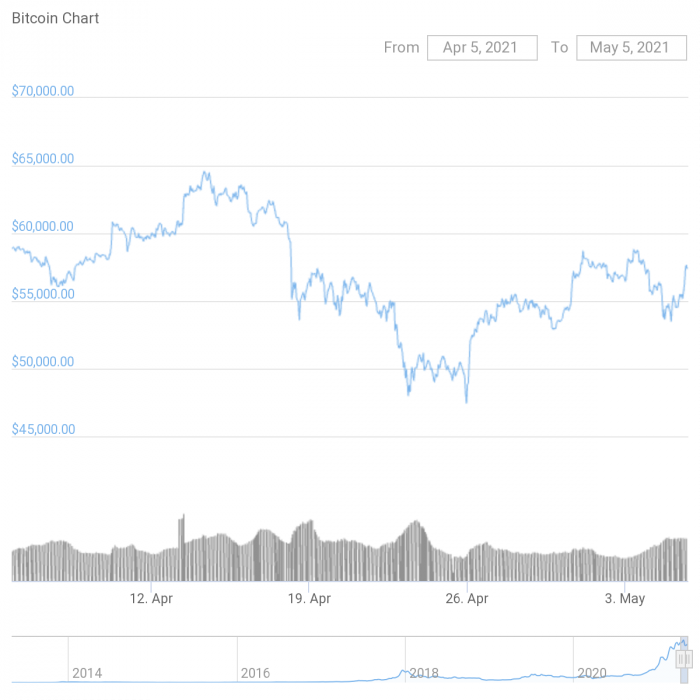

Goldman’s cryptocurrency trading desk has been buying and selling Bitcoin (BTC) futures. The team has successfully traded two kinds of Bitcoin-linked derivatives.

According to the memo obtained by CNBC, it serves as the first acknowledgement the New-York based company has given that it is trading in crypto. As part of their initial launch, they successfully executed Bitcoin Non-Deliverable Forward (NDFs) and CME BTC future trades “on a principal basis, all cash settling.”

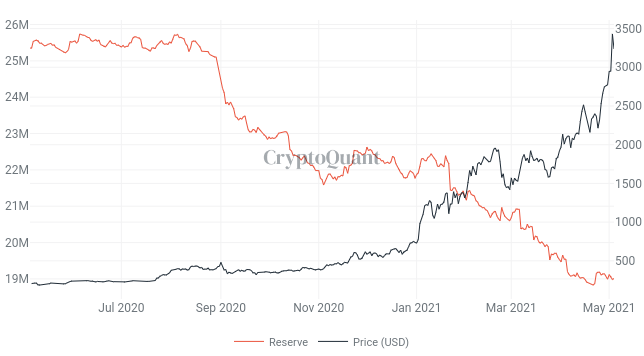

Earlier in March this year Morgan Stanley became the first big U.S. bank to offer its wealth management clients access to Bitcoin funds. Additionally, Citi also plans to launch crypto trading services after seeing surging interest from clients.

Goldman Sachs might have started crypto trading due to mainstream adoption and to probe the crypto economy should it hold promise for financial institutions. Also, considering the attention other institutions have given Bitcoin, they would have risked being left behind.

However, the firm clearly stated that they are not in a position to trade Bitcoin, or any cryptocurrency (including Ethereum) on a physical basis. Which is why they are traded through CME features.

Looking ahead, as we continue to broaden our market presence, albeit in a measured way, we are selectively onboarding new liquidity providers to help us in expanding our offering.

Goldman Sachs Memo

Goldman Sachs Active In The Crypto-Sphere

Goldman has been one of the very active traditional financial institutions in the crypto space recently.

In addition to the crypto desk, yesterday Goldman launched their Digital Assets dashboard which provides daily and intraday cryptocurrency market data and news to their clients. They’ve also made Bitcoin more accessible to Wall Street with the release of their derivatives.