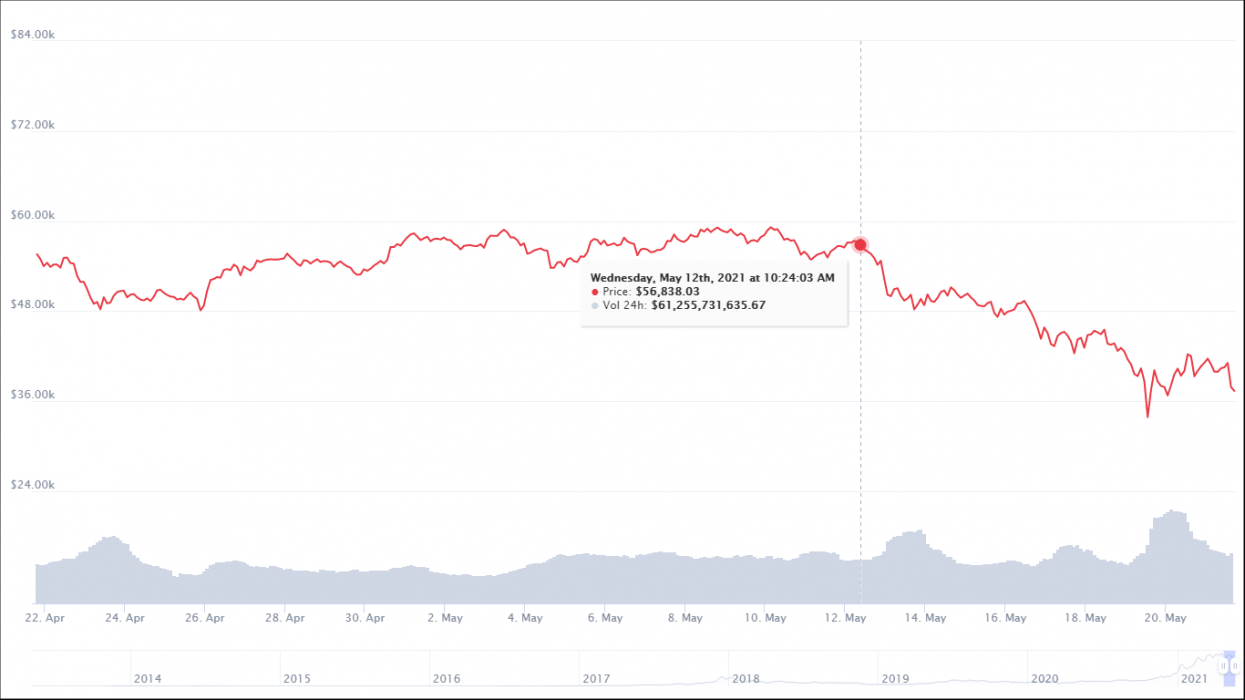

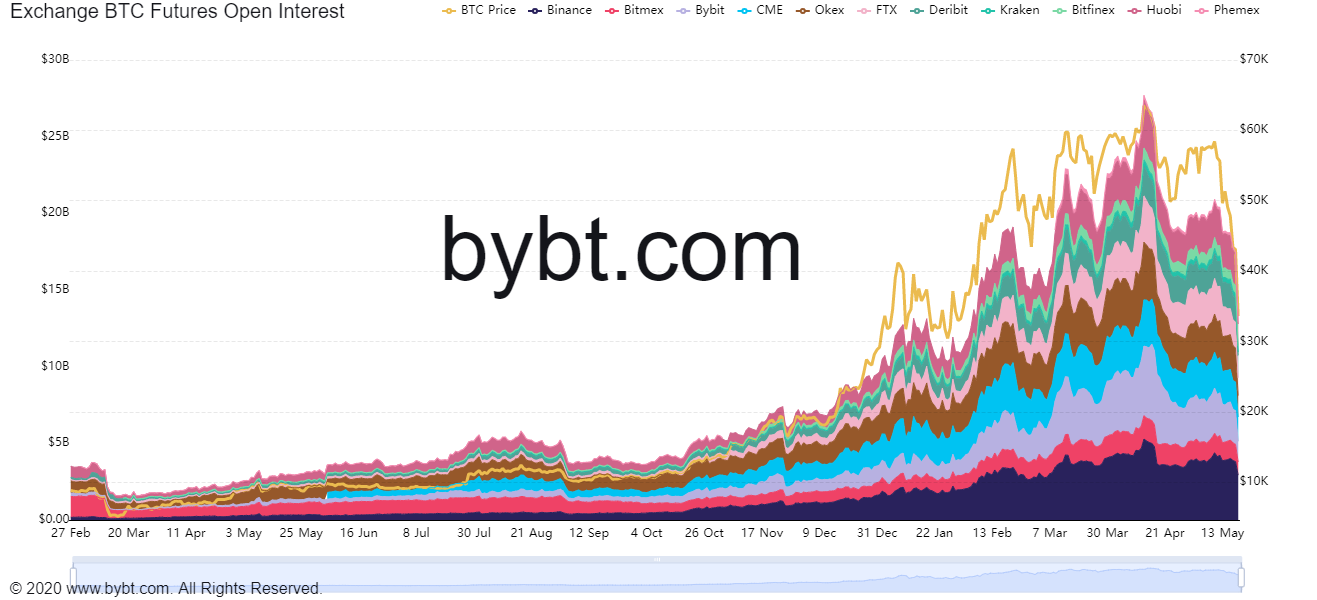

Last week Bitcoin had its worst sell-off since March 2020, and the global crypto market has suffered great losses along with it. Over 250 billion was erased from the market as selling panic took over.

