As conflict between Russia and the Ukraine intensified, it wasn’t clear whether bitcoin would act as the “risk-on” asset it has been in the past. However, as Russian citizens scramble to get their money out of ATMs after being cut off from the SWIFT system, geopolitical turmoil has seemingly done the improbable, causing bitcoin to surge by 15 percent overnight.

Bitcoin Flippens Russia’s Ruble

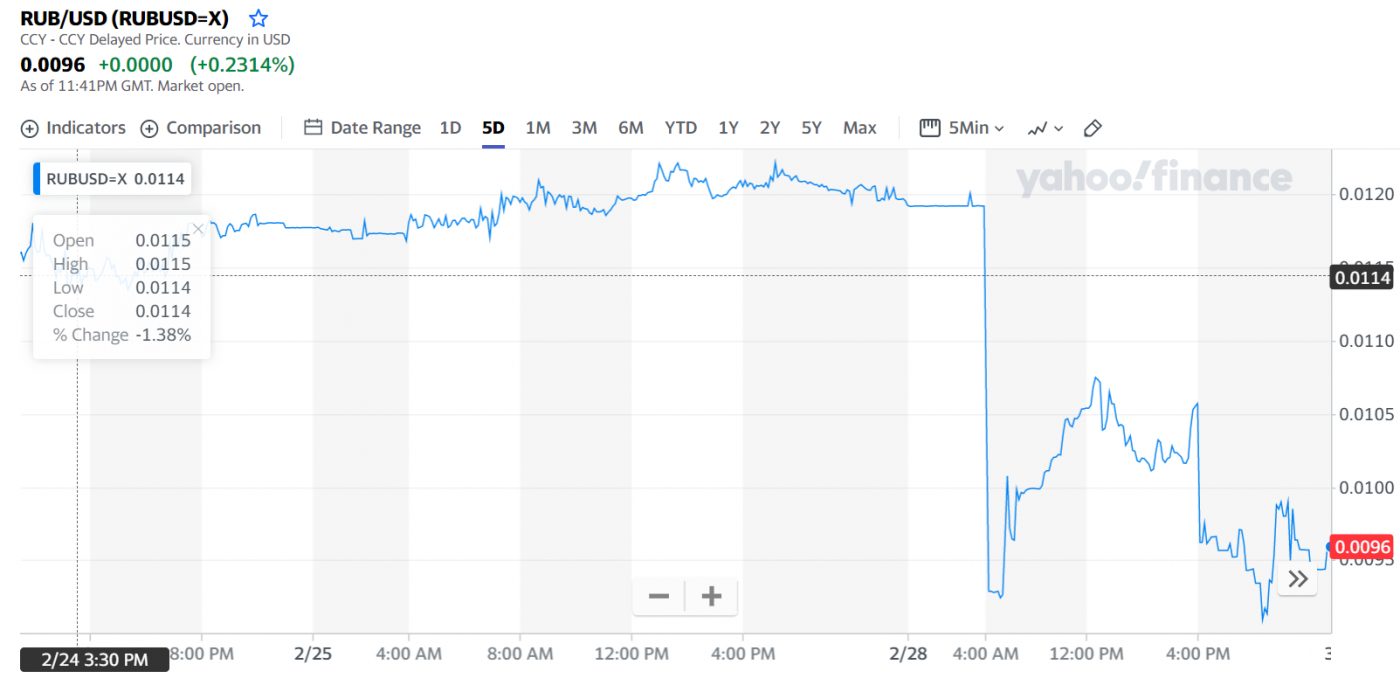

Since its invasion of Ukraine, Russia’s domestic currency, the ruble, has collapsed in dramatic fashion against the US dollar by some 30 percent.

As a result of bitcoin’s gains and the ruble’s precipitous downfall, bitcoin soon overtook the Russian ruble by market cap in a so-called “flippening”.

Bitcoin Now Risk-Off?

