On-chain analytics provide a unique data-driven glimpse into the innumerable dynamics at play within the free market for digital monetary technology. According to a recent article by on-chain Bitcoin analytics firm Glassnode, there are several indicators suggesting that this bull run is far from over.

Key points:

- Long-term BTC HODLers continue to accumulate during bear markets

- A new bear market BTC accumulation phase has started

- Current bull cycle top has not yet been reached

Long-Term HODLers Continue to Accumulate

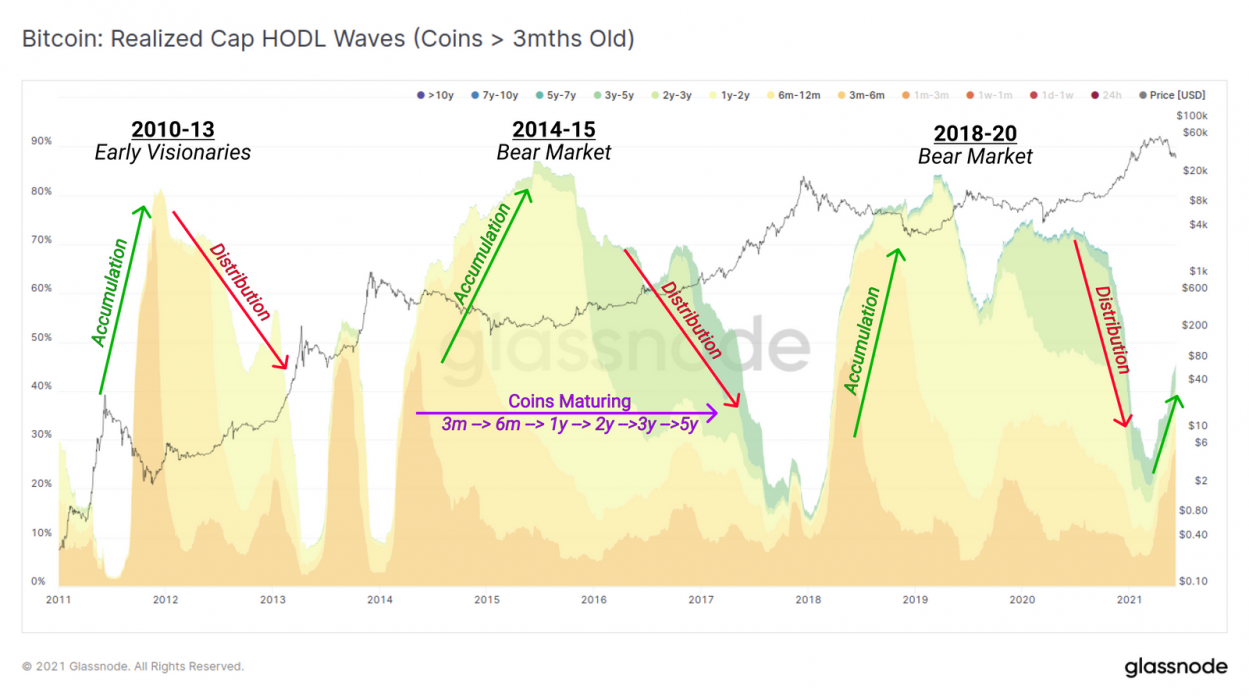

To illustrate, the chart below shows supply accumulation by long-term HODLers and how it consistently peaks during the bear markets.

Based on historical patterns, it would appear that a market top remains some way away.

Long-Term HODL Conviction Continues to Grow

To elaborate on an earlier point, Bitcoiners and smart money generally implement a simple strategy: accumulate Sats as cheaply as possible and then realise profits (if at all) late in the bull cycle. On-chain data reflects this as long-term HODLers increase holdings during bear markets and withdraw into cold storage.

