Lightning Network payment platform Strike is allowing its users in the US to instantly convert all or a portion of their paycheques into bitcoin. The company, well known for its work in El Salvador, is following the lead of Coinbase, which recently started allowing its users to convert their salaries to crypto and be paid in bitcoin (BTC).

‘Pay Me In Bitcoin’ Now Active

From October 15, Strike’s “Pay Me In Bitcoin” feature allows users to enable direct deposits and configure any amount of money coming into their accounts to be converted into bitcoin with no fees attached.

Strike began experimenting with the feature last year when National Football League player Russell Okung used the payment platform to split his salary between bitcoin and fiat. Several other athletes and content creators have since followed in Okung’s footsteps.

“Pay Me In Bitcoin” gives anyone in the US easy access to sound money for anybody eligible for a Strike account, regardless of who they work for. In the words of company founder and CEO Jack Mallers, “Today, anyone with a Strike account, no matter who their employer, can get paid in bitcoin.”

Seeking to Give Financial Freedom

The new feature seeks to give financial freedom to those who cannot get paid directly in BTC. Almost anybody in the US or El Salvador can sign up for Strike and start saving a portion of their income in BTC automatically. It will also enable users to shield themselves from high inflation rates and have more control over their money.

If you are not getting a 25 percent raise every year and you are saving in dollars, you are not out-earning or out-saving the rate of inflation or the increase in cost of living, and your quality of life will degrade as time goes on.

Jack Mallers, founder and CEO, Strike

Mallers has been vocal as to the benefits of BTC:

Strike Involved in El Salvador and Twitter Tips

Twitter has recently rolled out Bitcoin Tips, which allows users to tip each other using Bitcoin’s Lightning network. One of the two payment options Twitter has made available is through Strike, which can connect to the Lightning Network.

Since the Central American republic made bitcoin legal tender last month, Strike has been integral in helping El Salvador build its national bitcoin-based payments system.

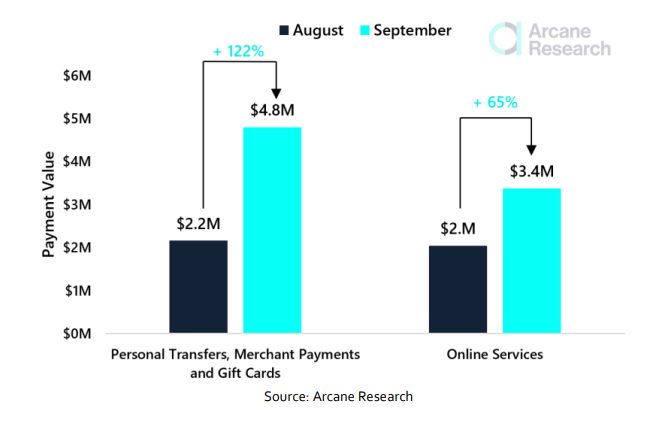

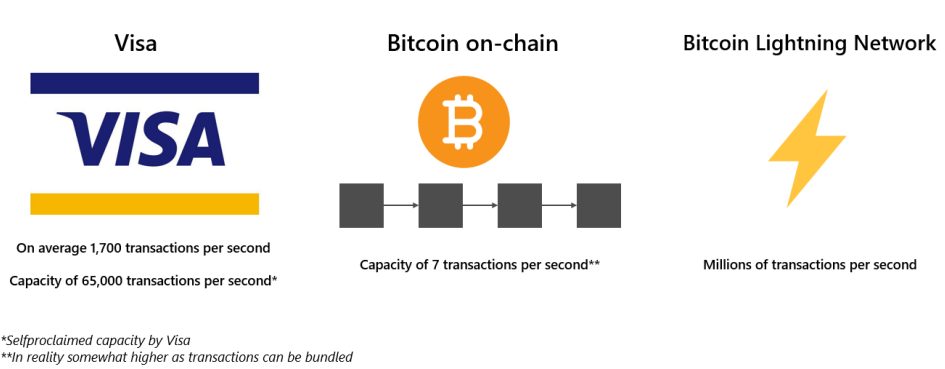

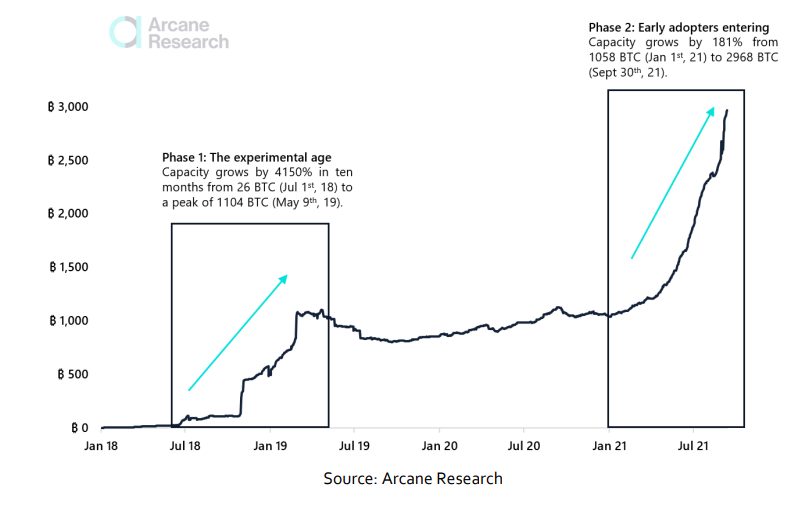

This latest announcement from Strike comes at a particularly good time for Lightning Network, which has seen 122 percent growth in the past few months.