The cryptocurrency sector has generated over US$30 billion in fundraising in the first half of the 2022 fiscal year – more than the entire year of 2021, according to a report from crypto firm Messari.

The report says US$30.3 billion was raised through 1199 funding rounds across centralised finance (CeFi), decentralised finance (DeFi), Web3 and NFTs (non-fungible tokens ). At least US$25.9 billion came from crypto funds and US$10 billion from traditional funds.

Centralised Exchanges Attract Wide Capital Influx

Moreover, centralised exchanges have attracted a wide influx of capital despite some brokers filing for bankruptcy: US$4.6 billion in the first quarter of H1 and US$5.6 billion in the second quarter of H1. This represents 108 percent more than H1 2021 and more than a third of total fundraising:

DeFi Sector Falls Behind

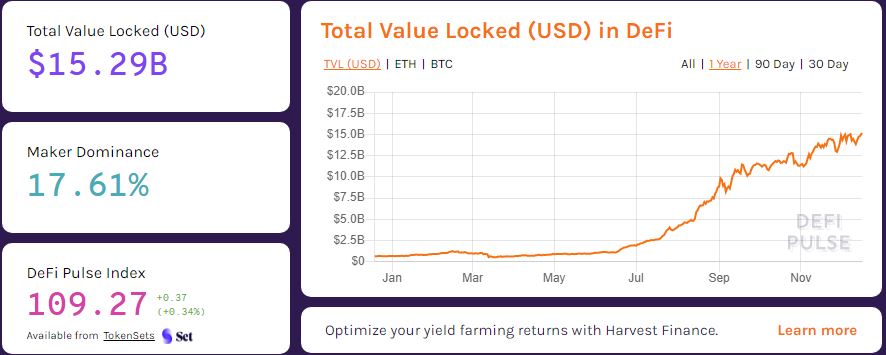

Web3-related startups have also attracted considerable capital. However, it seems the DeFi sector fell behind with barely US$1.8 billion raised. Astar Network was one of the stellar protocols in terms of fundraising. On April 5, the protocol announced it had secured over US$22 million in a fundraising round led by several crypto companies and angel investors.

Moreover, blockchain game GOALS netted US$15 million in seed funding led by Northzone, a venture capital firm, and the CEO of Sorare.

Bear Market Out to Two Years?

After the fall of several cryptocurrency companies following the collapse of Terraform Labs, combined with global inflation and other macro economic factors, selling pressure has been widening across the crypto market. Some crypto analysts even predict a two-year-long bear market. But institutions and big investors are still betting on blockchain technology and crypto assets, the report notes.