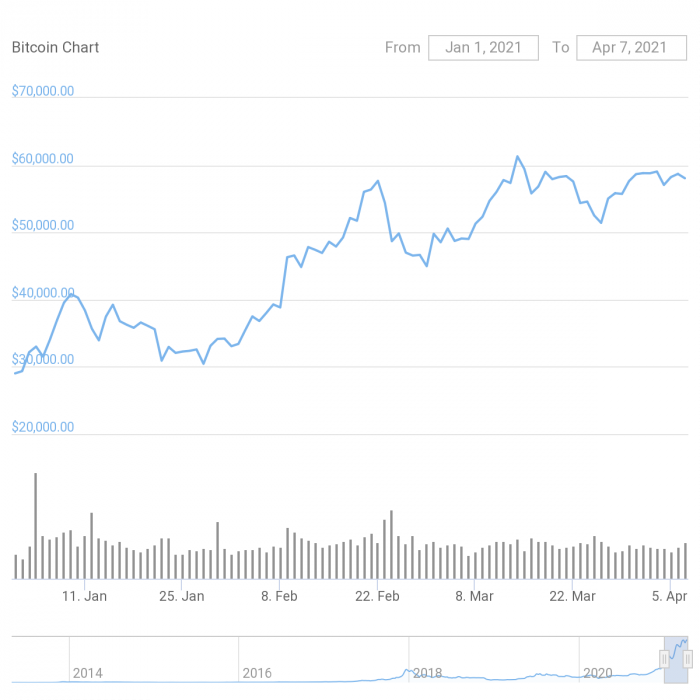

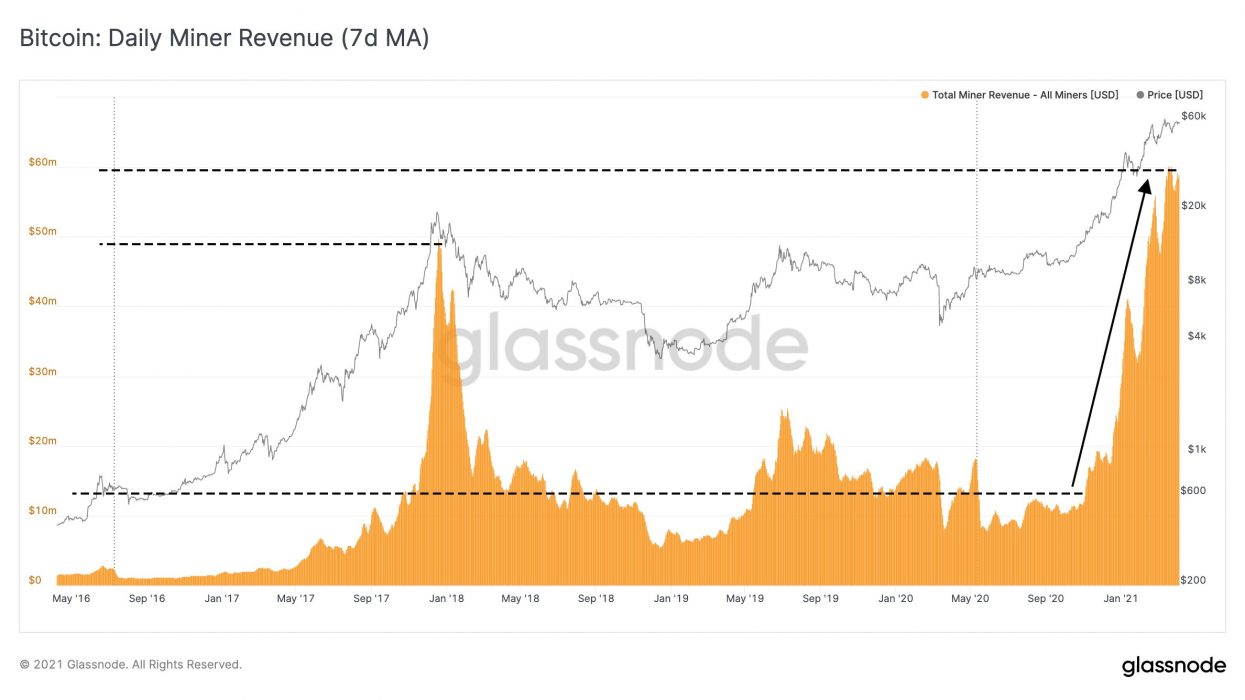

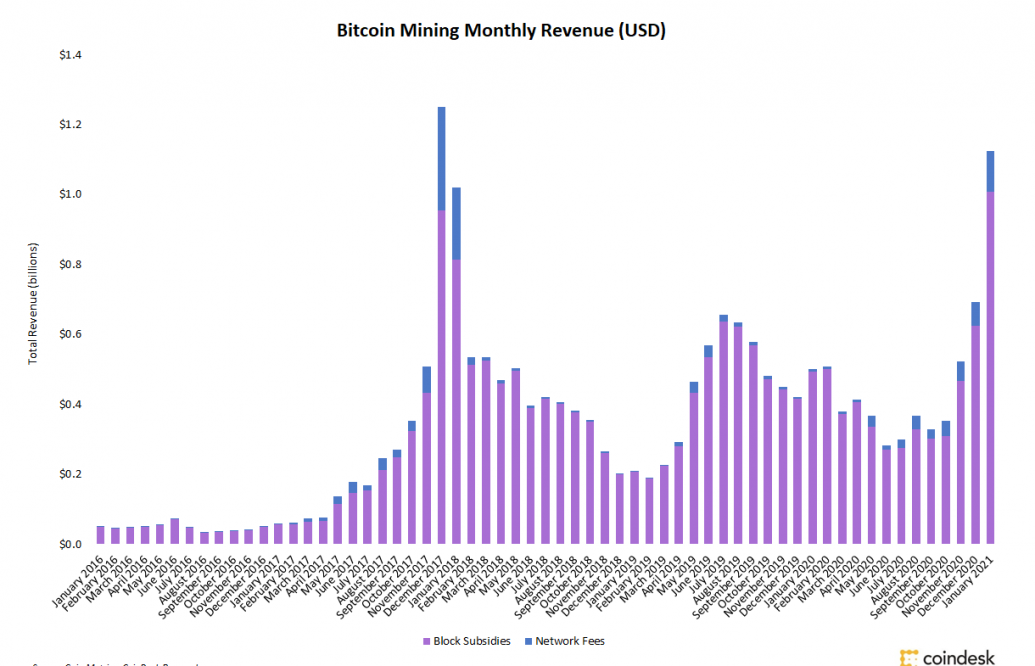

Bitcoin miners have been generating much more in revenue over the recent months, according to data from Glassnode – an on-chain crypto analytics platform. The revenue usually consists of the cryptocurrency block subsidy and transaction fees. The increase in miners’ revenue follows the recent growth of Bitcoin in market value.

BTC Miners Average $50 Million Daily

As Rafael Schultze-Kraft, the CTO of Glassnode recently shared on Twitter, Bitcoin miners have been averaging $50 million in daily revenue for the past 30 days. The current record represents over 300 percent increase compared to the record a year ago, which was around $12 million daily revenue.

Overall, Bitcoin miners netted about $1.5 billion mining revenue in March alone, most of which came from the block subsidies paid to them.

