Widespread crypto adoption may be one step closer to reality in Australia with more companies following a global trend in holding bitcoin on their balance sheets.

According to Swyftx, a popular Queensland-based cryptocurrency exchange, there has been a significant increase in small and medium-sized businesses using its platform to buy crypto.

Swyftx’s customer base has gone parabolic, increasing from 15,000 users a year ago to over 300,000 at present. Around six per cent of these accounts hold more than A$250,000 in assets.

We’ve got accounting firms. We’ve got building and construction companies. We’ve got property development companies. We’re seeing a pretty large uptick in these types of accounts.

Tommy Honan, Swyftx head of strategic partnerships

Aussie Companies Follow MicroStrategy and Tesla

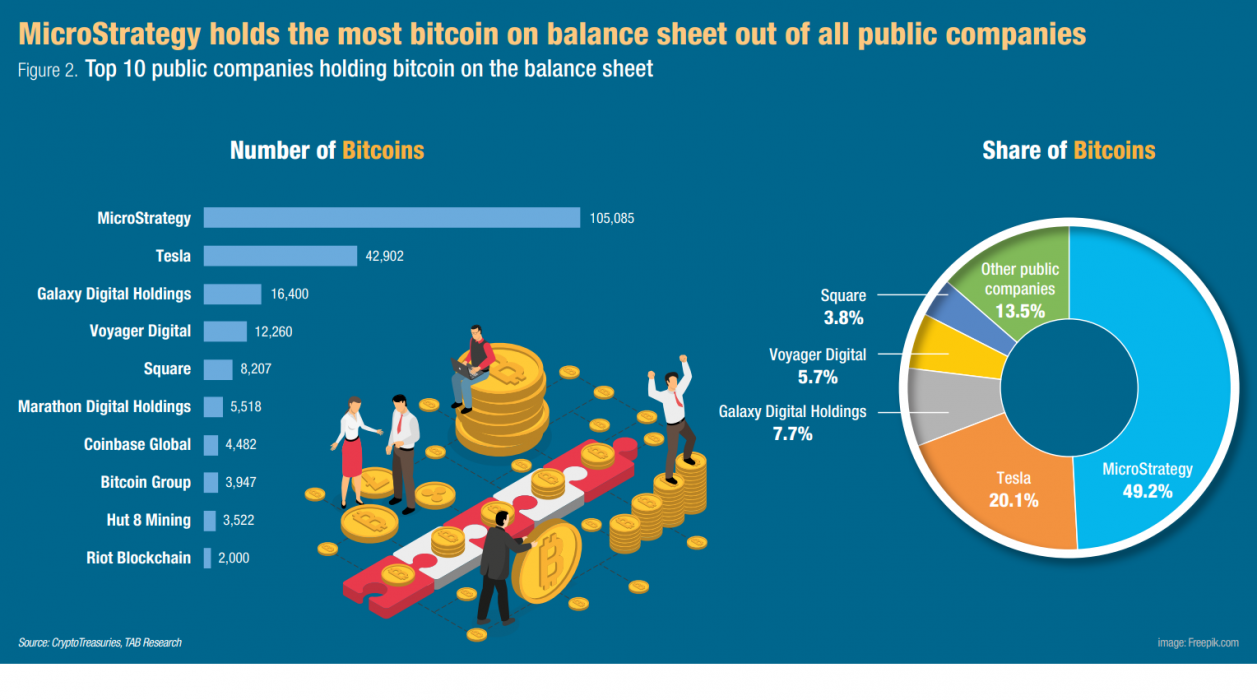

Honan believes Australian companies are emulating big multinationals such as Tesla and MicroStrategy, who have large bitcoin balance sheets. In February, Tesla dropped a cool US$1.5 billion into bitcoin, which many believe fuelled the run-up to April’s all-time high. According to CoinGecko, Tesla currently owns 48,000 BTC worth US$1,562,519,291.

Last month, MicroStrategy added another US$500 million worth of bitcoin to its holdings. MicroStrategy currently holds 105,085 BTC worth US$3,420,777,911 and in May announced revenue growth of 10 percent for 2021.

Australian Companies Enter the Race

At present, there is only one Australian company in the top 20 in terms of global public company BTC holdings. DigitalX, an Australian tech and finance company, holds 215 BTC but, if the trend continues, we could see more Australian companies populating this list in years to come.