El Salvador is leading Bitcoin adoption in Central and South America, declaring it will launch 1,000 Bitcoin ATMs across the country for buying and selling BTC.

The 1,000 new Bitcoin ATMs will be installed by Athena Bitcoin, which has established a strong presence in the Bitcoin ATM market and currently operates across the US, Colombia, Argentina and El Salvador.

Earlier this month, El Salvador became the first country in the world to recognise Bitcoin as legal tender. President Nayib Bukele stating that his country is “adopting Bitcoin for the benefit of the people“. Bukele, who many see as a revolutionary, also announced plans for a volcano-powered Bitcoin mining facility.

The Rise of Crypto ATMs

Chainbytes, another crypto ATM company, is also keen to get in on the action. It recently announced that it wants to “make El Salvador the manufacturing hub of Bitcoin ATMs for all of the Americas”.

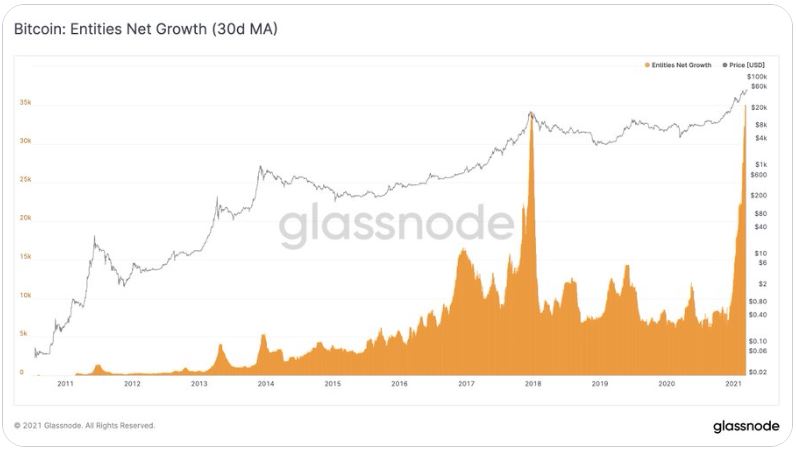

There are approximately 22,000 crypto ATMs operating in the world today. ATM installations have increased by over 10,000 in the past year alone. These numbers seem to be a reliable barometer for worldwide crypto adoption.

In Australia, Bitcoin ATMs do exist but are very rare, and almost non-existent outside of the capital cities. But as worldwide crypto adoption surges forward, access to crypto ATMs in Australia should increase as well.