ProShares, a global exchange-traded fund (ETF) provider, has launched an ETF enabling investors to bet against bitcoin, otherwise known as “going short”:

Profiting Off Bitcoin’s Decline

The ProShares Short Bitcoin Strategy ETF, scheduled to commence trading under ticker symbol BITI on June 22 on the New York Stock Exchange, enables investors to “short sell” bitcoin.

Unlike most investments which speculate on the price appreciating, short selling involves the opposite – betting that the asset in question will decline. In a statement, ProShares CEO Michael Sapir commented that conditions were ripe for the product:

As recent times have shown, Bitcoin can drop in value. BITI affords investors who believe that the price of Bitcoin will drop with an opportunity to potentially profit or to hedge their cryptocurrency holdings.

Michael Sapir, ProShares CEO

BITI purports to deliver the inverse of the performance of the S&P CME Bitcoin Futures Index, and it will obtain exposure through Bitcoin futures contracts.

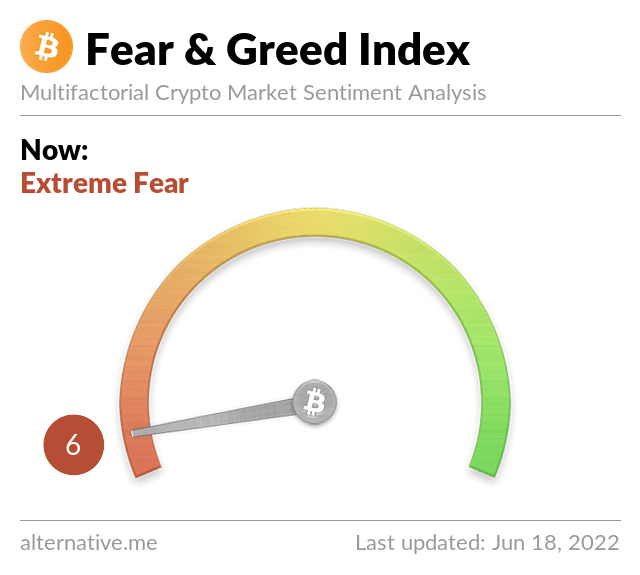

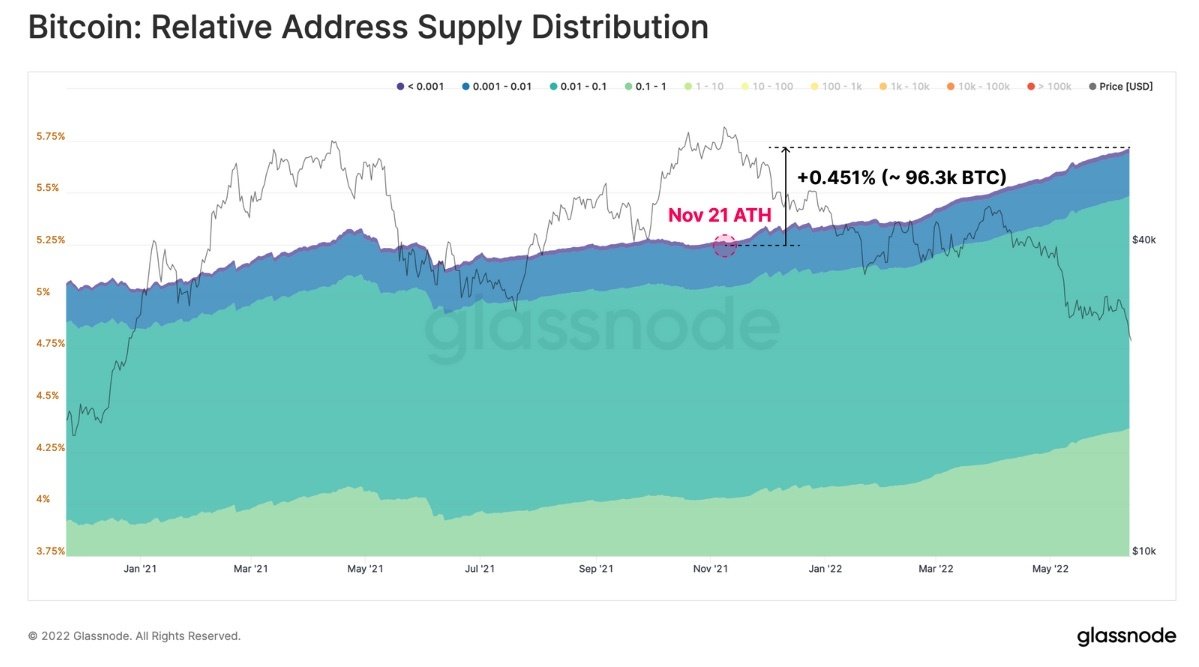

