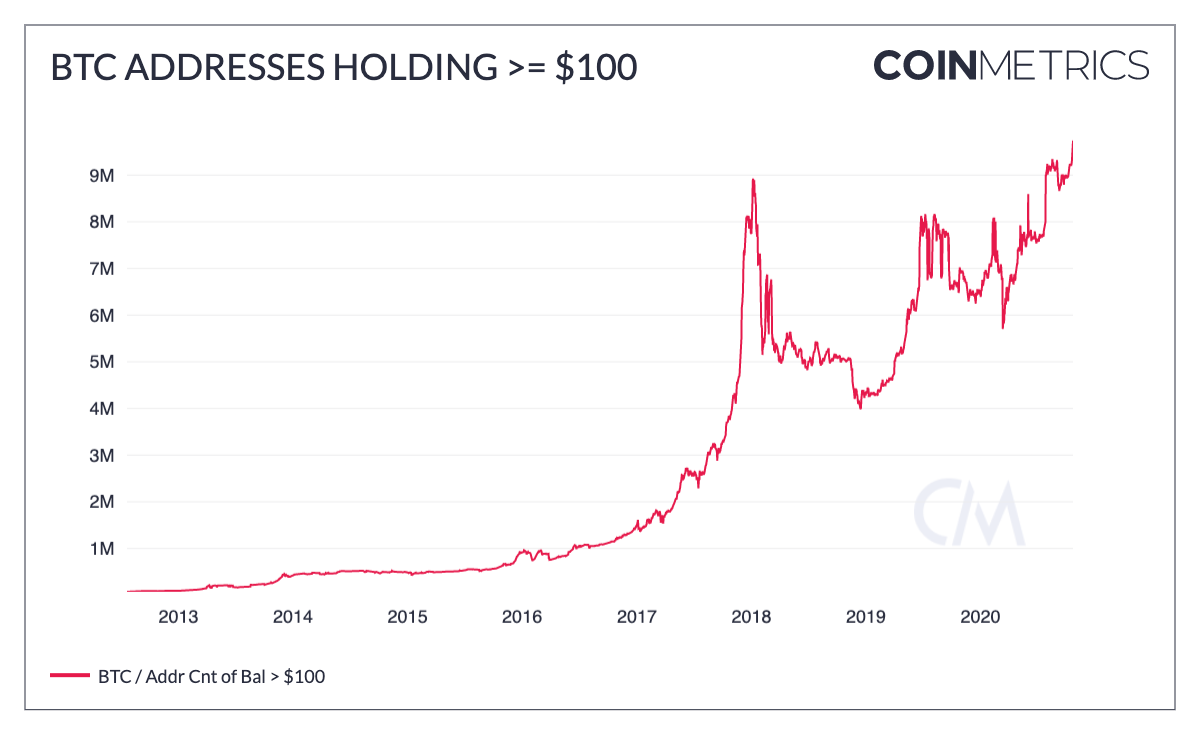

According to the latest blockchain letter from Pantera Capital, Paypal’s entry into the cryptocurrency market is one other factor contributing to the current rally in the market – led by Bitcoin (BTC), the largest digital currency by market capitalization. For some reasons, which include PayPal’s user base, the blockchain investment company believes that the current bull run is more sustainable compared to the past record in 2017.