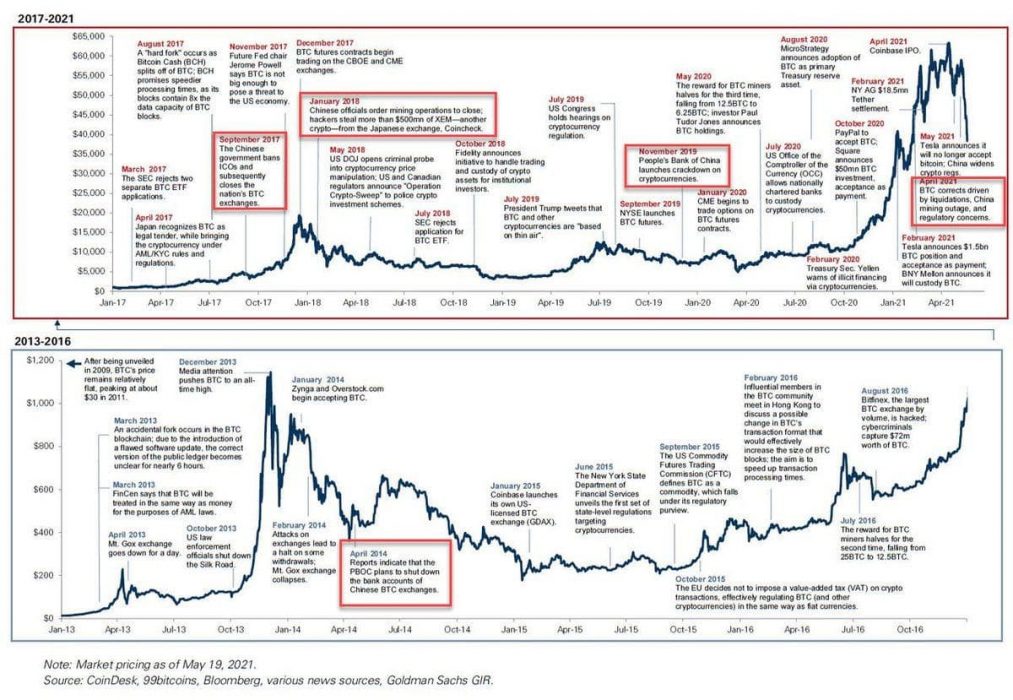

While many were panicking and considering this as the end of the bull run, some we’re taking a closer look at the data and compared todays BTC price with 2013 and 2017 and the results showed a positive correlation.