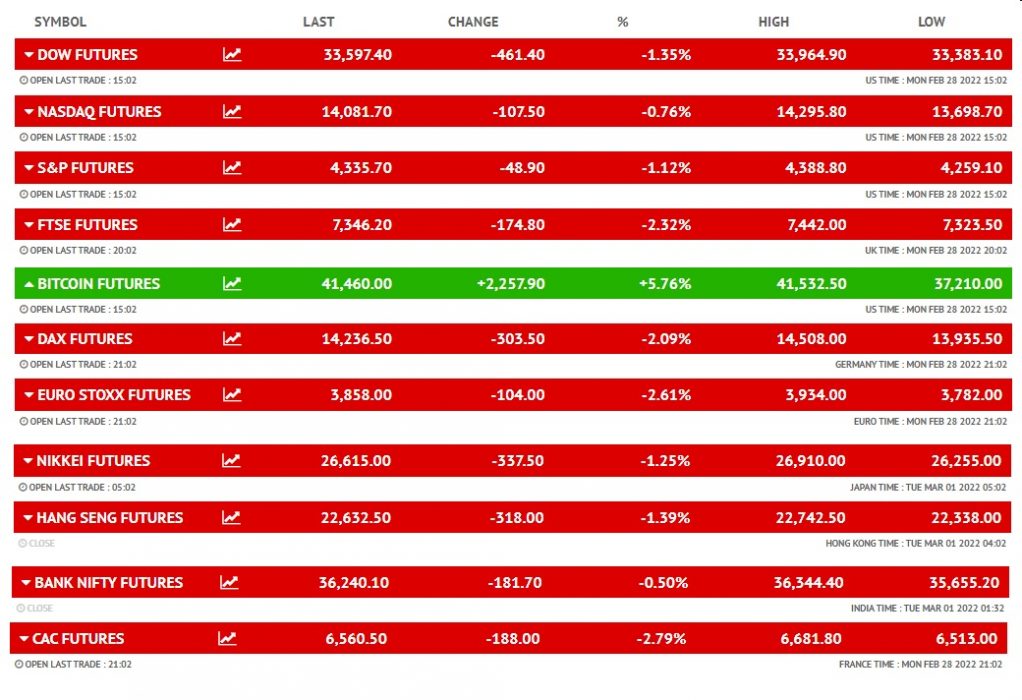

As markets shifted in a distinctly “risk-off” direction, equity futures were slammed. Curiously, however, bitcoin futures were up, suggesting that perhaps it doesn’t always trade as a high-risk technology stock.

What’s Driving the Price Action?