PayPal is Buying 70 percent of New Bitcoin

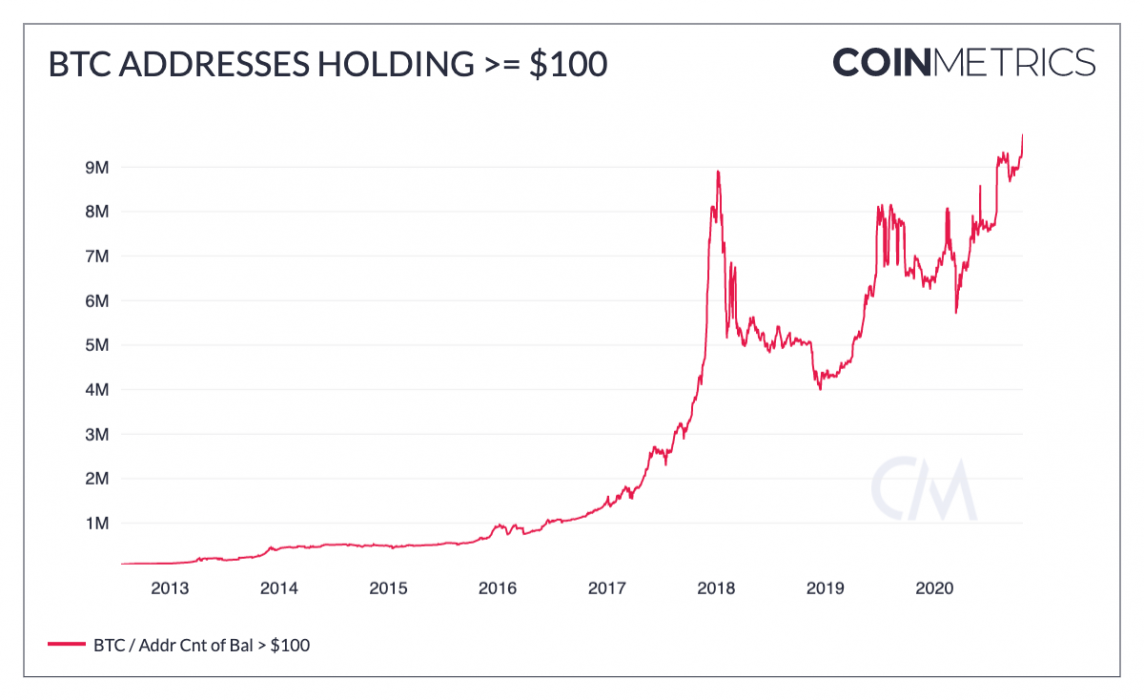

Notably, the rally in the crypto market kicked-off shortly after PayPal announced that it would support the buying and selling of digital currencies like Bitcoin, Ether (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). Interestingly, the development exposes over 300 million users on PayPal to Bitcoin, which means more adoption for the cryptocurrency. Additionally, Pantera Capital noted that PayPal’s user-friendly platform is making it easier for people to buy Bitcoin and other cryptos.

“Previously the friction to buy bitcoin was pretty onerous: take a selfie with your passport, wait days to a week to get activated, daily limits. Three hundred million people just got instant access to Bitcoin, Ethereum, and other cryptocurrencies,” the company said.