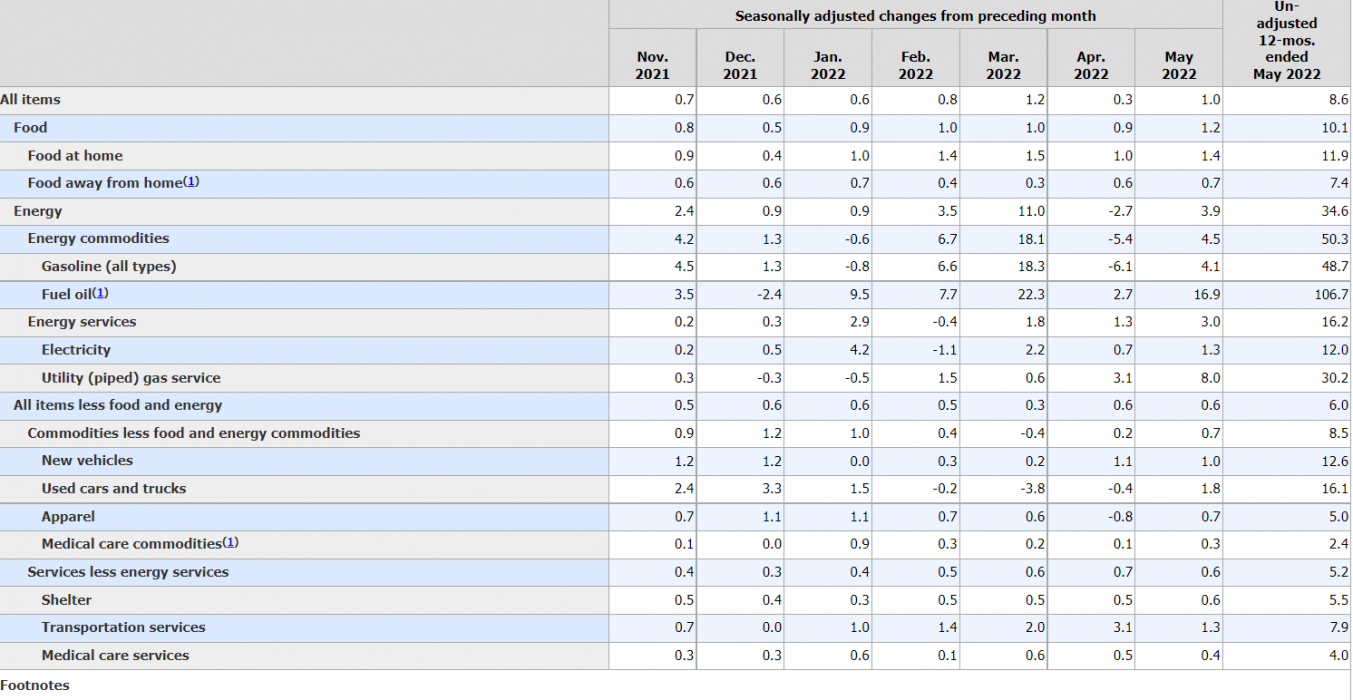

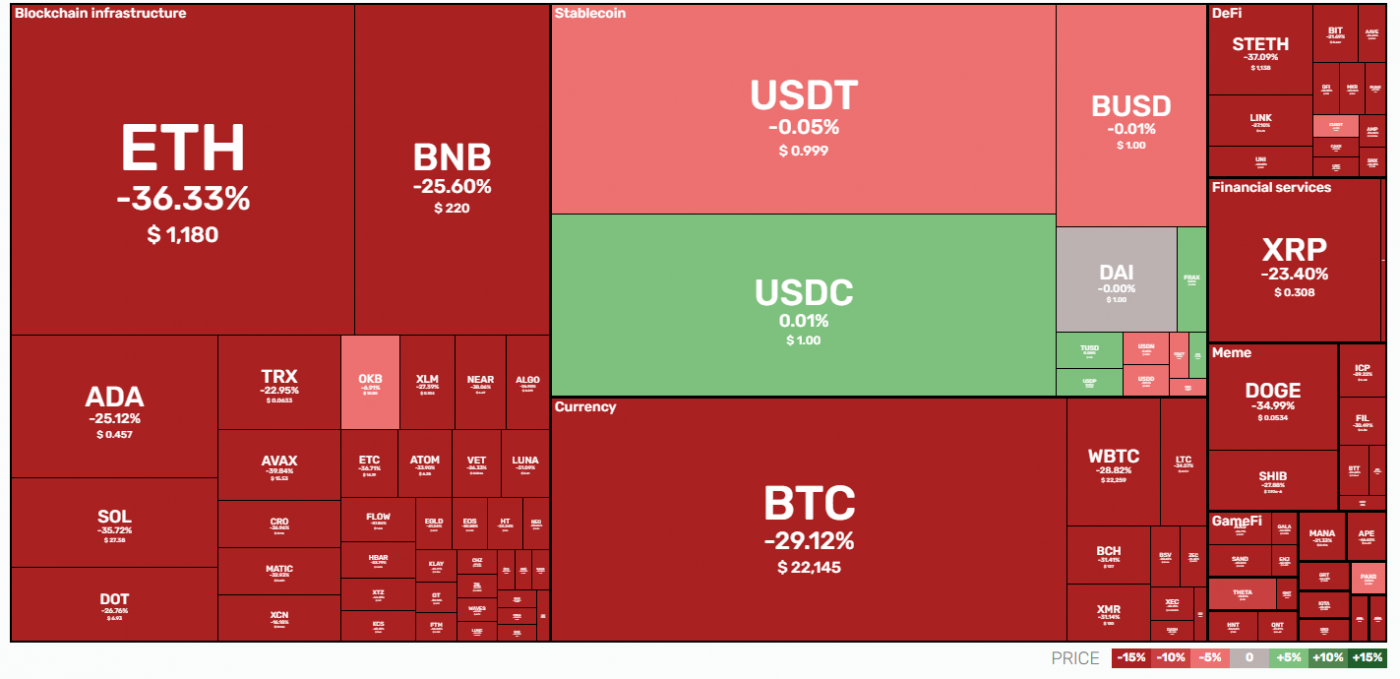

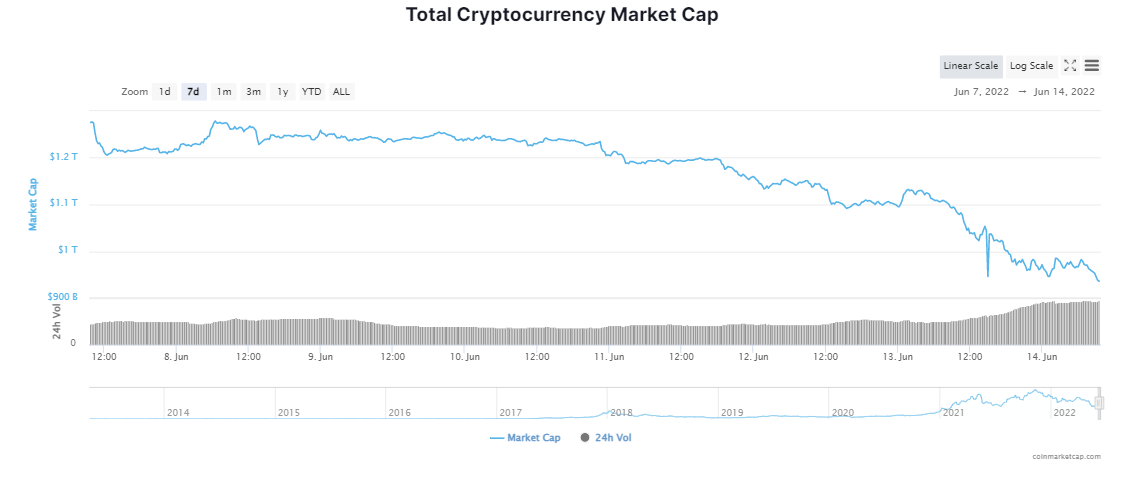

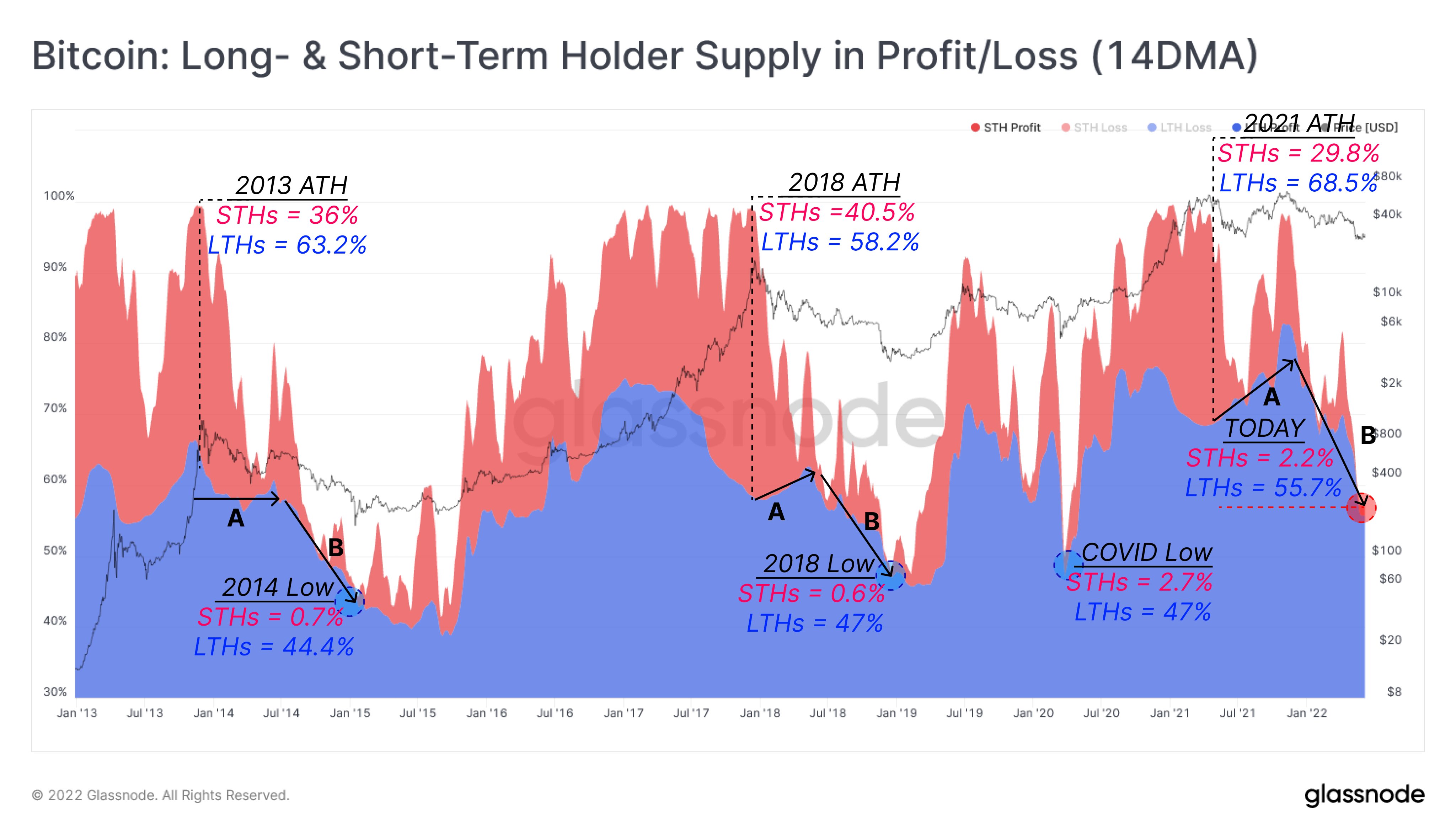

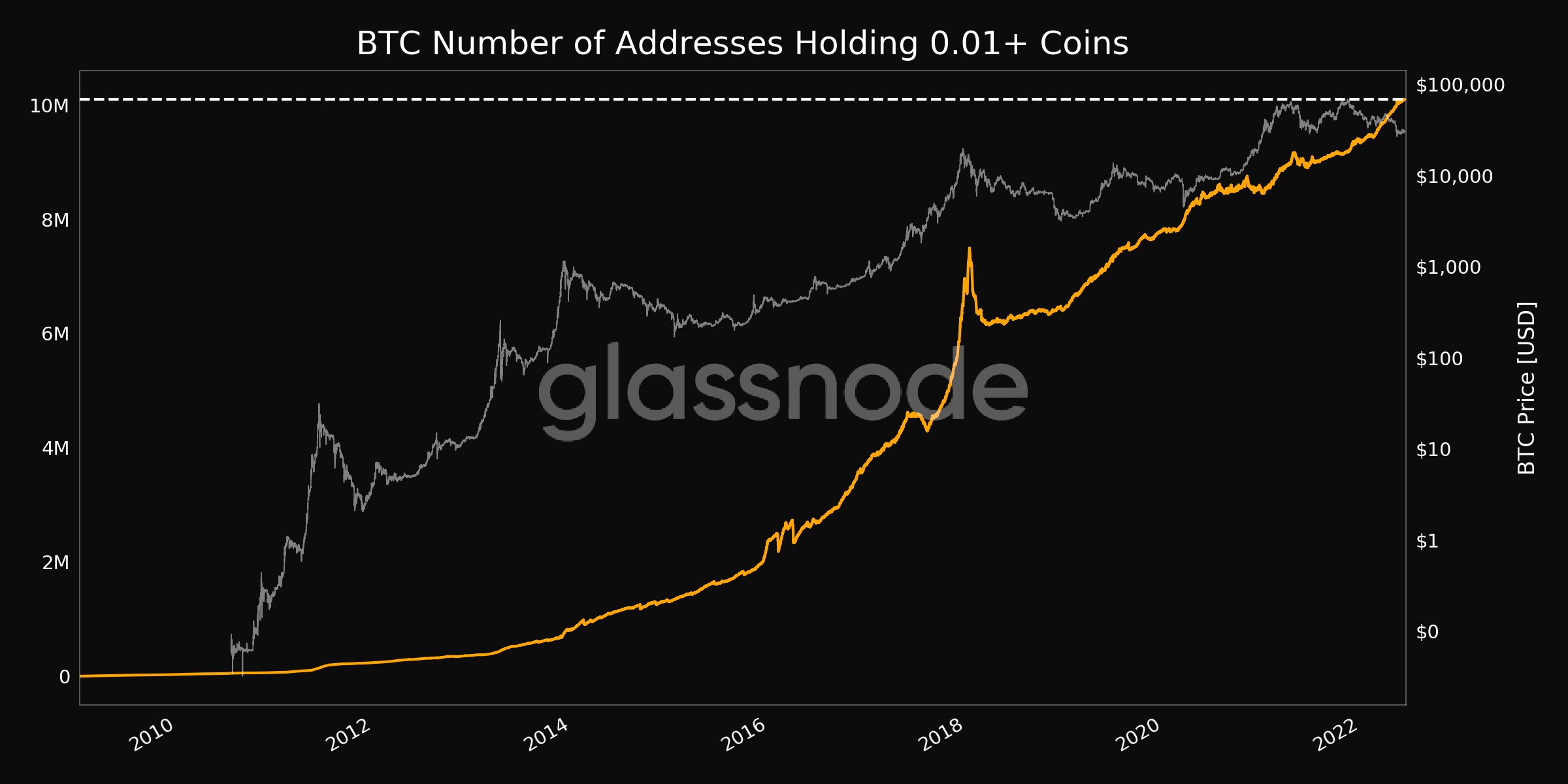

The launch is rather timely, given bitcoin’s recent unprecedented decline below 2017’s previous all-time high. Since November last year, the overall cryptocurrency market has shed US$2 trillion from its market capitalisation, peaking at US$2.9 trillion and currently hovering around US$900 million.

SEC Drags its Heels on Spot Bitcoin ETF

Despite other jurisdictions such as Canada and Australia having multiple spot bitcoin ETFs, as the world’s largest financial market the US is yet to get one of its own. The US regulator, the Security and Exchange Commission (SEC), has repeatedly denied spot bitcoin ETFs, citing “market manipulation” as one of several reasons for failing to approve one.

Remarkably, investors in the US now have the option to invest in bitcoin futures, as well as bet against bitcoin, but they still cannot invest in an ETF tracking its price:

Commentators on Twitter appeared baffled by the decision, describing it as “intentional”, with others saying it was unequivocally clear that the SEC had an agenda:

The news comes in as Grayscale remains committed to converting its Grayscale Bitcoin Trust into an ETF, and just yesterday, Bloomberg reported that Anthony Scaramucci’s SkyBridge was scheduled to file for a spot bitcoin ETF this week.

Pressure is mounting on the SEC. How much longer can it continue to deny a spot bitcoin ETF? The longer the situation persists, the more difficult it is to argue that its decision-making isn’t political.