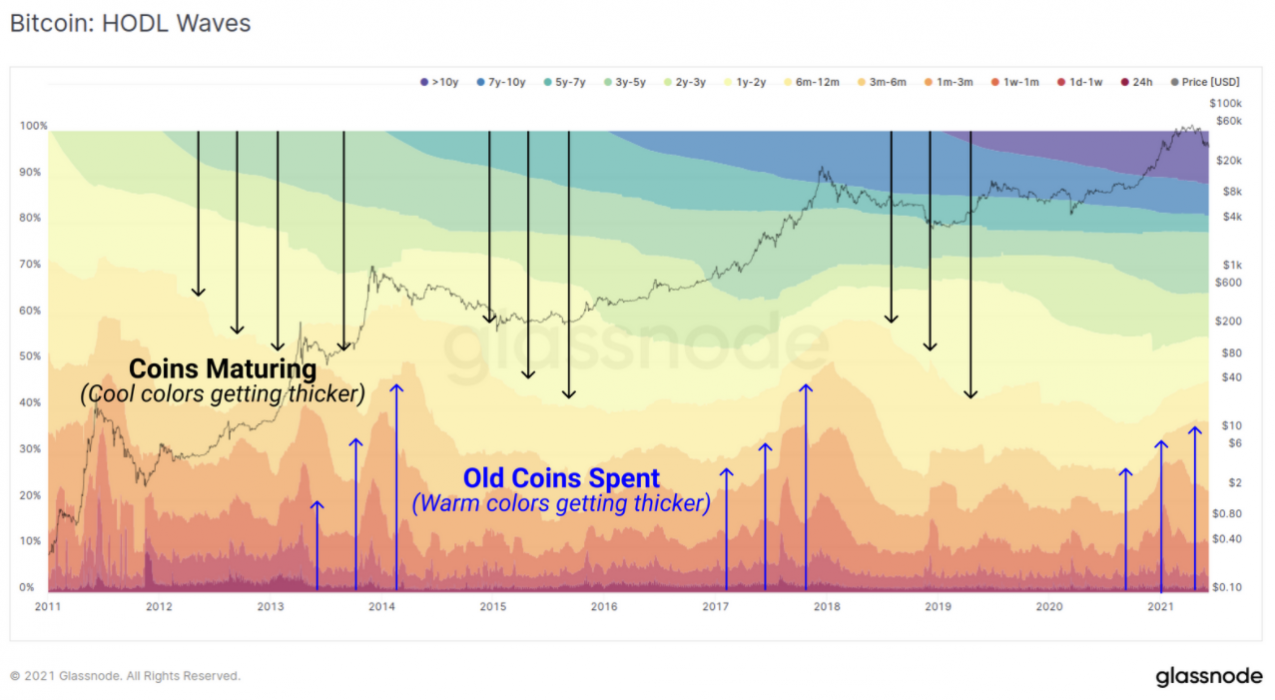

This is outlined in the HODL waves chart below where it can be seen that older age bands (cool colours) are increasing in thickness, suggesting that coins are maturing and are held by strong hands. The thicker these cool bands become, the more supply is owned by long-term HODLers. As old coins are spent, they become reclassified as young coins (warm colours) with a corresponding increase to young HODL wave thickness.

Since Bitcoiners usually only spend their coins late in the bull cycle, one of the ways to identify a shift in macro sentiment is if there is a noticeable swelling in the young age bands.

Comparing the thickness of young age bands relative to previous market tops, it is evident that if history were to repeat itself, then this bull cycle is likely to accelerate further for some time.

This sentiment is also reflected in the Realised HODL ratio, which describes the cyclical nature of wealth transfer from weak hands to strong hands.

Importantly, bull market tops have been characterised by long-term HODLers transferring a portion of their wealth to new investors. This results in an increased liquid supply and creates a new maximum number of new holders.

Based on historical patterns illustrated in the chart below, it could be argued that a market top in this bull cycle remains out of sight, at least for the time being.

On-Chain Analytics: Best Viewed in the Broader Context

Despite these positive metrics, analysts often caution investors against relying entirely on on-chain analytics. In an emergent space with an array of diverse participants, each with their own incentives, it is important to always consider the broader context, including technical and fundamental analysis.

Interested in On-Chain Data? Read Further …

In March this year, we reported that a data metric called NRPL (Net Realised Profit/Loss) showed that people were taking profits – with the metric dropping negative for the first time since September 2020.