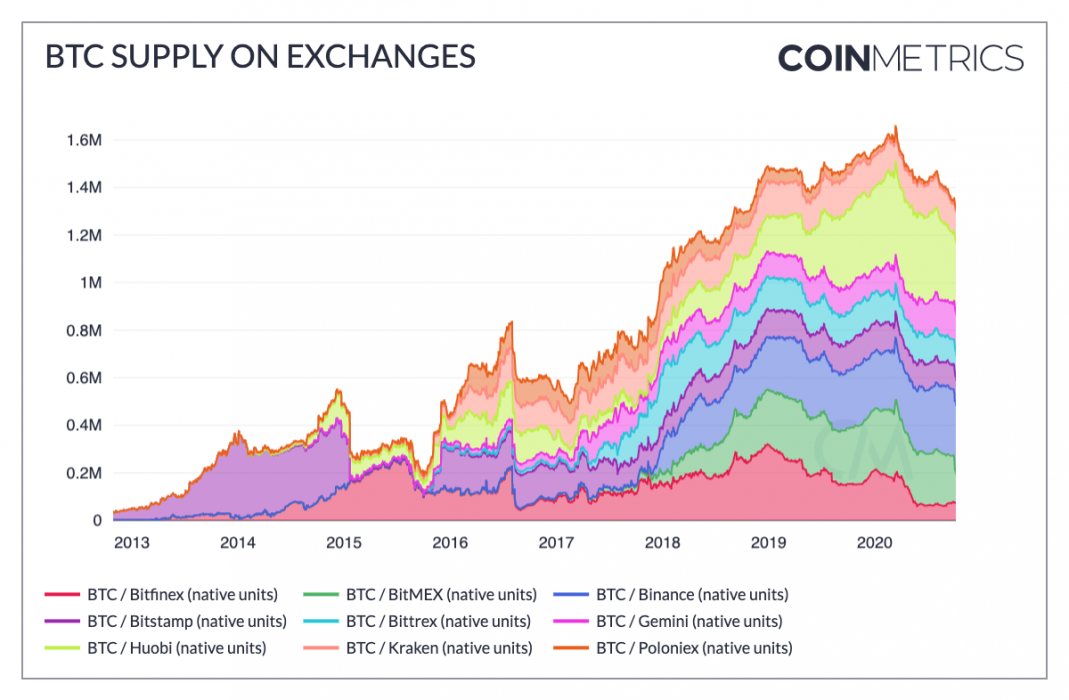

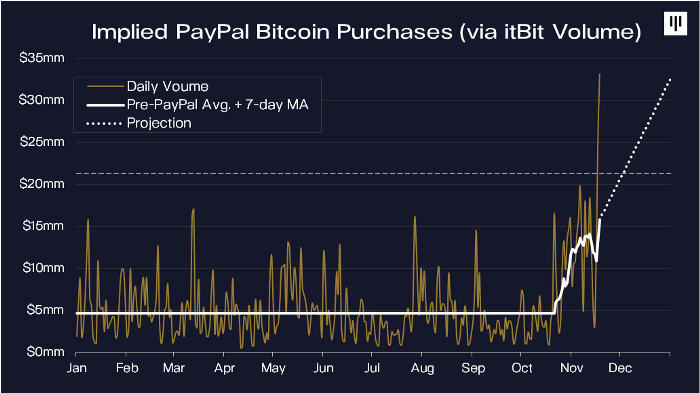

Due to the growing interest among PayPal users in the cryptocurrency, the digital payment platform has been acquiring a significant amount of newly-minted Bitcoin. Note that the crypto service on PayPal is powered by Paxos, which also operates itBit exchange. The volume of Bitcoin purchases on the exchange began increasing significantly after the service went live PayPal.

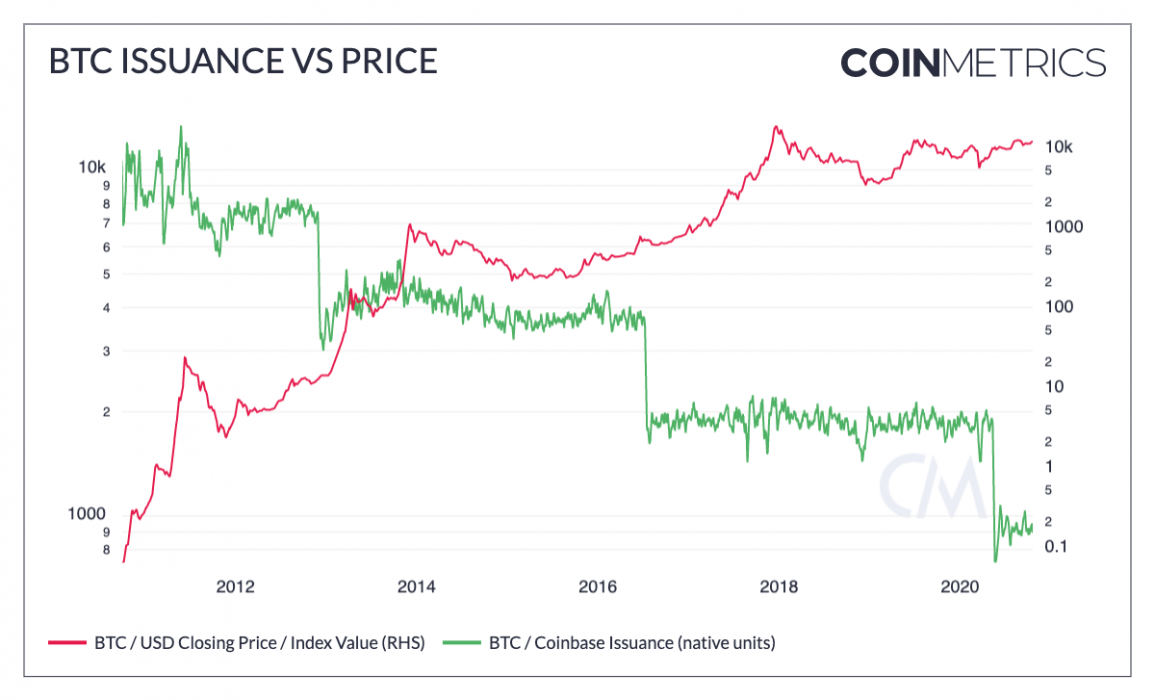

Having analyzed the tremendous growth, Pantera Capital highlighted that PayPal was already buying about 70 percent of new Bitcoin.

Cash App, PayPal is Causing Bitcoin Scarcity

Aside from PayPal, Square’s crypto-friendly digital payment platform, Cash App is also acquiring a significant amount of Bitcoin. Pantera Capital estimated in the report that Cash App buys 40 percent of all newly-issued bitcoin. Together with PayPal, the two companies are purchasing more than 100 percent of newly-minted Bitcoin, which means demand is higher than the supply rate – i.e., scarcity.

“When other, larger financial institutions follow their lead, the supply scarcity will become even more imbalanced. The only way supply and demand equilibrate is at a higher price,” Pantera Capital added.