Goldman Sachs investors don’t seem to agree on whether Bitcoin (BTC) is an investable asset or not.

The multinational investment bank issued a report on June 15 called “Digital Assets: Beauty Is Not in the Eye of the Beholder” – concluding that Bitcoin is no longer an investable asset.

Bitcoin is Not “Digital Gold“

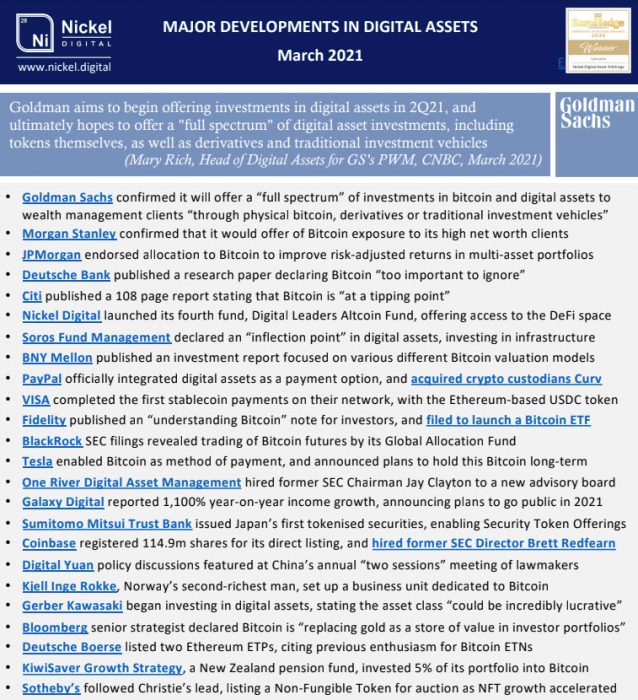

This new report was issued by the bank’s Investment Strategy Group and contradicts its plans to launch crypto investment services in Q2 for its wealthiest clients. As reported, Goldman Sachs began trading Bitcoin futures on June 18 in a partnership with Galaxy Digital.

Further, the report concludes that Bitcoin itself is not digital gold, as gold is not a “reliable store of value”:

The argument that Bitcoin and cryptocurrencies are a digital version of gold does not confer any value to Bitcoin and other cryptocurrencies, because gold itself is not a consistent or reliable store of value.

Crypto May Not Be As Viable an Investment as Many Thought

This also contradicts Goldman Sachs’ May 21 report called “Crypto, a New Assets Class?” where several experts in the crypto field, such as Galaxy CEO Mike Novogratz, were gathered to analyse the current market, outlining a positive future for cryptocurrencies and stating that they were a new alternative investment.

The report suggested that despite many advances in blockchain technology, this would become obsolete with time and many enterprises would turn away from it. It concluded by saying cryptocurrencies are not a “viable investment” for their clients:

After analysing various valuation methodologies and our multi-factor strategy asset allocation model, we have concluded that cryptocurrencies are not a viable investment for our clients.