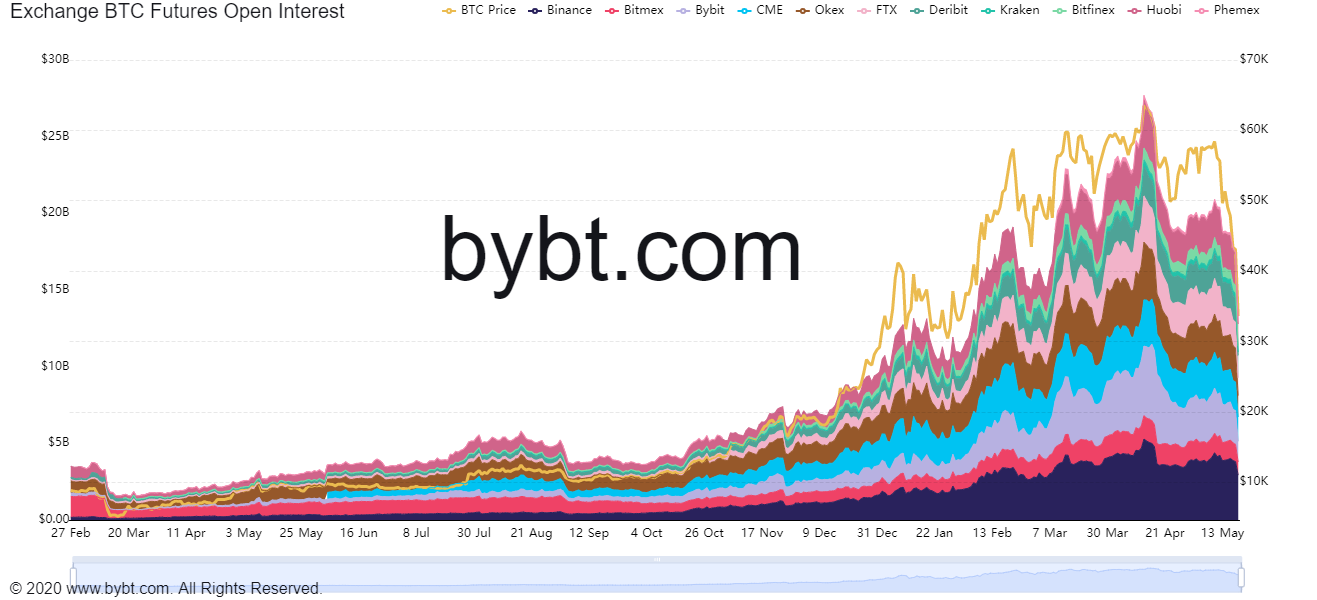

In a white paper recently released by Galaxy Digital, a tech investment and research firm shows that Bitcoin’s annual energy consumption is considerably lower than that of gold and the largest players in the banking industry.

Bitcoin Production Uses Way Less Energy Than Gold Production

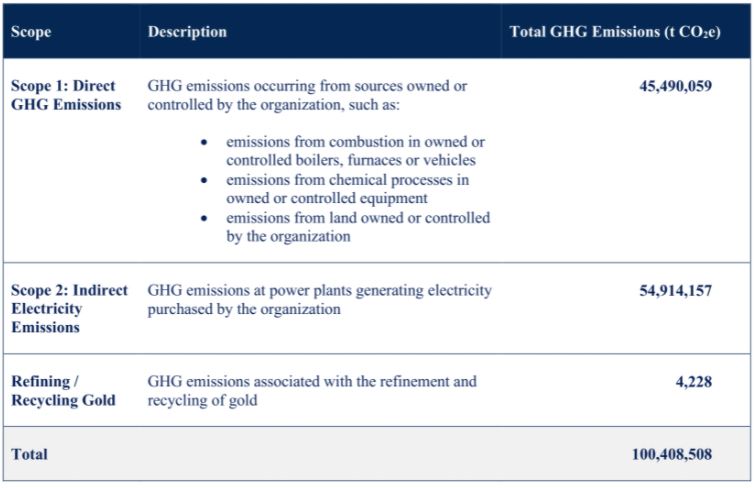

Auditing Bitcoin’s energy usage is quite simple compared to retrieving data for energy usage of the gold industry since this data is publicly disclosed.

Gold uses roughly 240.61 TWh/yr when using the standard conversion from GHG Emissions to kWh/yr using the global IEA carbon intensity multiplier. That’s just more than double that of Bitcoin, these estimates don’t include second order effects like production and discarding of vehicle tires and other materials used by the industry.

Bitcoin Also Uses Less Energy Than Gold

Banking uses an estimated 263.72 TWh/yr. This includes energy used by banking data centres, bank branches, ATMs, and card network’s data centres, which is discussed in-depth in the report. A comprehensive number would require individual banks to self-report on their electricity usage.

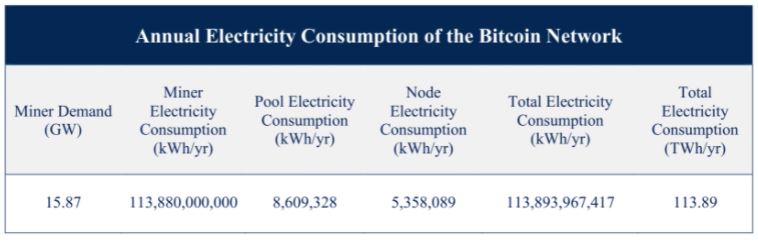

Bitcoin uses an estimated 113.89TWh/yr which is considerably lower than that of both other industries.

Kathy Wood also recently stated that 50% of Chinese bitcoin mining initiatives use renewable sources of energy as well as the fact that many use offset electricity.

Just cleaning up our wastage could power the Bitcoin network. The authors found that the amount of energy lost in transmission and distribution is 19.4x that of the Bitcoin network according to data from World Bank and IEA.

Bitcoin and Ethereum Will (Eventually) Go Eco-Friendly

Most new technologies that have high energy consumption eventually turn more eco-friendly, and we are starting to see Bitcoin and Ethereum take steps towards this.

Ethereum 2.0 is switching from proof-of-work to proof-of-stake (mining to staking) to consume 99% less electricity. And we also see some Bitcoin mining operations switch to carbon neutral systems.

The recent price drop of Bitcoin was linked to Elon Musk’s debate with Michael Saylor about Bitcoin’s environmental impact. Hopefully, this is something cryptocurrencies can address in the near future.