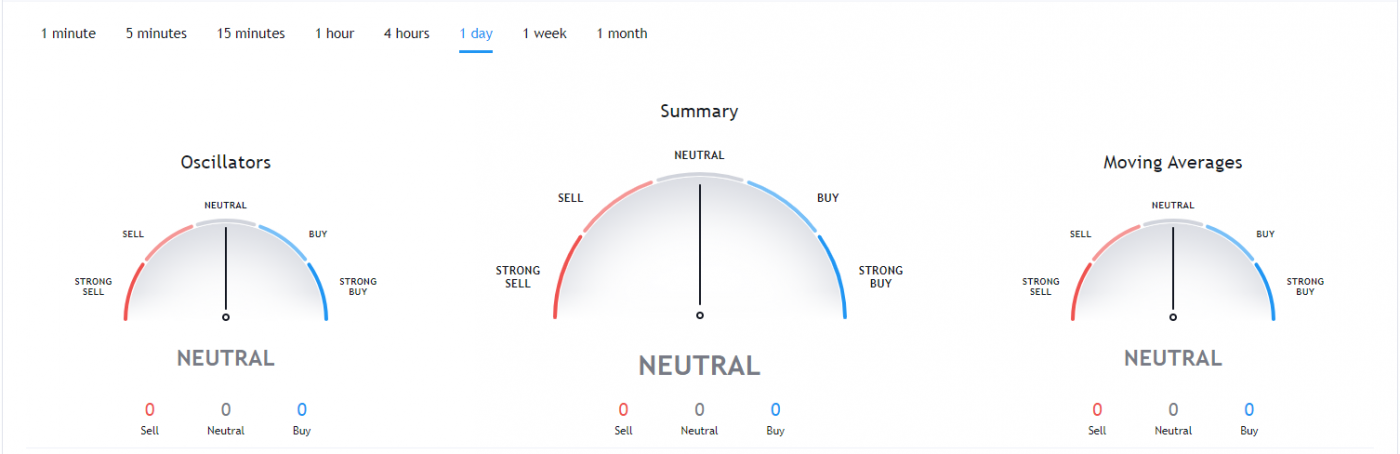

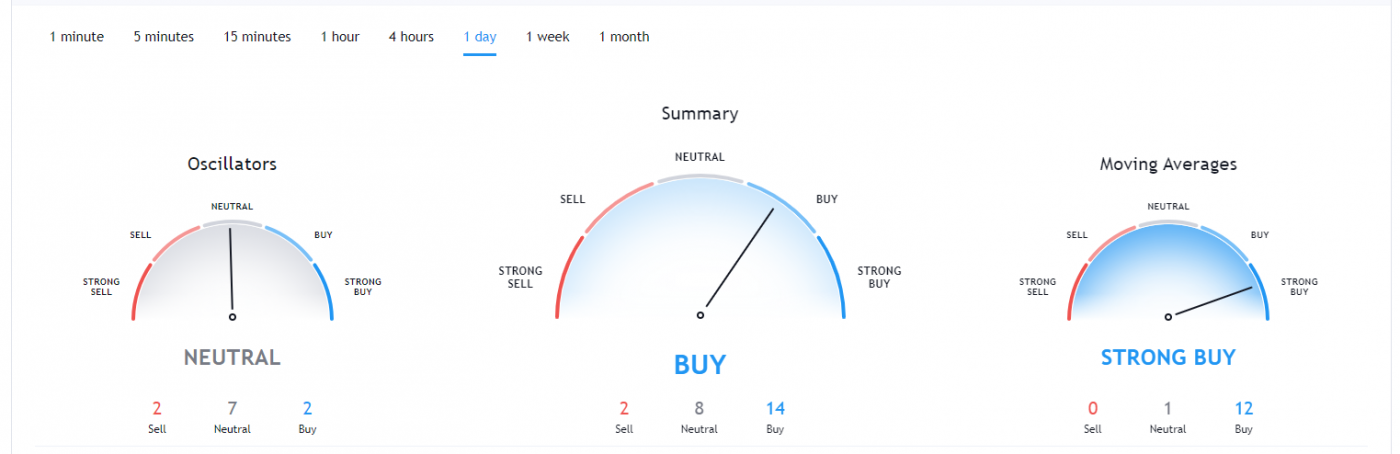

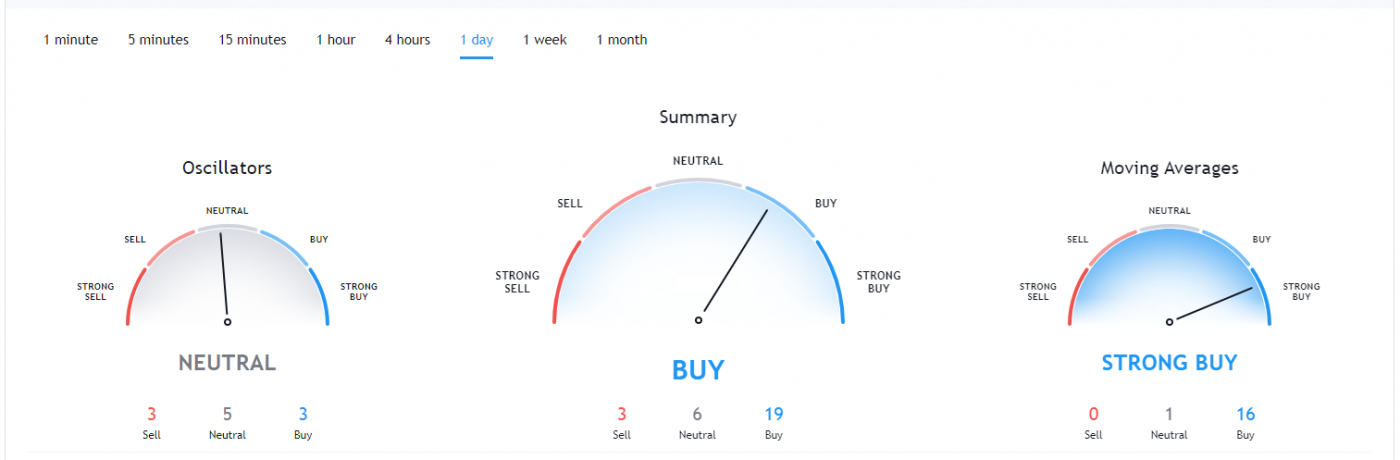

The Bitcoin TradingView indicators (on the 1 day) mainly indicate BTC as a buy, except the Oscillators which indicate BTC as a neutral.

So Why did Bitcoin Breakout?

The recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout of Bitcoin. Another reason could be the whales, secretly stacking up Bitcoin to their portfolio for the next bull run rally.

A few other reasons for Bitcoin’s return to the record highs. It’s about $30,124 as of this writing, matching the previous highs from 2017’s original explosion.

Reason One: Paypal and Square’s Cash App, according to reports, are in a race to acquire enough Bitcoin to facilitate the next generation of their money transferring services. They both seek to allow their massive user bases to be able to seamlessly transact with merchants in Bitcoin, moving money back and forth from sovereign currencies into Bitcoin, etc.

Reason Two: Wall Street legends are being won over. Don’t underestimate the pull of FOMO, peer pressure, idol worship, etc, Read this article in Barron’s about how institutions are afraid of missing out.

Reason Three: Gold and Silver aren’t “working.” Go look at a chart of gold or a gold ETF since the summer. It peaked in July in US dollar terms. The weakening (some would say plunging) dollar is one of the biggest macro stories around right now. Gold should be rallying. So far it’s not. Just fell below its 200-day last week.

Recent Bitcoin News & Events:

- 05 October 2020 – Token 2049

- 15 October 2020 – Schnorr/Tapproot Merge

- 05 November 2020 – Hong Kong Meetup

- 09 May 2024 – Block Reward Halving

Where to Buy or Trade Bitcoin?

Bitcoin has the highest liquidity on Binance Exchange so that would help for trading USDT/BTC pair. However, if you’re just looking at buying some quick and hodling Bitcoin then Swyftx Exchange is a popular choice in Australia.