Ontology ONG just pumped up to +206% in the last few hours with a strong breakout on Binance & other Exchanges. Let’s take a quick look at ONG, price analysis, and possible reasons for the recent breakout.

What is Ontology?

Ontology is a new high-performance public blockchain project & a distributed trust collaboration platform. It provides new high-performance public blockchains that include a series of complete distributed ledgers and smart contract systems.

Ontology Quick Stats

| SYMBOL: | ONG |

| Global rank: | 42 |

| Market cap: | $465,820,527 |

| Current price: | $0.3420 AUD |

| All time high price: | $5.98 AUD |

| 1 day: | +206.4% |

| 7 day: | +210.70% |

| 1 year: | +234.74% |

Ontology ONG Price Analysis

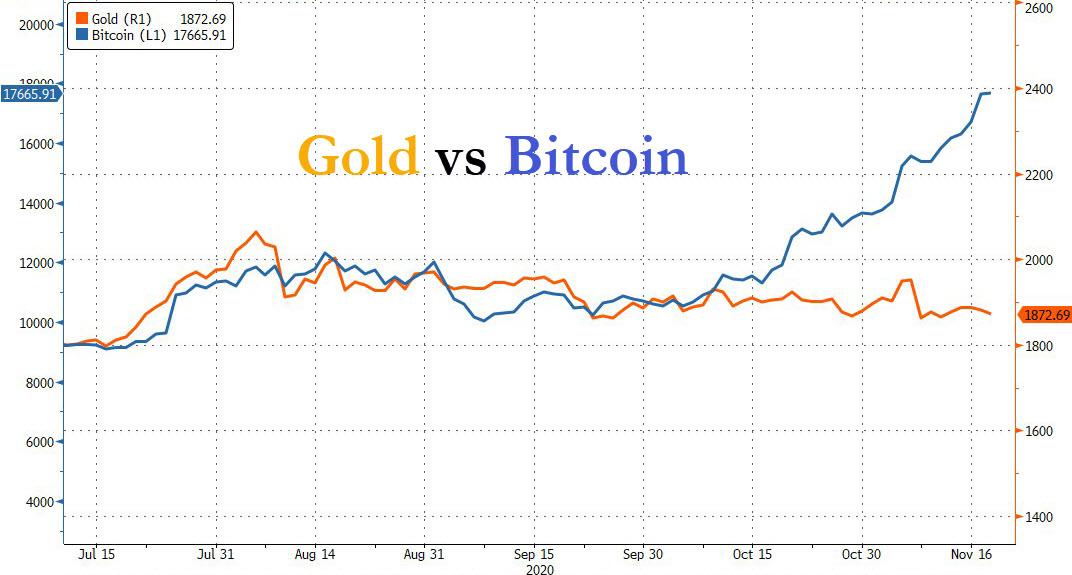

At the time of writing, ONG is ranked 42nd cryptocurrency globally and the current price is $0.34 AUD. This is a +210% increase since 20 November 2020 (7 days ago) as shown in the chart below.

