Coinbase, the leading United States cryptocurrency exchange, has finally launched on NASDAQ, with a 50 percent increase in the share price.

Coinbase Valuation Has Surpassed $100 Billion

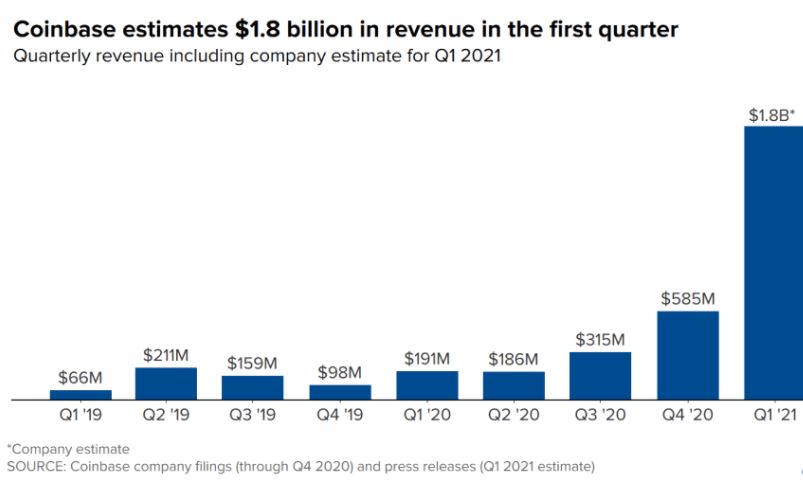

The Coinbase Shares (ticker symbol COIN) began trading on the stock exchange on Wednesday at the market price of $381 USD. This is about 50 percent higher than the reference price set by the exchange on Tuesday. At 1:31 PM, New York time, the shares’ price exploded to as high as $403 USD, bringing Coinbase’s valuation to over $100 billion shortly after the market debut.

COIN performance so far ranked the exchange as the 142nd largest company in the globe, according to data from Companies Market Cap.

We’ve had a number of ups and downs on our way here. Through luck and skill, Coinbase succeeded where many predicted it would fail. […] Today’s listing is a milestone, but it’s not as important as every new day in front of us. Coinbase has an ambitious mission: to increase economic freedom in the world.

Brian Armstrong, Co-founder, and CEO of Coinbase

Industry Reaction to COIN Listing on NASDAQ

Coinbase listing on the stock market has been one of the most-discussed topic in the cryptocurrency space, as it marks the first-ever crypto company to go public. Instead of choosing the traditional initial public offering (IPO) route, the exchange direct-listed on NASDAQ, meaning the exchange will issue its existing shares rather than offering new ones.

Many crypto enthusiasts and companies reacted positively to the development today. Binance has announced it will list the Coinbase stock tokens after the stock market debut.

The author of Rich Dad Poor Dad, Robert Kiyosaki, also commented on the milestone, saying that Coinbase listing will bring more credibility to the crypto market.