Personalised crypto number plates are starting to appear around the world on social media as the Bitcoin craze goes mainstream.

You can use almost any phrase as your car registration number plate to make your vehicle stand out. You can create your own number and letter combinations, and restyle your existing number plates as long as you follow the rules for your state.

Let’s take a look at some popular ones and how you can get one in Australia.

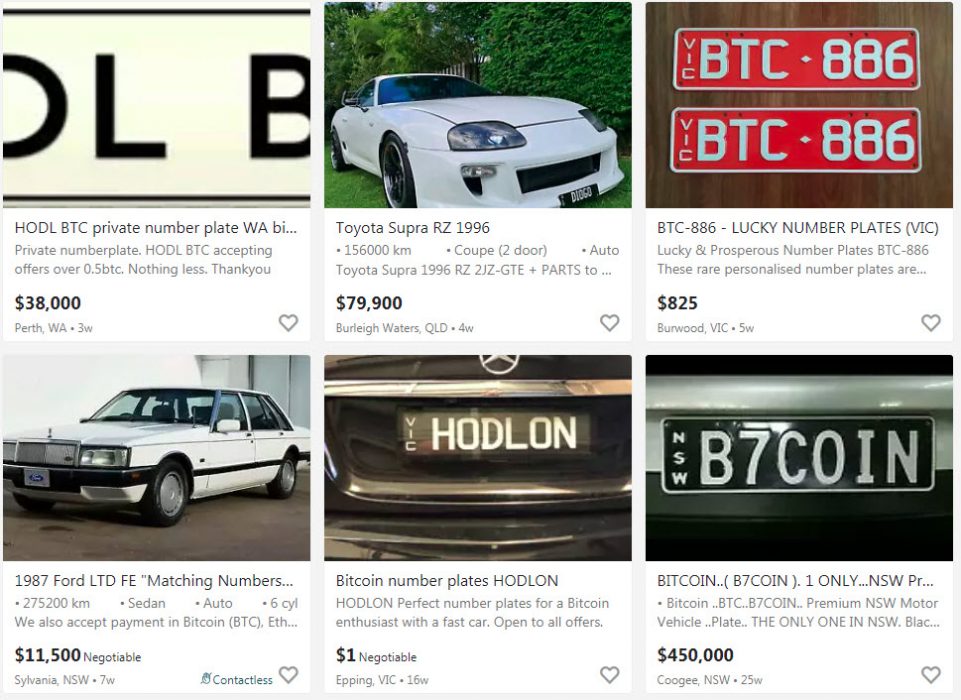

Popular Crypto Number Plates In Australia

Crypto enthusiasts all over the world have been promoting Bitcoin and their favourite coins by getting custom car number plates. Here are some of the best one’s we’ve seen in Australia.

How to Order a Custom Number Plate in Australia?

Let’s take a look at where you can check and order your custom rego plates in Australia.

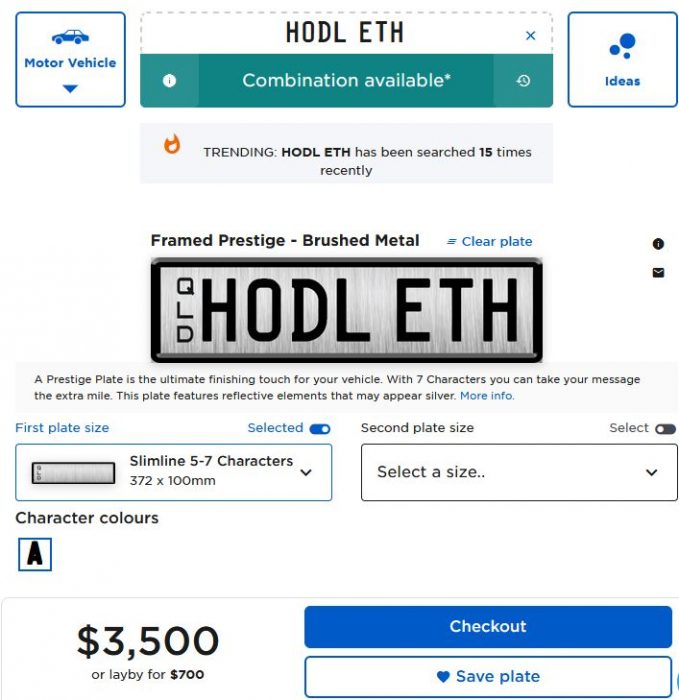

Personalised Plates Queensland (PPQ)

You can check if the plates you want are available using the PPQ website.