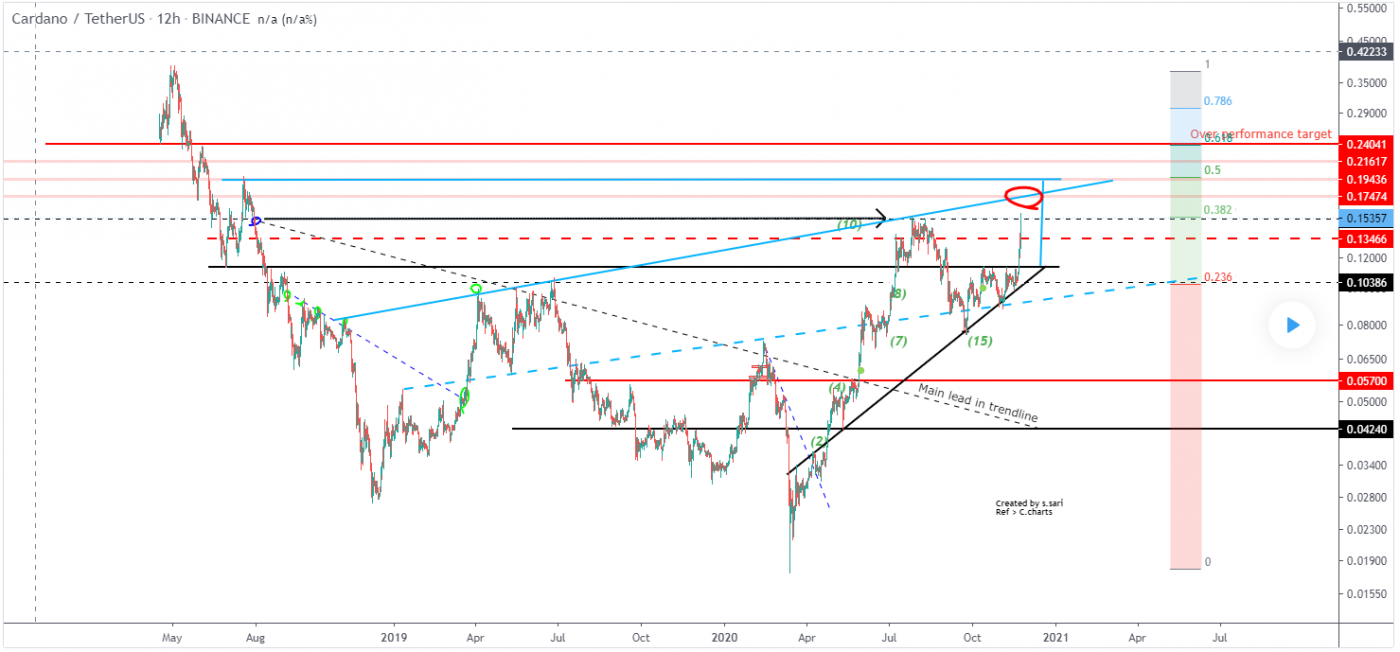

If we see the above 1-day candle chart, ONG was trading inside the falling wedge at the $0.1245 AUD price levels. Ontology Gas just did an awesome breakout by breaking all the major resistances in a single day and is now currently trading at $0.2452 AUD.

The price gained pace above the $0.30 AUD price levels and the 100-day simple moving average. It even broke the $0.40 AUD price level and traded to a new multi-month high at $0.4150 AUD. Ontology ONG price is currently correcting lower and trading below $0.2500 AUD.

What do the technical indicators say?