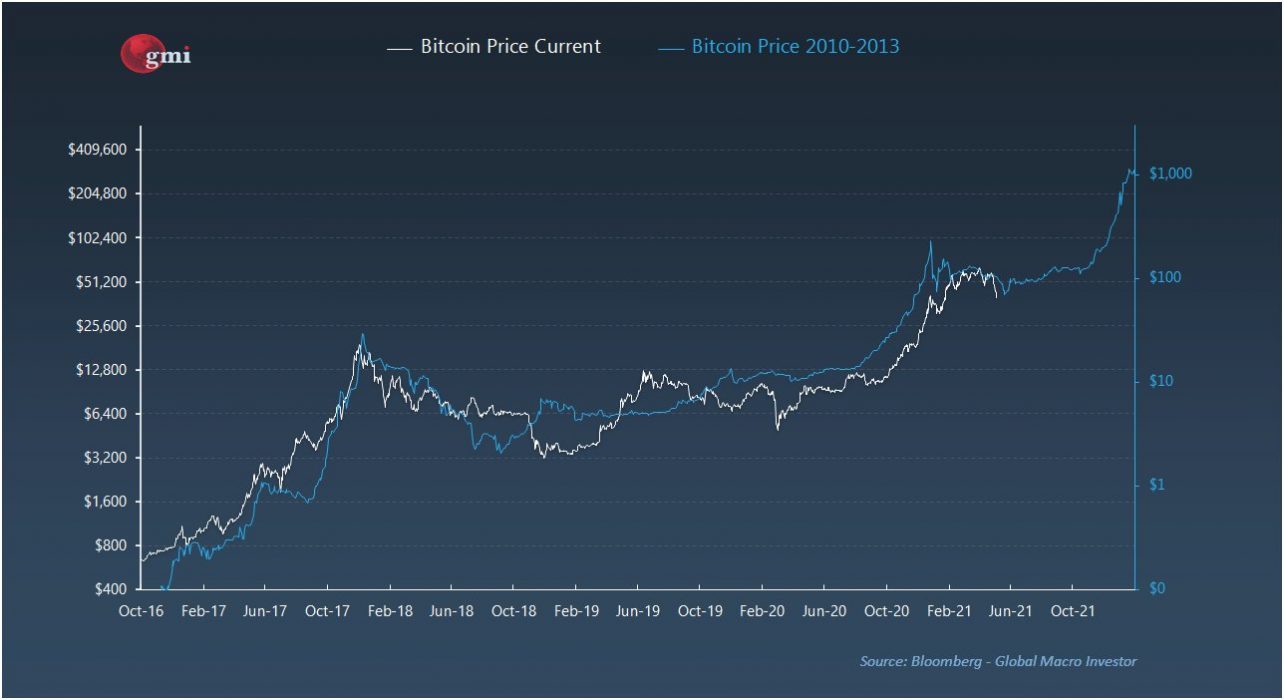

BTC Now vs 2013

The graph above shows a positive correlation for the BTC price now vs back in 2013. Back in 2013, BTC corrected up to 50% before rocketing to another all-time high just over US$1,000.

This data might suggest that this a normal cycle for BTC, as the market corrects, then resets and resumes into the final phase of the bull run. At least thats what happened in both 2013 and 2017.

