In the fallout of the swift and shocking collapse of FTX last week, rival exchange Crypto.com chose to share their cryptocurrency reserves publicly in an effort to shore up customer confidence.

However, this attempt to ease customer concerns backfired when it was revealed just over 20 percent of Crypto.com’s reserves, valued at close to US$500 million, are held in the meme-coin Shiba Inu (SHIB).

This means that Crypto.com holds more SHIB than Ethereum (ETH) and USD Coin (USDC) — in fact, the only cryptocurrency the exchange holds more of than SHIB is Bitcoin (BTC).

What Exactly Does This Mean?

Initially many in the crypto community incorrectly believed that Crypto.com’s large holdings of SHIB were part of an irresponsible meme-coin heavy investment strategy.

It’s since been clarified that the exchange holds so much SHIB because its customers have purchased a lot of the token, the exchange holds 1:1 reserves of customer assets — as a Crypto.com spokesperson explained:

“The reason our Proof of Reserves include Shiba is because we hold customers’ balances 1:1. Thus, our Proof of Reserves are dictated by our customer holdings.”

Crypto.com spokesperson

Crypto.com Sent 320,000 ETH To Wrong Address

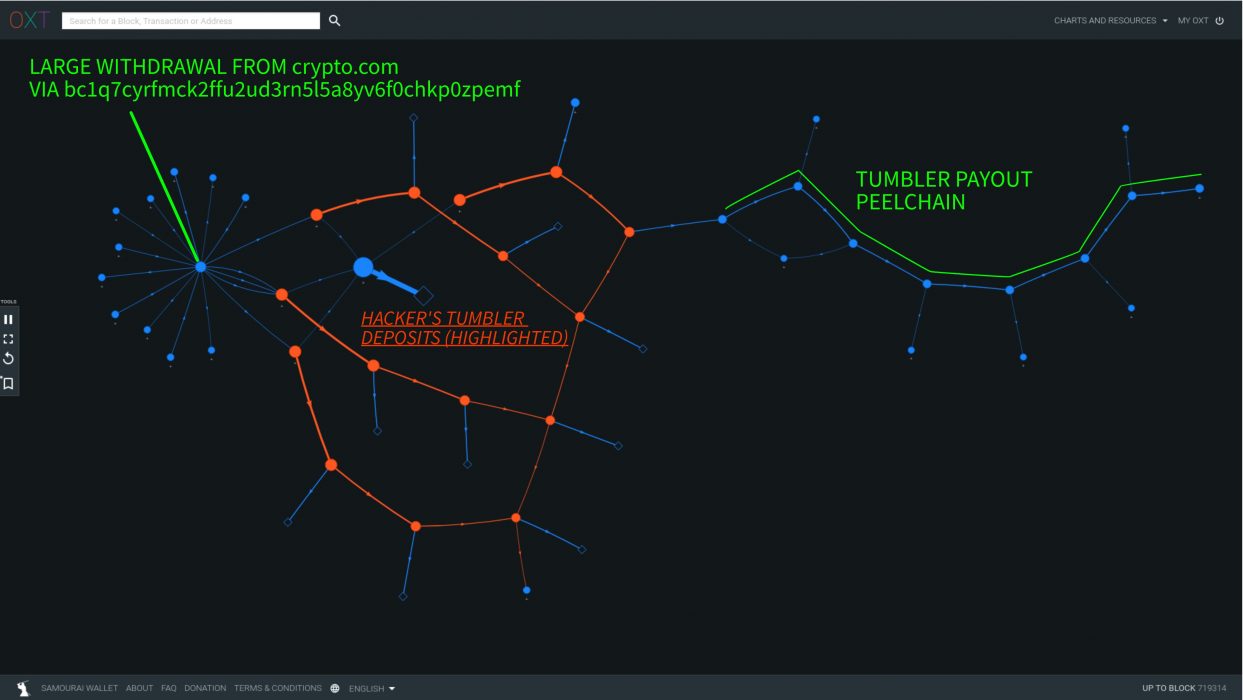

In another concerning piece of news, a Twitter user named @jconorgrogan unearthed a transfer of 320,000 ETH from Crypto.com to a wallet on rival exchange Gate.io.

This transfer, representing over 80 percent of Crypto.com’s ETH holdings, occurred on October 21 but it wasn’t until @jconorgrogan noticed it and tweeted that the wider crypto community became aware of it.

Crypto.com says that the transfer was an error, claiming the ETH was accidentally sent to a whitelisted account under its control on Gate.io instead of being transferred to a new cold storage wallet.

Since the accidental transfer occurred, 285,000 ETH have been confirmed to have been returned to Crypto.com, while the remaining 35,000 have been sent to a different address whose ownership is yet to be confirmed.

Crypto.com CEO Kris Marszalek says the incident has been resolved and claims new processes have now been put in place to avoid a recurrence:

In this particular case the whitelisted address belonged to one of our corporate accounts in a 3rd party exchange instead of our cold wallet. We have since strengthened our process and systems to better manage these internal transfers.

— Kris | Crypto.com (@kris) November 13, 2022

Fear Triggers Flight to Safety, CRO Dump

This string of bad news has sparked fear among Crypto.com customers, prompting many to move their assets off the exchange and sell their holdings of CRO, Crypto.com’s exchange token. As a result, Crypto.com’s reserves have fallen significantly over the past few days, from close to US$3 billion to just over US$2 billion.

Similarly, the price of CRO has dropped precipitously in the past few days — at the time of writing data from CoinGecko showed it was down over 50 percent since Wednesday, changing hands at US$0.05