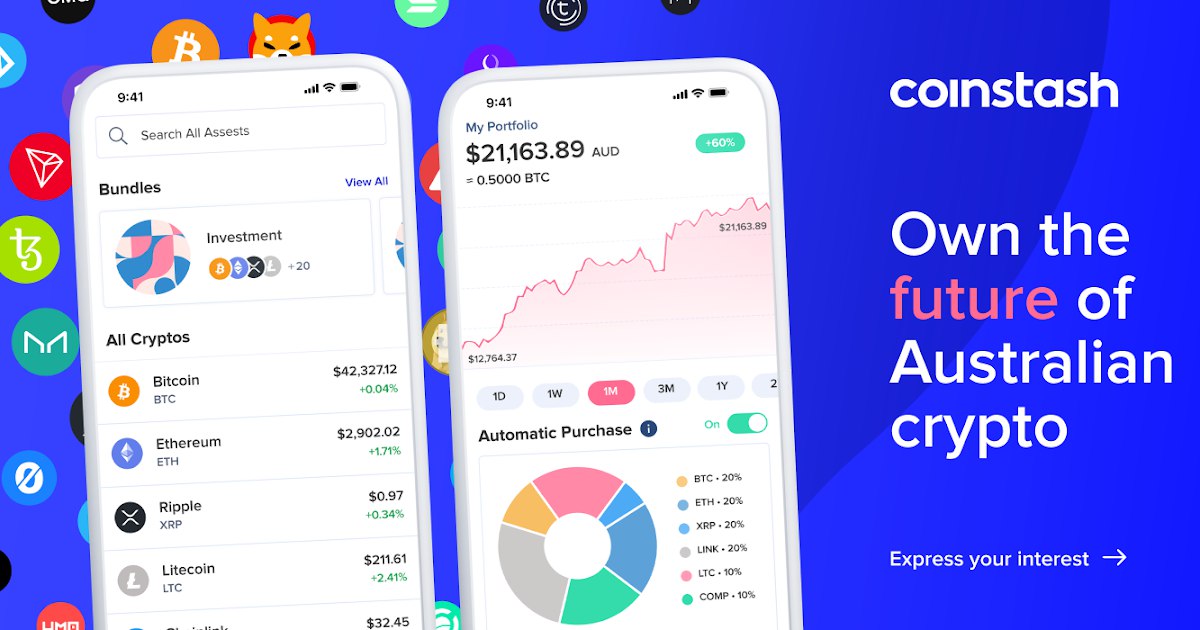

Fancy owning a piece of a rapidly growing and trusted Australian crypto exchange? Brisbane-based digital asset platform Coinstash is growing at a rapid rate and now presents Australian retail investors with the opportunity to own a piece of the action:

Public Crowdfunding Round

AUSTRAC-registered Coinstash is officially offering prospective investors to register interest in an opportunity to participate in its second equity crowdfunding round.

At Coinstash, we believe cryptocurrency is one of the biggest and most transformative inventions of the 21st century. Our mission is to financially empower our clients by bridging the gap between traditional finance and the world of crypto.

Ting Wang – CEO & Co-Founder

This follows an enormously successful A$2.8 million crowdfunding raise in 2021. In fact, last year proved to be an enormously successful one for Coinstash, which demonstrated exponential growth across a number of key metrics. In particular, customer growth exceeded 500 percent, while trade volume increased by 322 percent.

Currently, the exchange has more than 20,000 registered users who trade more than 340 cryptocurrencies. Part of the company’s success is no doubt attributable to recently launched Coinstash Earn, a loyalty program where customers can earn rewards of up to 24 percent on their crypto assets.

Exciting Future For Brisbane and Crypto

According to its website, Coinstash has a number of exciting plans scheduled for launch prior to the end of 2023, subject to regulatory approval. These include:

- Coinstash Borrow – where customers can borrow Australian dollars (or crypto) using their crypto holdings as collateral.

- Coinstash Spend – a crypto credit card where customers’ crypto holdings would be a factor in determining their credit limit.

These exciting initiatives offer additional evidence that Coinstash is much more than an exchange. As crypto investors increasingly demand yields on their crypto, not to mention the capacity to borrow against it, Coinstash appears well-positioned to capitalise on these trends.

Prospective investors can register their interest directly here and find out more by attending an upcoming webinar on May 27 at 12pm AEST.

For more information on Coinstash, please see our Coinstash review.

Disclaimer: Always consider the general CSF risk warning and offer document before investing.