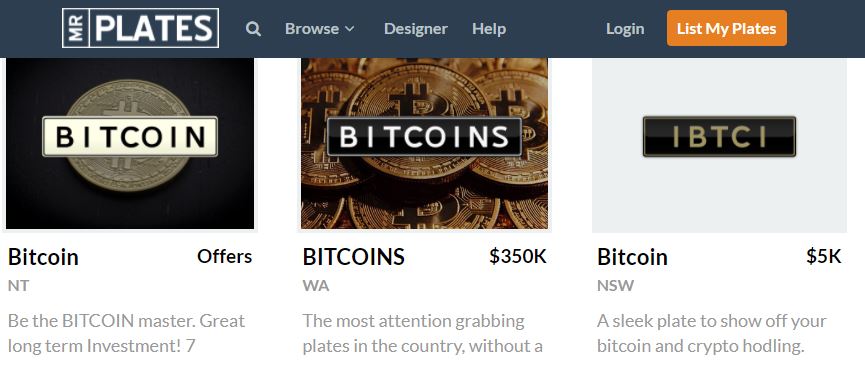

Mr Plates

Mr Plates is also an online marketplace where people sell number plates that they have registered to sell or are no longer using. There can be various reasons for selling custom number plates. Buying the plates online are considerably more expensive than creating your own. However, if your desired one is already registered you might need to buy it off that person.

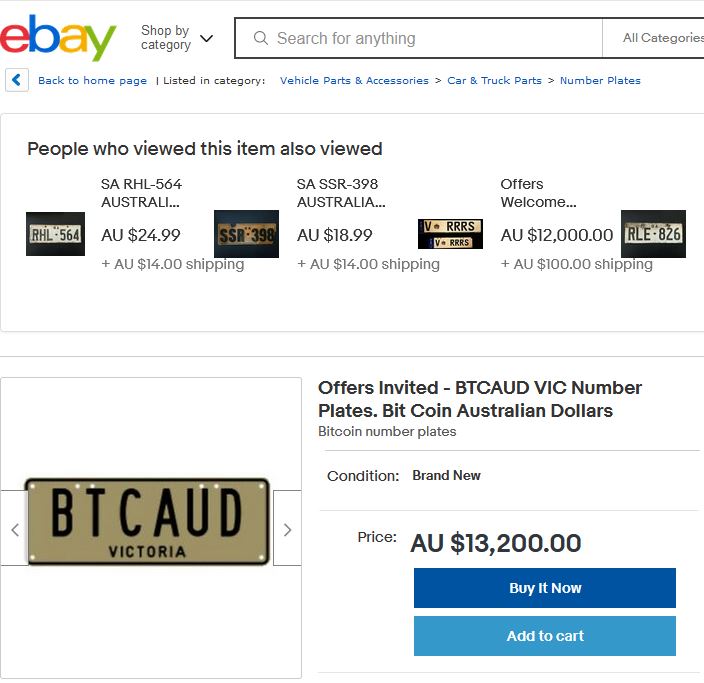

Ebay AU

Some people got in early to register crypto plates and are now selling them on some marketplaces like Ebay. There are some interesting ones for sale in Australia, including HODLNG listed for $10,000 AUD.

Gumtree AU

You can also find custom number plates for local sale on Gumtree AU.

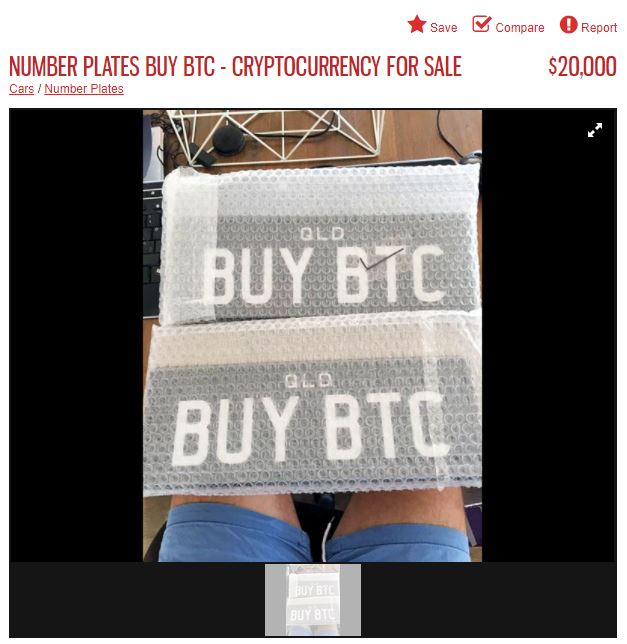

Trade Unique Cars AU

CafePress AU

One can also get a custom bitcoin frame for your numberplate to add that extra hint of personalisation.