Major crypto exchanges, including Coinbase and Binance, have continued to resist calls to suspend their services in Russia despite a wave of withdrawals of major payment providers from the Russian market.

7/ In addition, we are not preemptively banning all Russians from using Coinbase. We believe everyone deserves access to basic financial services unless the law says otherwise.

— Brian Armstrong – barmstrong.eth (@brian_armstrong) March 4, 2022

Following on from PayPal’s withdrawal last week, Visa and Mastercard have now moved to suspend their services inside Russia:

Payment services suspending operations in Russia, past two days:

— The Spectator Index (@spectatorindex) March 6, 2022

– American Express

– Mastercard

– Paypal

– Visa

In a statement released on March 5, Visa announced its restrictions would come into effect in coming days and would mean Visa cards “issued in Russia will no longer work outside the country and any Visa cards issued by financial institutions outside of Russia will no longer work within the Russian Federation”.

In a similar move, Mastercard will be suspending all cards issued by Russian banks, and any cards issued outside Russia will not work at Russian merchants or ATMs.

Russia Partners With Chinese UnionPay to Fill Void

In response to the announcements by Mastercard and Visa, several Russian banks – including the federation’s largest lender, state-owned Sberbank – have said they will begin issuing cards from the Chinese operator UnionPay in partnership with the Russia-based payments network MIR.

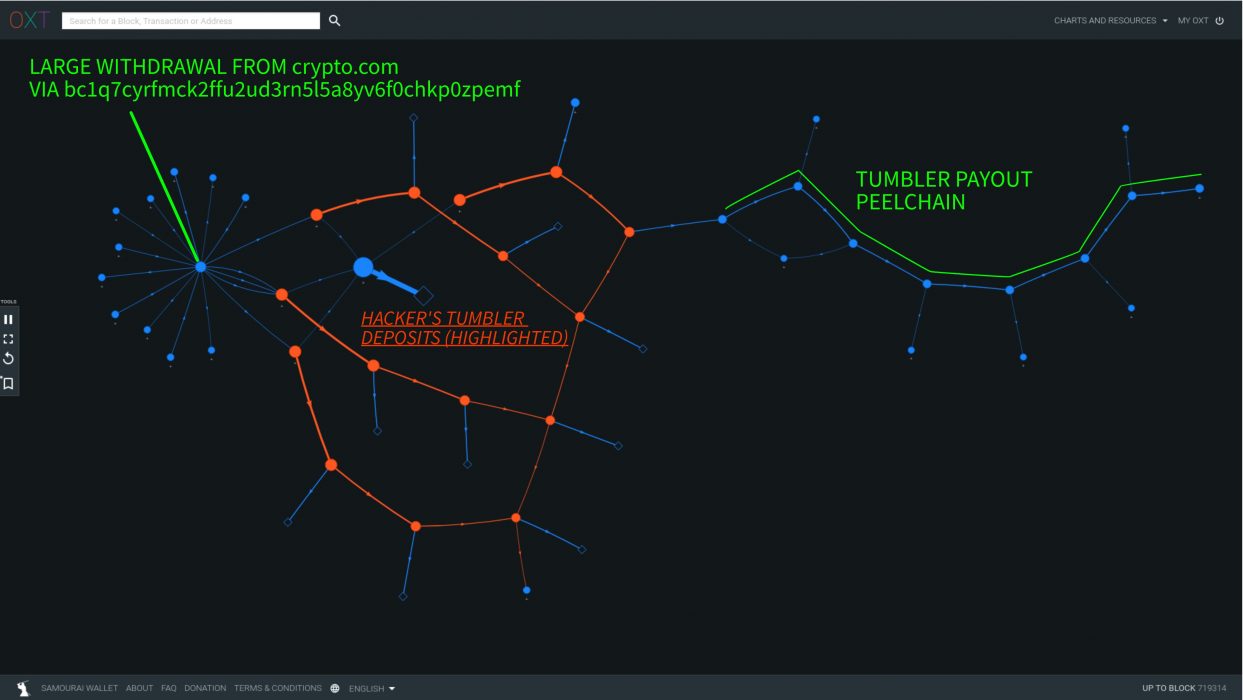

Crypto Unlikely to Help in Avoiding Sanctions

Although at first glance it seems reckless for crypto exchanges to continue operating in Russia, given the risk of circumventing sanctions, the relatively small scale of crypto markets, the lack of Ruble pairs, and blockchains’ highly traceable and immutable nature may actually make the risk relatively small.

According to Carole House, the US National Security Council’s director of cybersecurity, the sheer volume of currency Russia would need to circumvent the West’s economic sanctions “would almost certainly render cryptocurrency as an ineffective primary tool for the state”.

Jake Chervinsky, the Blockchain Association’s head of policy, created a Twitter thread to explain why Russia can’t use crypto to evade sanctions:

16/ Can crypto mitigate sanctions by offering an alternative to SWIFT? Not really.

— Jake Chervinsky (@jchervinsky) March 1, 2022

If Russia wants an alternative, they're far more likely to use China's CIPS than a public network they can't control.

Regardless, there's nobody in the free world to do business with them anyway!

Perhaps more importantly, there exists a much more established alternative for the Russian government – the Chinese CIPS network (which is essentially the Chinese SWIFT).