Brave, the company behind the popular privacy-focused web browser, has launched a public beta of its own search engine, Brave Search. The search engine promises to be fully private, anonymous, and transparent.

The Brave browser, first released in 2016, now has over 32 million active users per month and has become a popular choice for those who value privacy above everything else. Supporters of the Brave browser are excited by the release of the new search engine beta, which will become the default search engine in the browser later in the year.

The Brave New World

The Brave browser features privacy and security features such as in-built ad blocking, private windows, and password manager. The team also claims it is three times faster than Chrome out of the box. But perhaps its most innovative feature is the ability for users to earn Basic Attention Tokens (BAT) by viewing privacy-respecting ads. At this time, it is not clear whether using Brave Search will reward users with BAT.

The ‘Real Alternative’ to Google

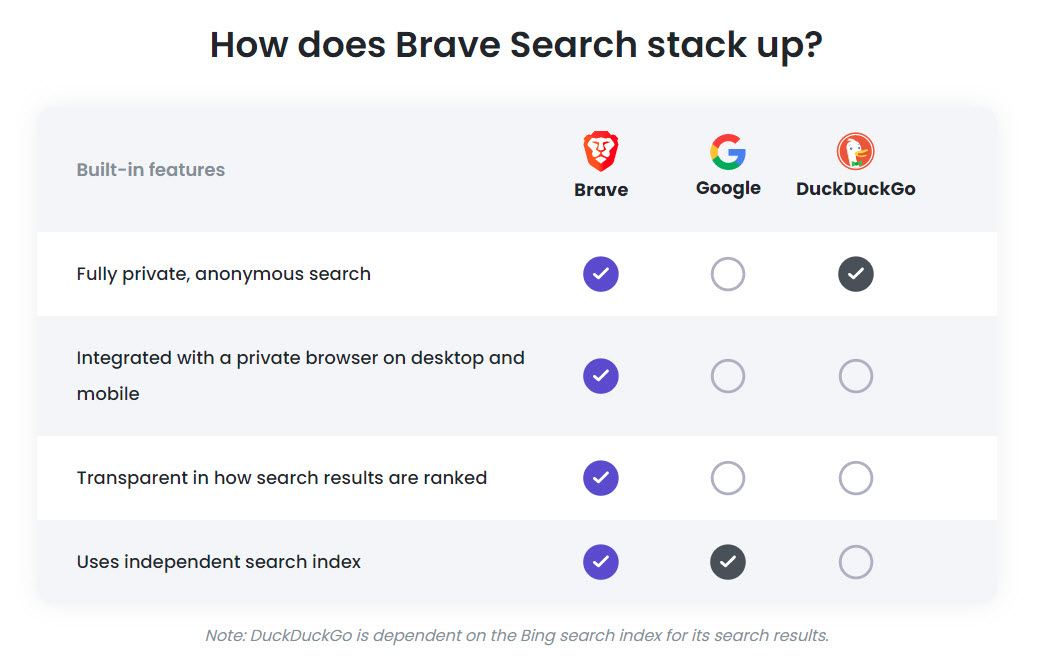

Brave Search doesn’t track you or your queries. Ever. Private, independent, and transparent, Brave Search is the real alternative to Google. On mobile, desktop, and anywhere the web takes you. Search private. Search with confidence.

Brave [source]

Brave Search will also feature an independent index of the internet, which is a bold (or brave, if you will) move considering most new search engines merely repackage results from Google and Bing.

The Underdog vs Big Tech

Google has a monopoly when it comes to web browser and search engine market share. Currently, over 90% of searches go through Google. Not even Microsoft’s Bing has been able to make any meaningful inroads in the search domain, with just above 2% market share. It would be an ambitious task indeed if the Brave team were trying to overthrow the king, but it seems it is simply trying to present an appealing, private alternative to the big tech company.

Brave Team Keeping Busy

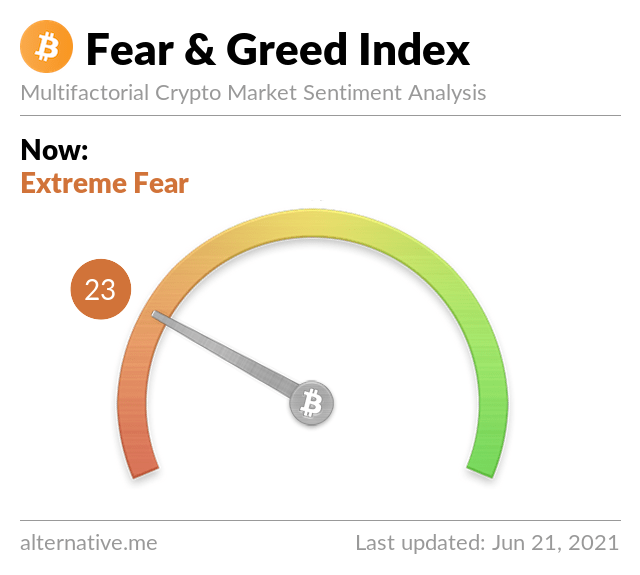

It appears that the Brave team has been very busy this year. It has also been building a Decentralised Exchange, which will feature benefits for BAT holders, such as discounts on transactions. Now could be a good time to be bullish on Brave.