These are the coins i really like the look of in 2021. This is not financial or trading advice, I’m just sharing some information and thoughts on these projects that look interesting this year.

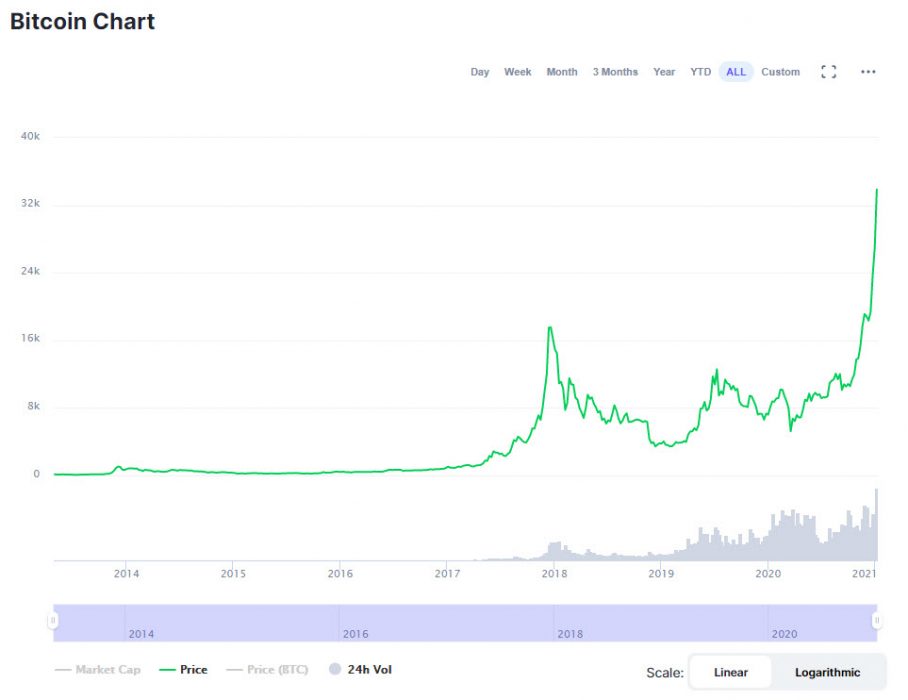

1. Bitcoin (BTC)

Bitcoin is the first successful internet money based on peer-to-peer technology; whereby no central bank or authority is involved in the transaction and production of the Bitcoin currency.

The end of 2020 saw the start of the institutional money flowing into BTC with the Bitcoin marketcap rising from US $130 Billion to over US $500 Billion. With big players such as Paypal, Square Inc, MicroStrategy Inc and other institutions adding thousands of BTC to their holdings.

There is also a big reduction in the supply of new BTC as we saw the daily issuance supply dry up. And the data shows 78% of circulating BTC being illiquid and not traded, and big companies buying the newly mined Bitcoins which is also having an impact on the supply of BTC.

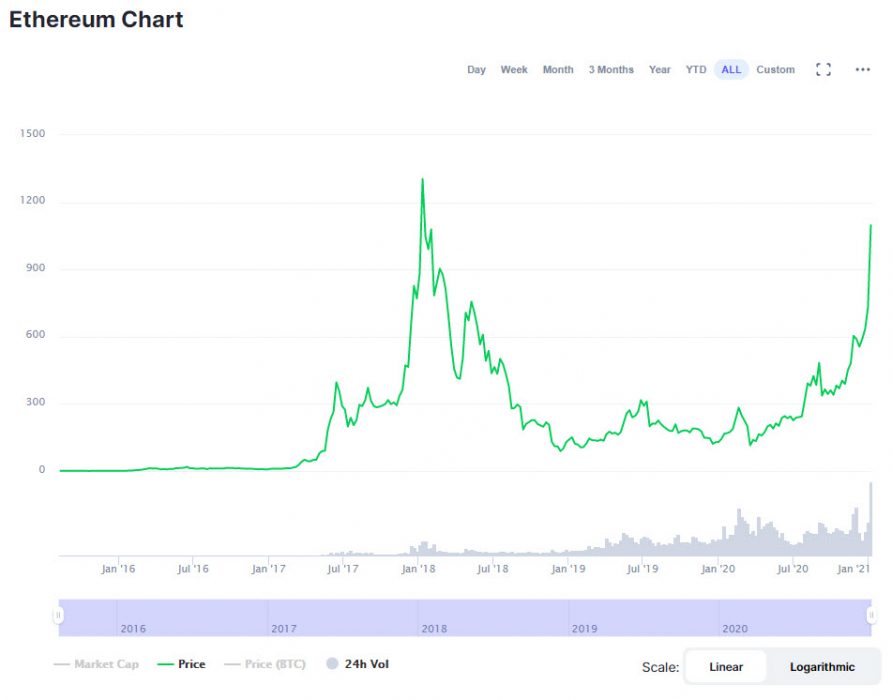

2. Ethereum (ETH)

Ethereum is a decentralized open-source blockchain system that features its own cryptocurrency, Ether. ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralized smart contracts.

