Iris Energy, which has raised $25 million from investors, has plans to triple the computing power in its mining operation in Canada, which is powered by hydroelectricity, to meet the growing desire for ‘green’ investments.

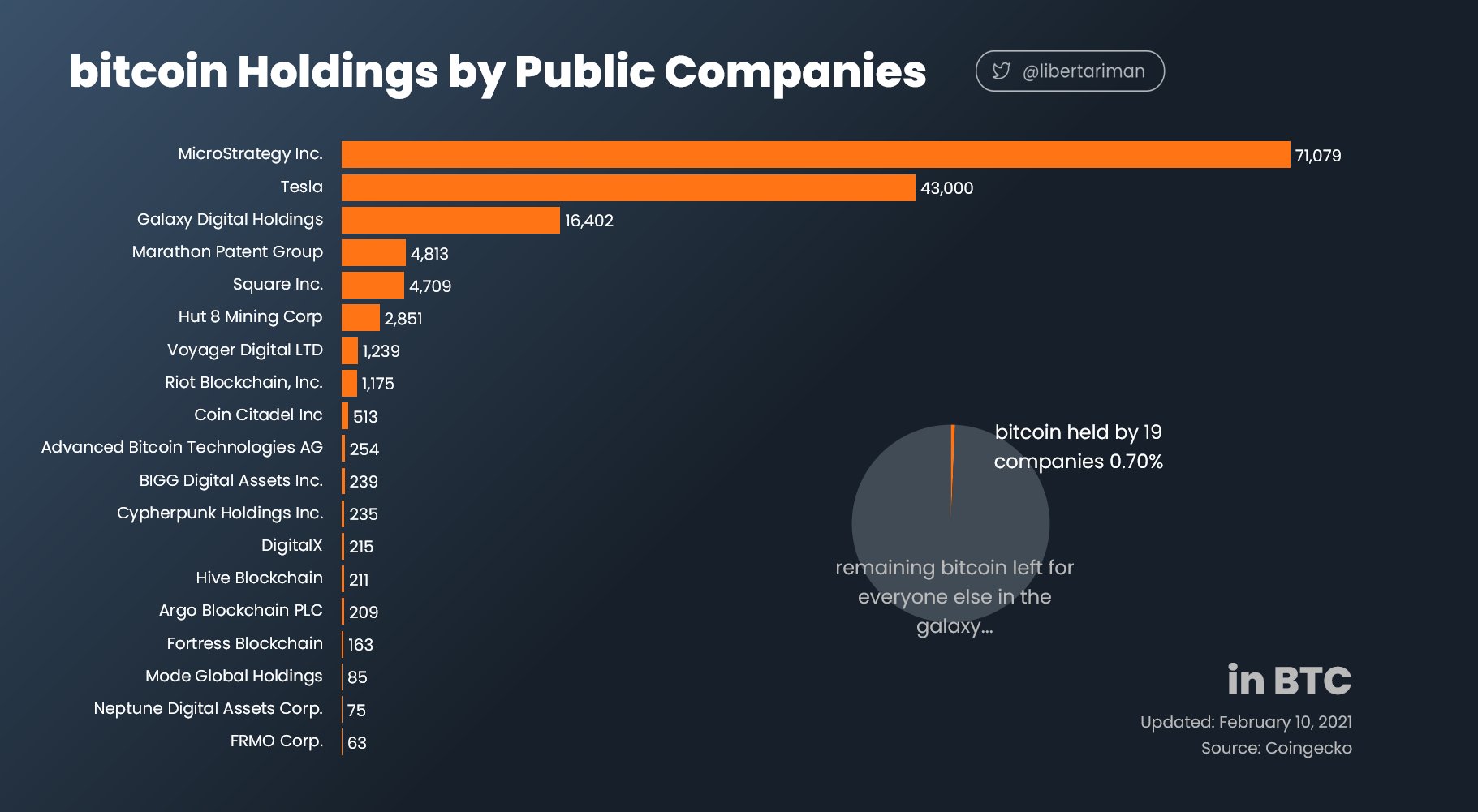

Following Tesla’s recent investment in Bitcoin, Elon Musk, has led the way for more investments into crypto mining, enabling Iris to grow from their one facility hosting computers drawing on 9 megawatts of power, and build another 21 megawatts in two new data centres.

Who Is Iris Energy?

Started by brothers Dan and Will Roberts, Iris Energy receives regular income in bitcoin for its mining, which is immediately liquidated into fiat currency. It uses the raw computing power to find a solution to the SHA-256 algorithm that secures the bitcoin network. The amount of bitcoin received is linked directly to the amount of computing power. About every 10 minutes, 6.25 bitcoins are released to the minor that solves the problem and then provides security to the network, know as the ‘block reward’. Dan Roberts says:

We sell bitcoin the day they are mined. We don’t hold or keep it. This, and the focus on renewables and integration with energy markets, is one of the reasons it is popular with institutions.

At present, Iris represents 0.5 percent of the bitcoin mining activity. However, Dan Roberts believes this will shift after they invest in new application-specific integrated circuit (ASIC) SHA-256 machines. This is where renewable energy is helping them get ahead.

Tesla Leading the Way For Others

The Tesla investment comes after a flurry of interest from mainstream US financial institutions, including PayPal, Square and Visa. Lead portfolio manager at Wilson Asset Management, Oscar Oberg has made a small pre-IPO investment in Iris from its micro-cap fund. Oberg says:

“The growing US institutional interest in bitcoin, and Tesla’s huge investment this week, helped to validate the investment.”

Executive Chairman of Iris, Dan Roberts, who was Vice President at Macquarie Group in 2011, and then spent eight years at specialist infrastructure fund manager Palisade Investment Partners, says:

Tesla’s investment is another example of the institutional validation and interest we have seen over the past 6 to 12 months. In the current macroeconomic environment, the value proposition for a digital, scarce asset is gathering appeal.

The Future Of Green Mining

In the past 18 months, responsible investment has reached a tipping point, with sustainability concerns coming to the front for many institutional investors.

Investors, consumers and technology are aligning to accelerate the low-carbon transition, says Serge Colle, EY Global Energy Consulting Leader, creating the potential for outperformance by companies involved in the green economy.

Dan Roberts agrees with this shift. When it comes to bitcoin mining, it has moved away from those with access to the newest technology, to those who can build large-scaled energy and data centre infrastructure projects with access to institutional capital markets. And these institutional capital markets are going green.

Speaking on Iris Energy, Oberg says:

These guys are building data centres using the cheapest source of energy they can find, which is renewable, and they will have a lower cost of production to conduct bitcoin mining versus their competitors.

Dan Roberts says that if bitcoin reaches 20 per cent of gold’s market capitalisation, compared to a few per cent today, the energy demand to maintain the network would rise to 70 gigawatts. This is 10 times the level of bitcoin mining today, or three times the amount of power used by all of the world’s data centres. He says:

The operational flexibility in bitcoin mining makes it the perfect load balancing solution to energy networks dominated by intermittent renewables. With the ability to dynamically adjust energy consumption in response to market conditions and locate data centres in remote locations, bitcoin miners are logical users of excess renewable energy and can manage intraday load variability from wind and solar farms.

Get Involved

If you’re looking to invest in bitcoin mining, here’s everything you need to know about what it is. And if you’re a customer looking to invest into cryptocurrencies then checkout our review of NGS Crypto where you can invest in Bitcoin without any technical know-how.