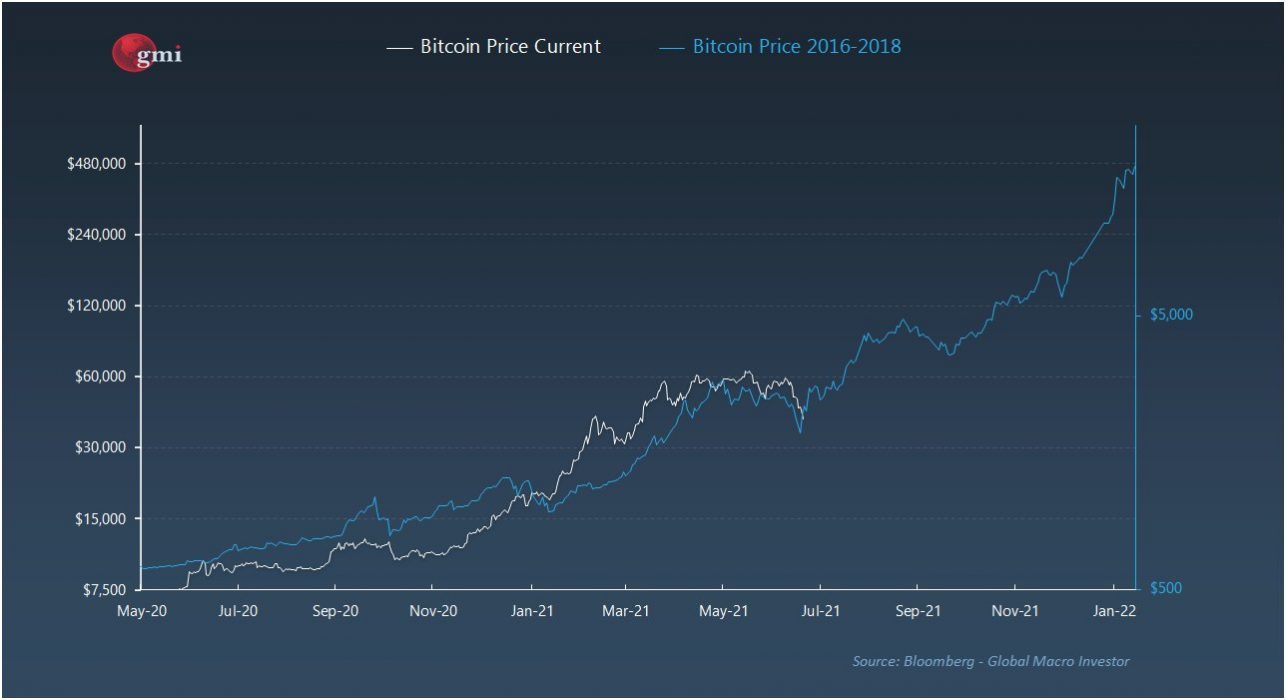

BTC Now vs 2017

The graph above also shows a positive correlation for the BTC price now vs back in 2017. Back in 2017, BTC corrected up to 50% before rocketing to another all-time high just over US$17,000.

If Bitcoin follows the same pattern as 2017 then BTC may be on track to retake its uptrend run and surge somewhere between US$70k – $120k.

As we previously reported, this is the 10th time BTC has dropped by over 30% since 2017. So newcomers should be aware that this market is still volatile and drops like this are “normal” for this market.

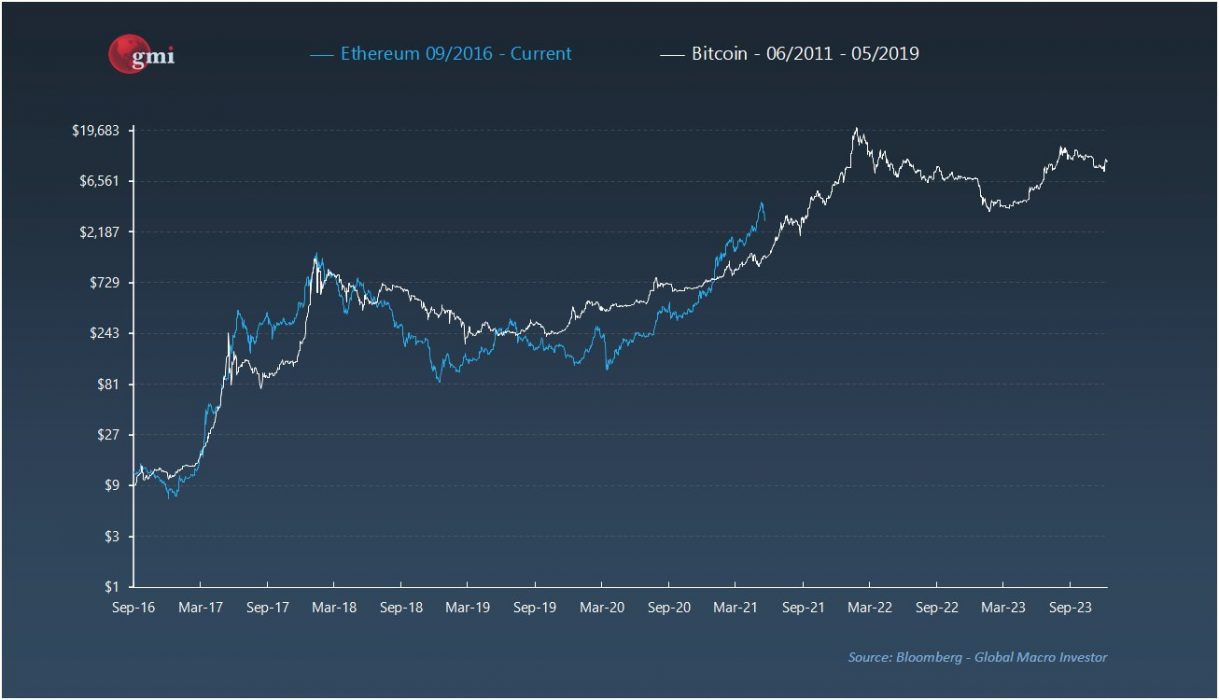

ETH vs BTC

Another interesting take is between ETH and BTC that shows a positive correlation across the same price period. If ETH continues on this pattern it would also retake its bull run.

This isn’t the End of the Bull Run, Says Top Analyst

Experts in the crypto field don’t believe the bull run has exhausted, whatsoever. During a podcast with Peter McCormack, top analyst Willy Woo talked about the current situation with Bitcoin, saying it might take time to recover from this crash before taking off to prices over $100k.

“I think it’ll take a bit of time to recover, just from the sheer amount of coins that we dumped out. I think ultimately, if you look at the network health, this is a good thing.”

Willy Woo

Woo referred to several indicators that are showing price positivity for BTC. He noted that this is not the end of the bull run rather an “unwind” necessary for the network’s health, referring to the NVT ratio, which shows network activity in relation to market cap.