BTC miners’ revenue has increased over the past few months. As of January, miners generated about $1.1 billion in revenue, which also represented about a 62 percent increase from the revenue in December.

Note that, Bitcoin block reward was recently halved to 6.25 BTC on May 11, which is 50 percent less than rewards in the months before. Yet, miners are still able to generate this much in revenue, mostly because of the increase in the price of Bitcoin.

Since Bitcoin’s third halving, the value of the cryptocurrency has increased by over 550 percent.

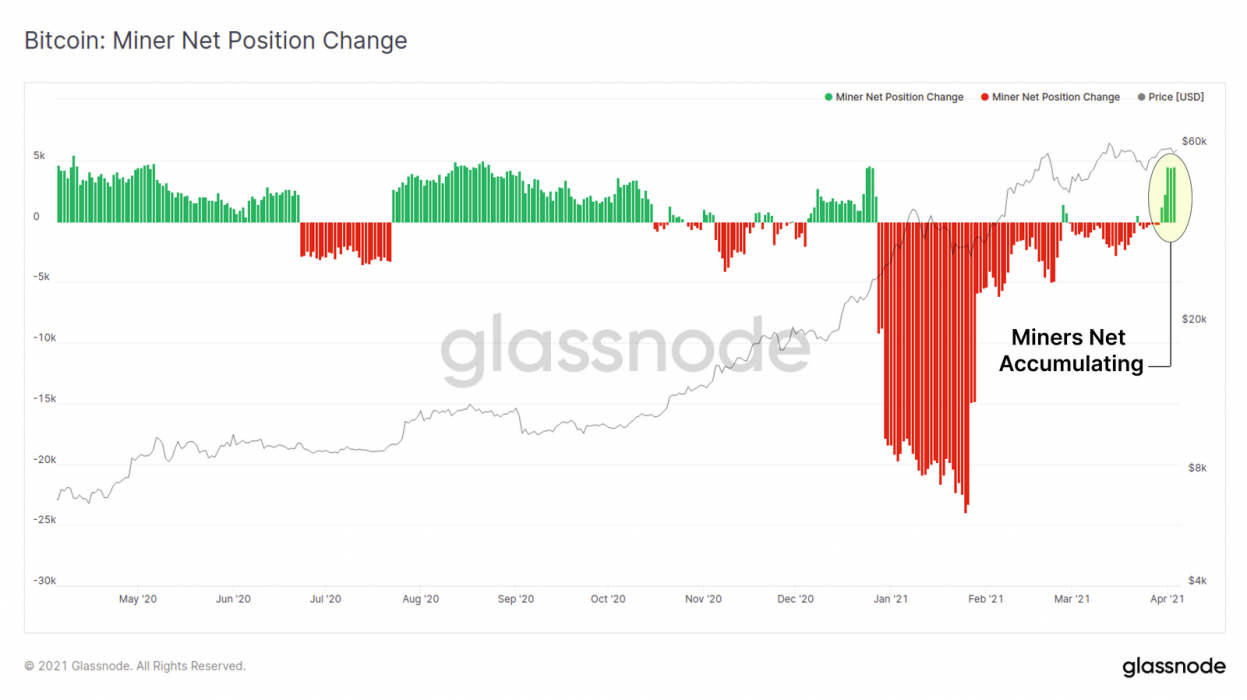

Most Miners are HODLing

Despite the massive increase in miners’ revenue, on-chain data from Glassnode also confirmed that they are HODLing most of their BTC rewards. For the past weeks, the miner net position change has remained positive, as Crypto News Australia reported on Wednesday. This means that BTC miners have been accumulating new Bitcoin for the stated period. This is quite bullish in the long-term, as it creates scarcity for BTC.