The amount of electricity needed to power Bitcoin increases every year. And a recent study has shown that Bitcoin network may soon consume up over 200 Terrawat hours (TWh) every year. To put that into perspective, The entirety of Australia consumed around 192 TWh worth of power in 2020.

Currently the Bitcoin network consumes 83 TWh of electrical energy, with this number suggested to continue increasing as calculated by the University of Cambridge’s model, setting the average electricity cost to 7 cents per kWh, would put the upper bound of Bitcoins annualised consumption up to 272 TWh.

Environmental Impact

Most cryptocurrencies are now mined on huge “mining farms”, where racks and racks of specialized mining devices, high-end GPUs and the like run all day solving the complex equations that allow Bitcoins to be mined.

Concerns regarding the environmental impact of using this much power are not new. Neither are concerns regarding the amount of energy siphoned off of the power grid, to the point where some regions in China, for instance, have stopped providing power to crypto farmers.

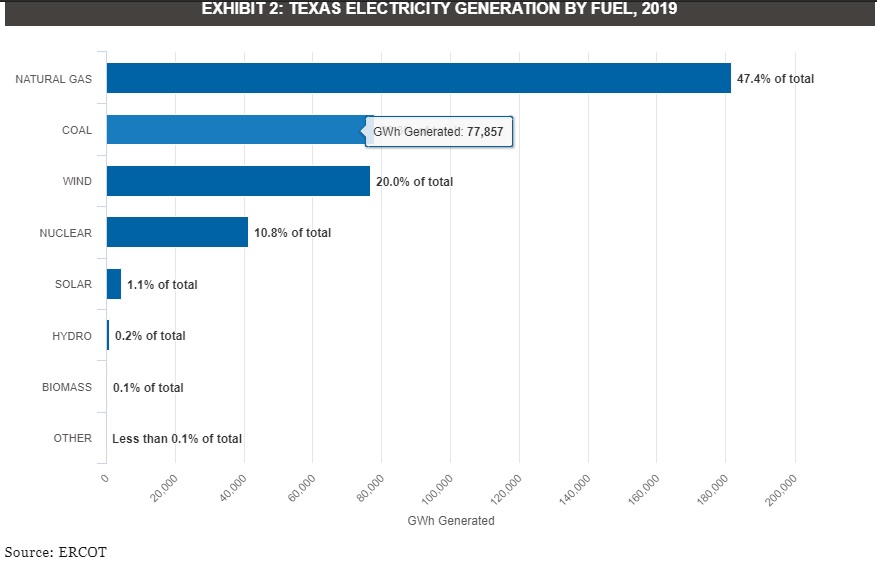

According to a study carried out at Cambridge University, around 61% of Bitcoins are mined using petrol and other non-replenishable sources of fuel. The remaining 39%, however, are mined using renewable energy.

It seems this segment is even being advertised by certain companies. Daniel Roberts – the co-founder of an Australian firm involved with crypto mining named Iris Energy – stated that investors may be creating a market for “renewably-mined Bitcoins.”

“Our unique energy strategy and ESG (environmental, social and governance) overlay mean that we also satisfy investors with green and climate-related commitments. All of our operations today are powered by excess renewable energy.”

The power consumption rate of Bitcoin mining will only become thornier as the difficulty of mining increases – so a push for the use of green energy now may save the industry more trouble than if it were to be implemented later.

Bitcoin Cryptojacking

One unintended positive affect that has arisen due to the increase in power, it the decrease in the unauthorised Bitcoin mining on peoples computers – known as cryptojacking.

Although the number of complaints regarding cryptojacking software running in the background on your PC has gone down, that’s mostly due to the fact that the ever-increasing complexity of mining Bitcoins requires more and more power, making methods not worth the effort.