Following yesterday’s call by Steve Vallas – the CEO of Blockchain Australia, a coalition of blockchain-oriented Australian businesses – more big-league Aussie blockchain experts have joined the call for more government support for this budding industry.

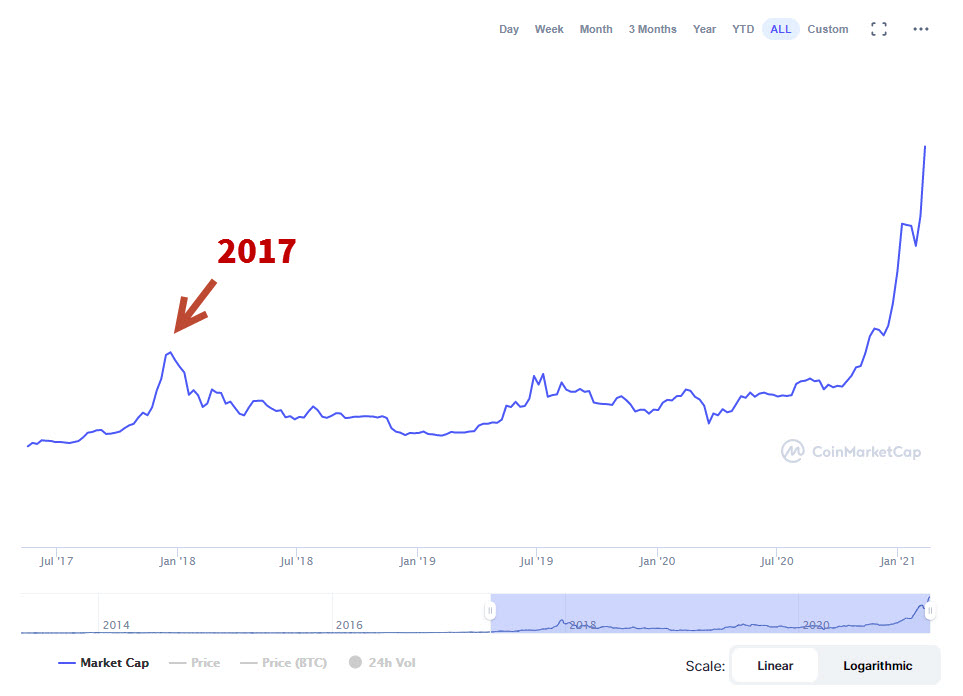

Lagging Behind The USA By About 2 Years

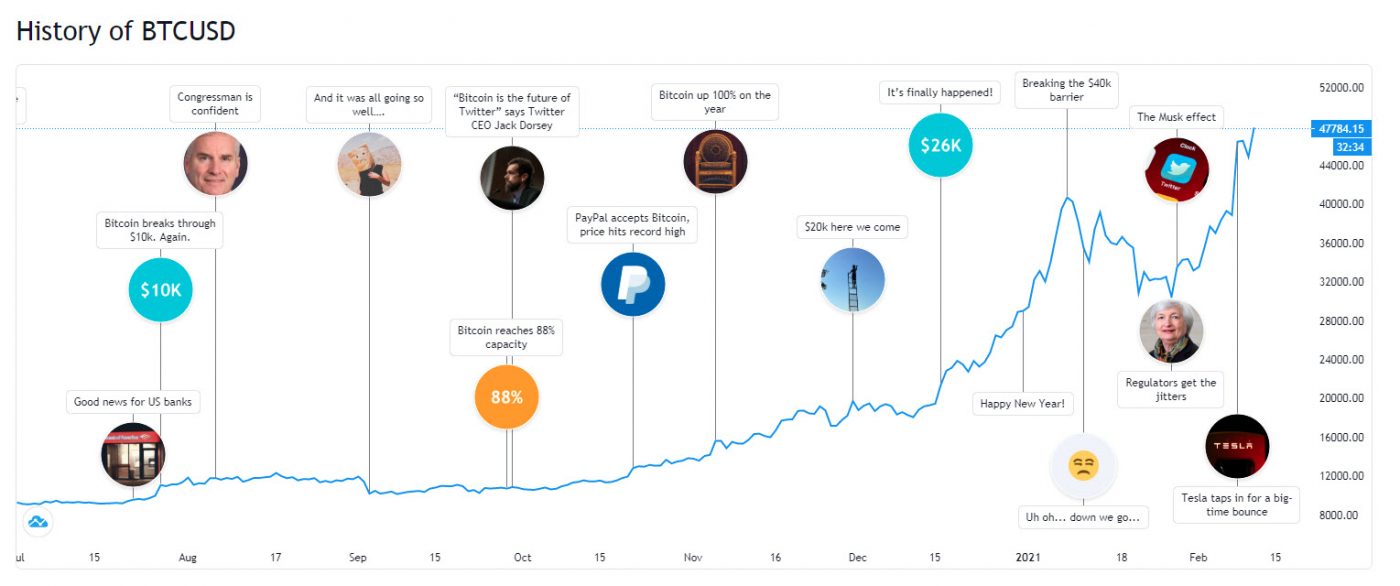

Leigh Daniel Travers – the CEO of DigitalX, a Technology Fast 50 company specializing in customized blockchain solutions – stated that Australian companies typically don’t deal with international markets as much as companies from other countries might. He believes institutional investors are one of the many things that could spur on the rate of crypto adoption in Australia.

“Both of those markets in Australia haven’t seen a lot of adoption compared to global markets. Australians typically haven’t had too much involvement into international markets unless it’s managed on their behalf.”