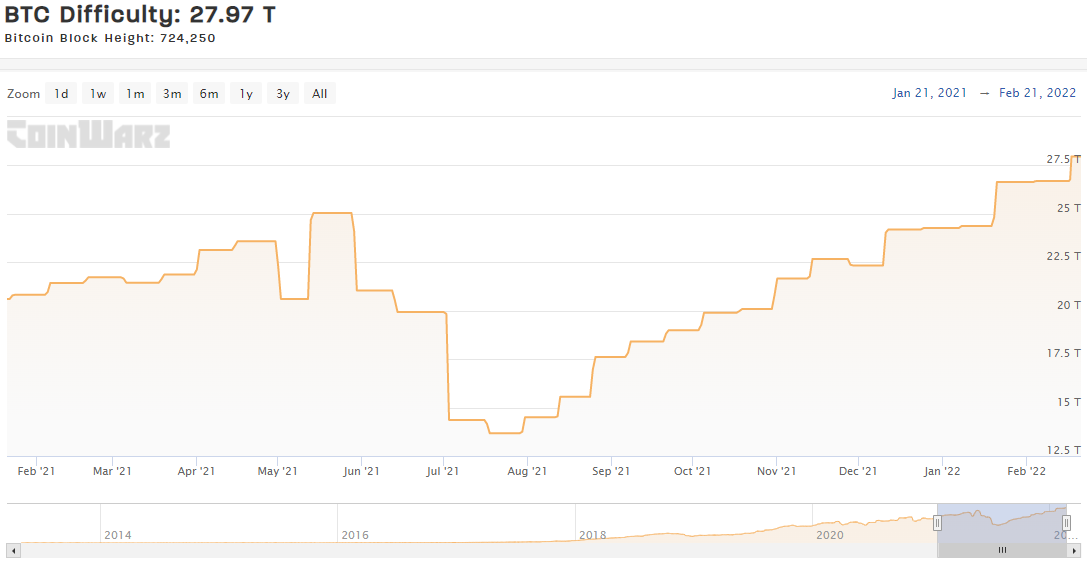

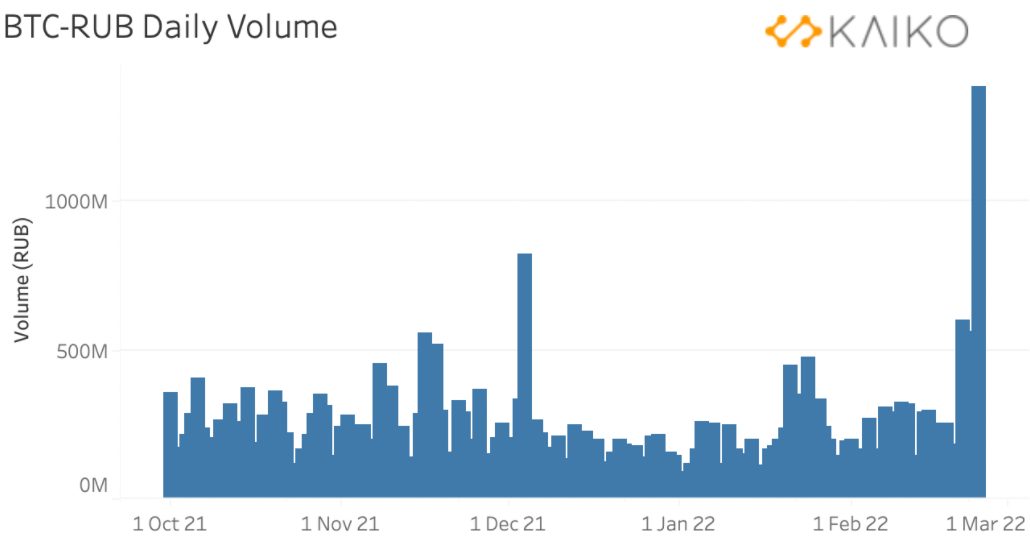

The first, and most obvious, inference is that Russians are flocking to buy bitcoin in unprecedented volumes as they watch their local currency collapse. No doubt they are seeking refuge in a fixed-supply, decentralised, and unconfiscatable digital asset. This is reflected in BTC/Ruble trading volume figures:

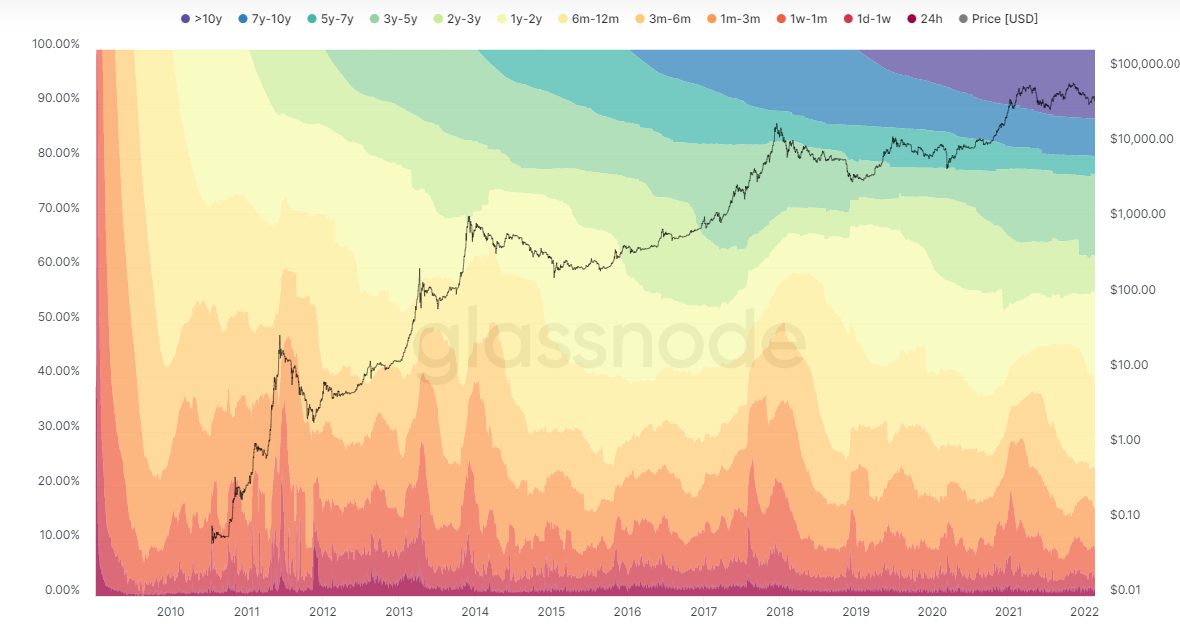

This is also supported by Glassnode data which illustrates that we’ve now reached an all-time high of non-zero BTC addresses:

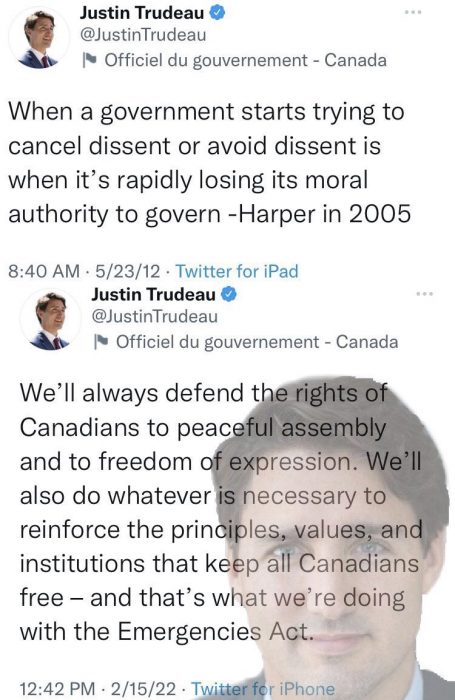

A second argument that podcaster Natalie Brunell makes is that this crisis, together with Canada freezing bank accounts of protesters, serves only to raise the profile of Bitcoin as a permissionless, censorship-resistant, borderless form of money that you can custody yourself.

Bitcoin’s overnight rise, while unexpected to some, is viewed by others as an entirely logical consequence of a debt-backed fiat system beginning to fray at the edges. That said, the situation in Ukraine remains complex is evolving. Time will tell how Bitcoin responds in the coming weeks and months.