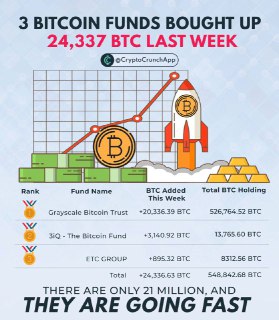

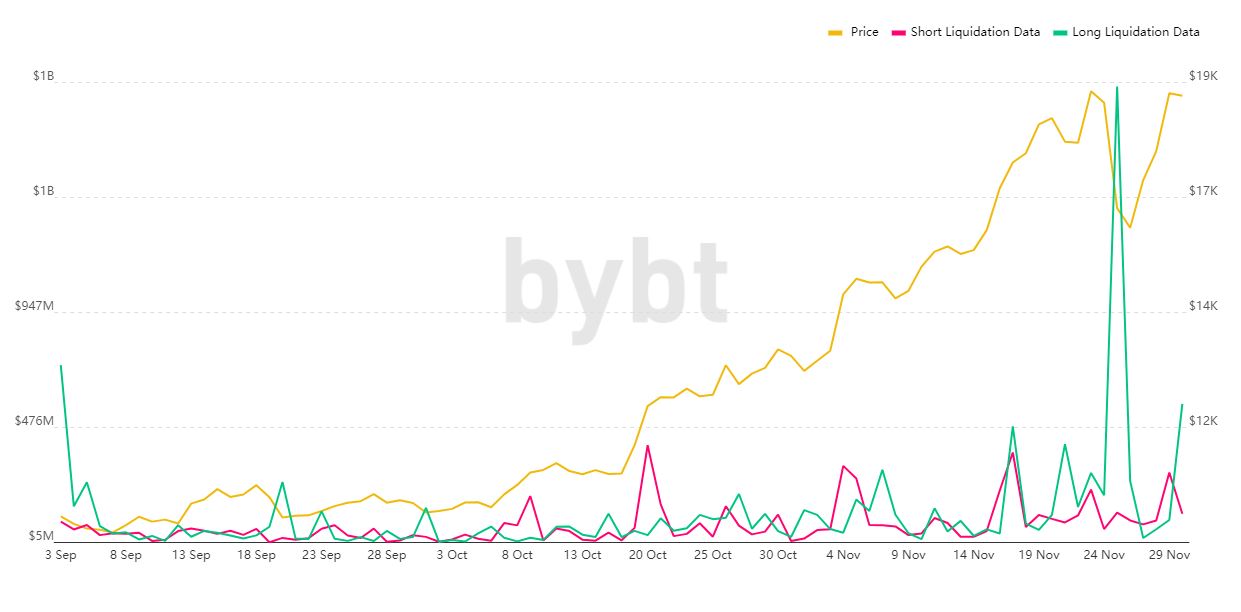

These past two weeks have been interesting for the cryptomarket world: an overall bullish trend and a new all-time high of $19,918 for Bitcoin since 2017 — more financial institutions savagely acquiring BTC, famous investors highlighting crypto in general and, even more insane: at least $860 million in Bitcoin, Ethereum, XRP, and other alts were liquidated this Tuesday, in just a few hours.

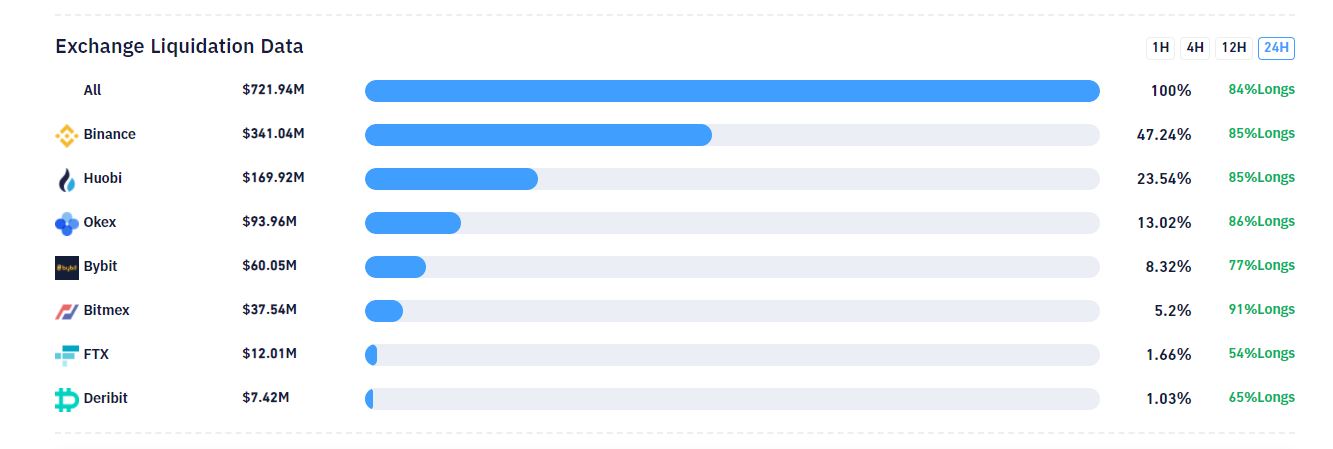

But Bitcoin takes the lead on ramping liquidations — recent data from Bybt shows how exchanges were massively liquidating trading positions after BTC dropped from 19,900 to 18,000 — which means that more than 80,500 long traders sold off their futures to avoid bigger losses.

Binance Takes The Lead

Binance is the current platform with the most liquidated positions — and long positions were 85 % of that sum. In a single order, a trader lost $6 million on the Singapore-based Huobi-BTC, which is the largest liquidation in a single order.

This Tuesday, investors were looking to hit $20,000 on Bitcoin after the price surged again at the beginning of this week. Sadly, it never went above 19,918. This second drop — from 19,900 to 18,000 — caused more than $370 million in liquidations in less than a single hour.

Now, in Bitcoin alone, the number appears to go as high as $720M at the moment of writing.

“It Was Just A Bull Trap”

However, some traders think that this was just a correction, and a more volatile market is ahead, just as Gleen Goldman, lays it out on his Twitter account:

$20,000 is a major resistance level, and we are now seeing volumes that are rarely traded. There’s a lot of uncertainty surrounding the next move of Bitcoin, so traders must take measures before entering the market again.