In addition, he went on to say that there is a relatively well-known consensus in the industry that Australian regulation for new technology is around 2 years behind that of the US, and this has an impact on investors’ willingness to shop around on Aussie markets.

“Australia hasn’t had a Greyscale equivalent and that’s really prevented a lot of investors coming into the marketplace because they want to go through the process they usually go through. Having a familiar vehicle makes a lot more sense and that’s what we’re trying to bring to the market. I think there’s probably a well-understood investment cycle where Australia is 2-3 years behind US markets and that appears to be playing out in the crypto investment market as well.”

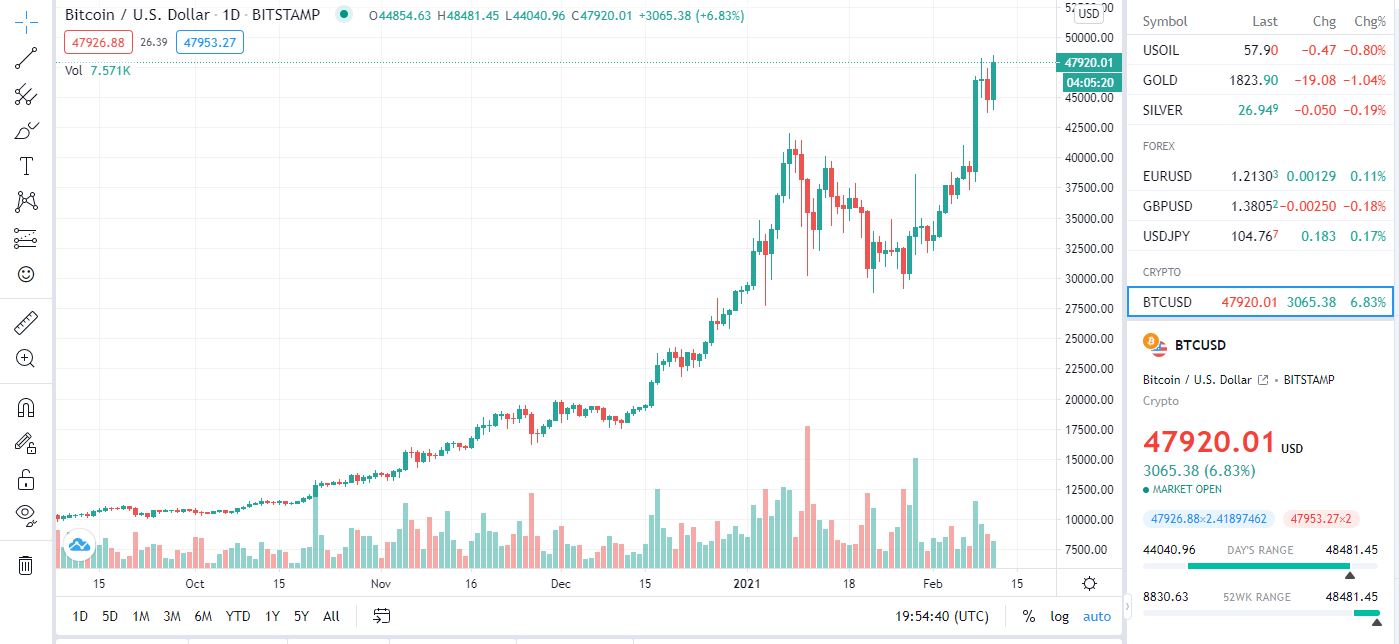

These aren’t empty words, either: in a recent update given to the ASX regarding its use of funds, DigitalX made note of the fact that they’ve increased their direct exposure to Bitcoin – as well as other digital assets by more than 70%.