Since 2020 we have seen ETH grow 744% in price outperforming Bitcoin which increased 371% and the S&P 500 at only 8.35%.

The recent developments of the ETH launchpad and Ethereum 2.0 has certainly sparked the interest in Ethereum.

In 2020 we also saw the emergence of DeFi and it’s marketcap surpassing US $10 Billion which looks like a very interesting market with lots of exciting developments for 2021.

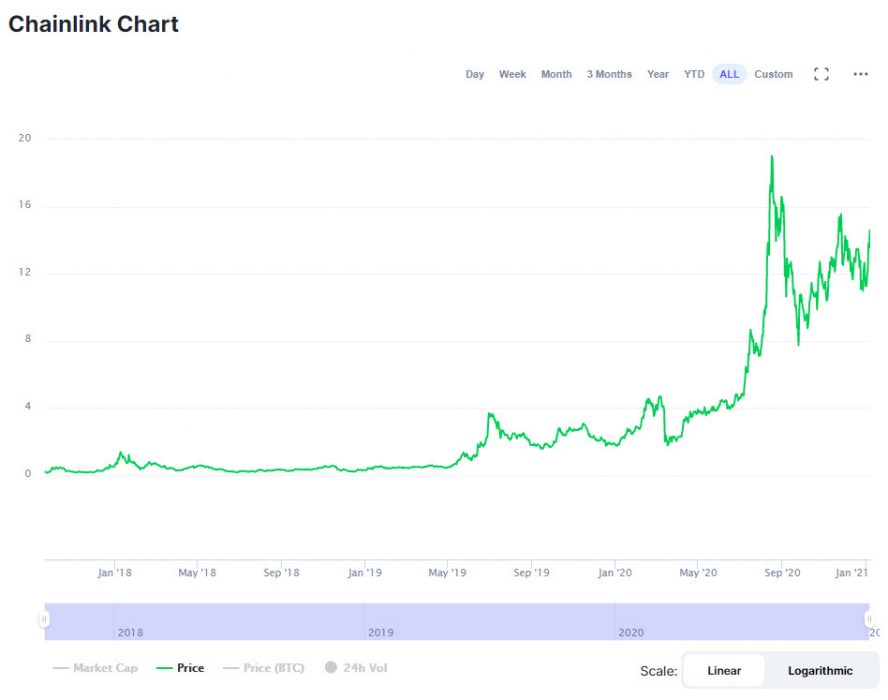

3. Chainlink (LINK)

Chainlink is a decentralized oracle network which aims to connect smart contracts with data from the real world.

Chainlink provides is the missing link (pun intended) between the real world data and the virtual blockchain data. The smart contracts provided by other blockchains such as Ethereum will require real world data to execute. This is where Chainlink comes in to provide verifiable data to those networks through real world APIs.

Looking to 2021 as Chainlink continues to add to its growing number of partnerships and more blockchains to start to use its services and DeFi projects to use Chainlink’s decentralized oracle network.

