The Brazilian Chamber of Deputies, the equivalent of Australia’s House of Representatives, has approved legislation to legalise the use of cryptocurrencies as a payment method throughout the South American nation. Before the legislation becomes law, however, it must be approved by the executive branch of the Brazilian government.

The new law will not recognise Bitcoin or any other cryptocurrency as legal tender, as was done in El Salvador last year. Instead, it adds cryptocurrencies to the definition of legal payment methods within the country, along with air mileage rewards programs.

Details of the New Legislation

The bill containing the new legislation, which was authored by Aureo Ribeiro, was passed by Brazil’s senate in April of this year but has been stuck in the nation’s lower house for several months.

In addition to recognising crypto as a legal payment method, the new law will allow for the creation of licenses for cryptocurrency exchanges, crypto custody providers and virtual asset managers.

The law will also require that exchanges avoid the commingling of company assets and their customer’s assets, in what appears to be an attempt to avoid a repeat of the FTX collapse.

Legislation Creates New Crime

The bill also establishes the new crime of fraud involving virtual assets with a minimum penalty of two years in prison and a maximum of six years, plus a monetary fine.

It also adds to Brazil’s regulatory framework around crypto, declaring that any virtual assets defined as securities will be regulated by the nation’s securities watchdog, the CMV. Assets not defined as securities will be regulated by a body yet to be determined by the executive branch but expected to be the central bank.

Companies will have 180 days to comply with the new legislation after it passes into law.

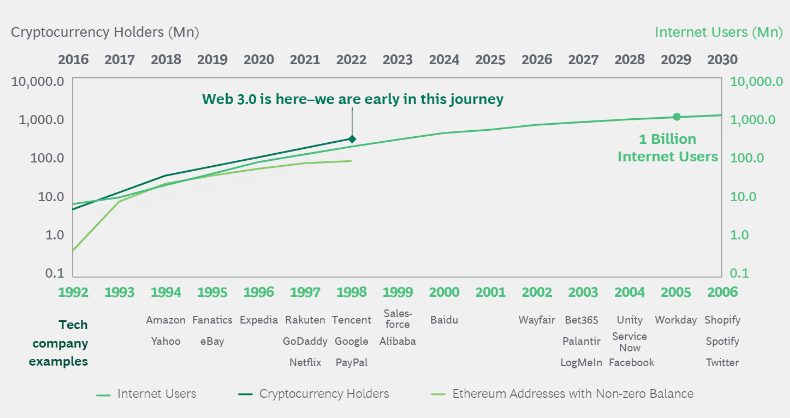

What it Means for Crypto’s Growth

Once the new legislation is signed off by the executive branch, banks in Brazil could start allowing customers to pay for goods and services using crypto as an alternative to credit and debit cards, which may lead to significant growth in the use of cryptocurrencies.

Already, some banks in Brazil have begun offering crypto-based services — in October, the Warren Buffet-backed neobank, Nubank, announced its plan to launch its own cryptocurrency in the first half of 2023.