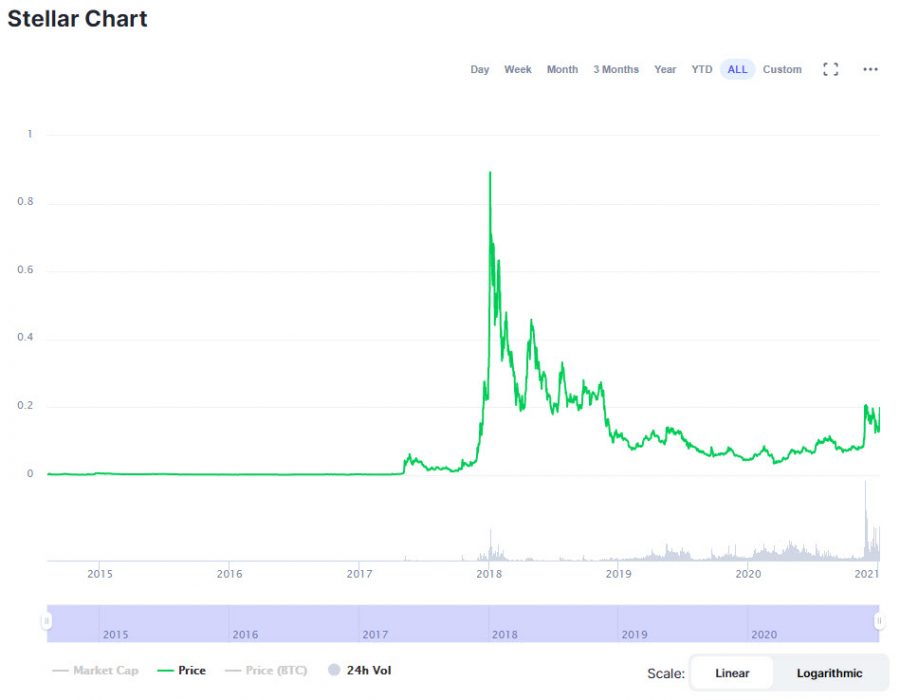

4. Stellar (XLM)

Stellar is an open network that allows money to be moved and stored. When it was released in July 2014, one of its goals was boosting financial inclusion by reaching the world’s unbanked — but soon afterwards, its priorities shifted to helping financial firms connect with one another through blockchain technology.

Stellar was founded in the USA where some of the Ripple founders left and cloned the codebase and rewrote it. I’m quite impressed with the coding activity of Stellar seen on Github which if it continues, they should have a great 2021. Also looking forward to seeing what the partnership with IBM and blockchain cross-border payments can produce and possible banks launching stablecoins on the network.

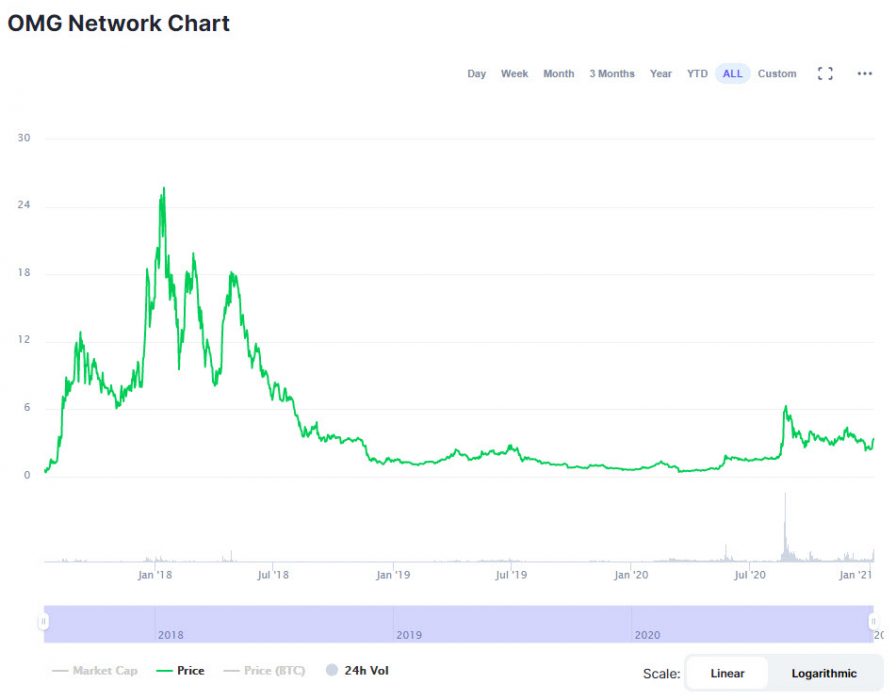

5. OMG Network (OMG)

OMG Network, formerly known as OmiseGo, is a non-custodial, layer-2 scaling solution built for the Ethereum blockchain. As an Ethereum scaling solution, OMG Network is designed to allow users to transfer ETH and ERC20 tokens significantly faster and cheaper than when transacting directly on the Ethereum network.

Founded in Thailand in 2017, OMG is covering areas such as payments, loyalty points and banking/finance.

2021 could see OMG switch to Proof of Stake (POS) and working with ETH to scale transactions lowering transaction fees through the Plasma Network.

Closing Remarks

Obviously there are thousands of cryptos and projects that are trying to solve complex problems and improve all areas of our industries. The cryptocurrencies and tokens are starting to enter mainstream news now and i’m sure 2021 will see a lot more exposure for these awesome projects.

The Price of BTC in 2020 went from US $7,000 to now $33,000

The Price of ETH in 2020 went from US $129 to now $1,090

The Price of LINK in 2020 went from US $2 to now $14

The Price of XLM in 2020 went from US $0.04 to now $0.19

The Price of OMG in 2020 went from US $0.6 to now $3.30

I wonder how these will perform in 2021… Check back next year for an update!