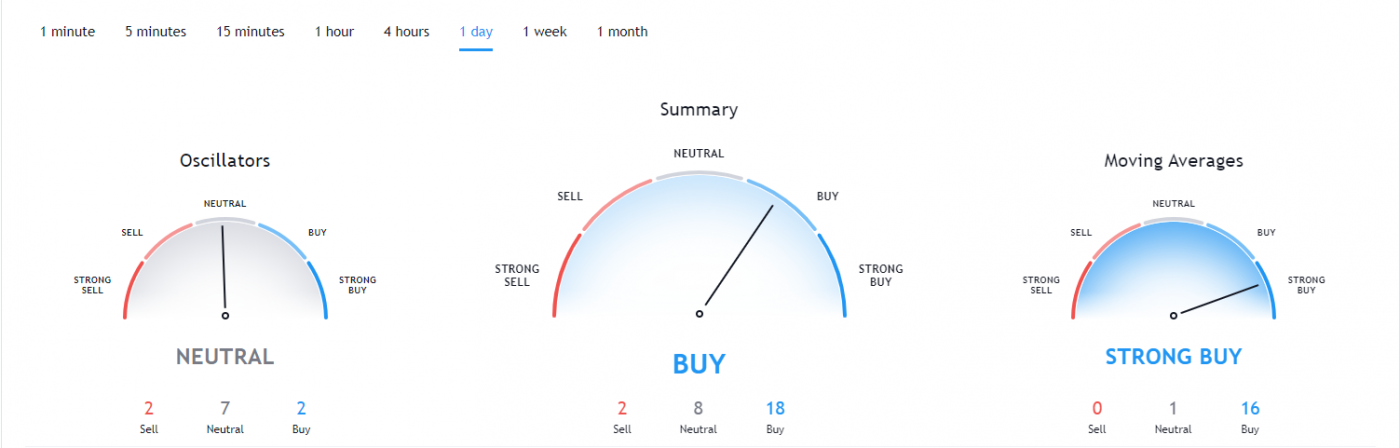

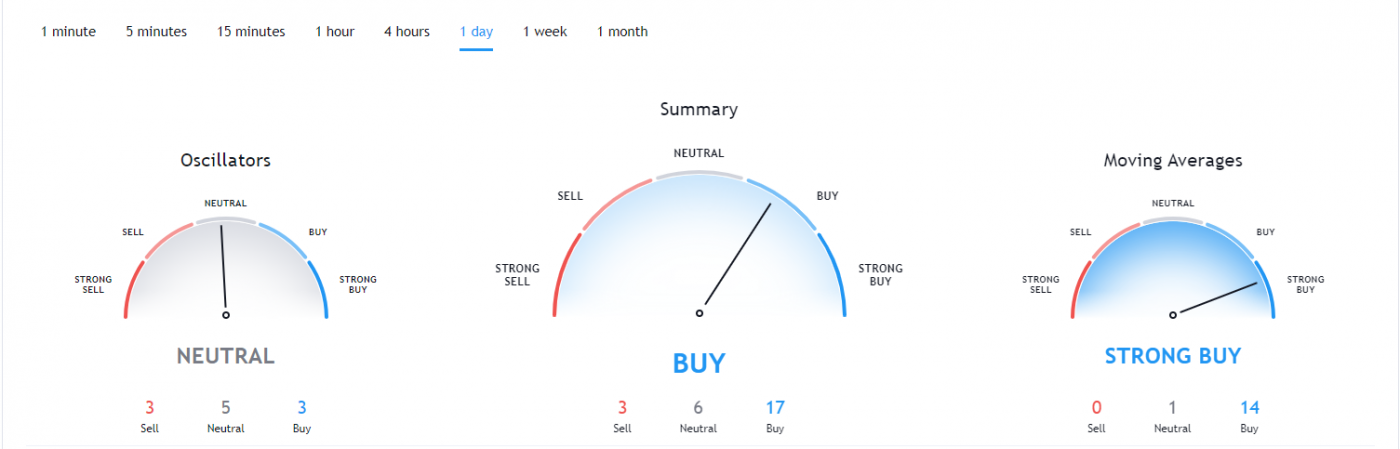

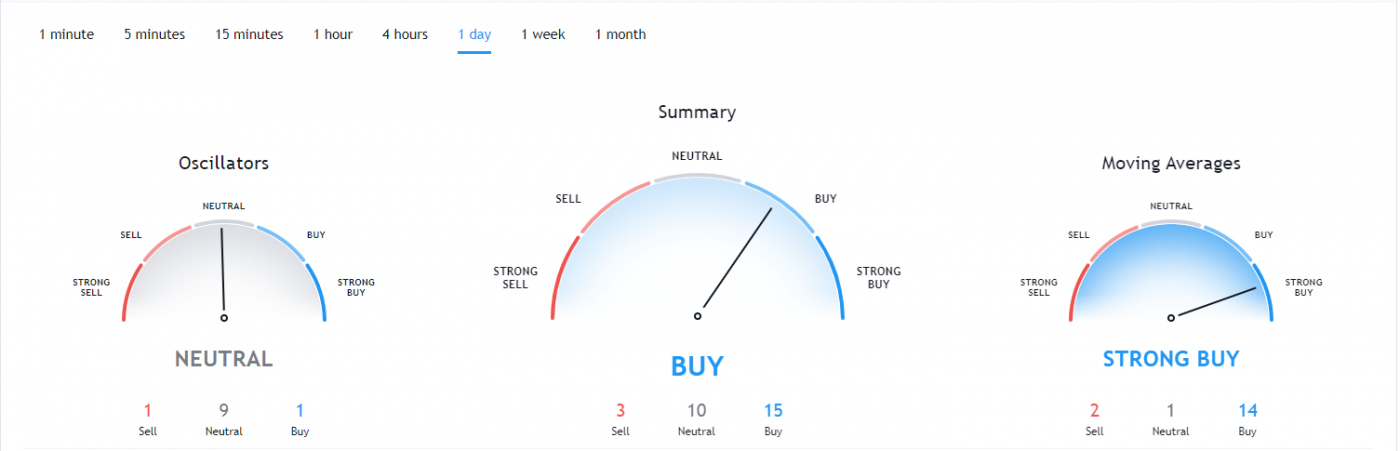

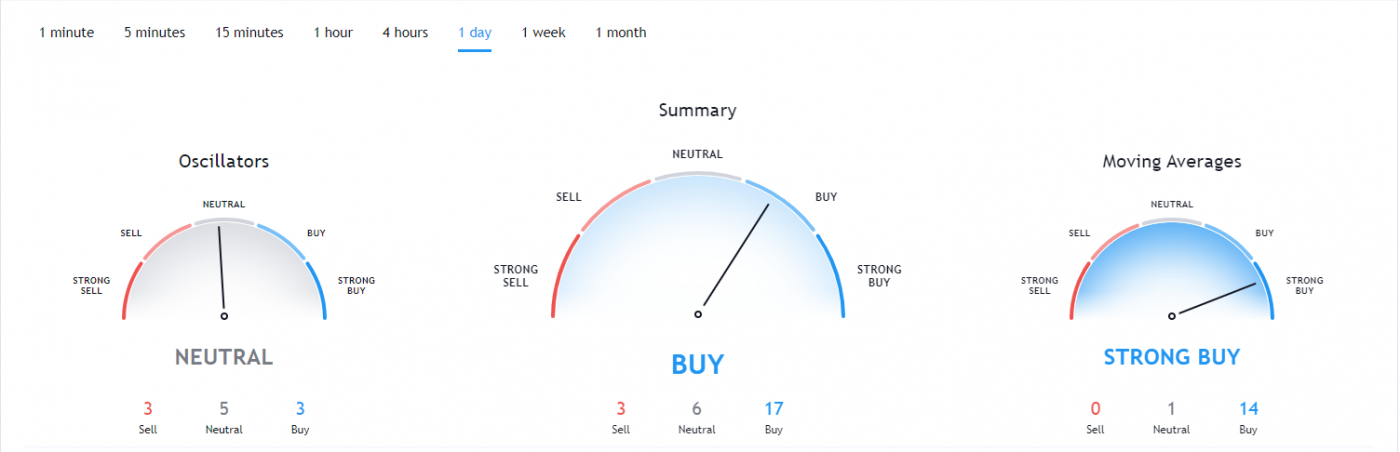

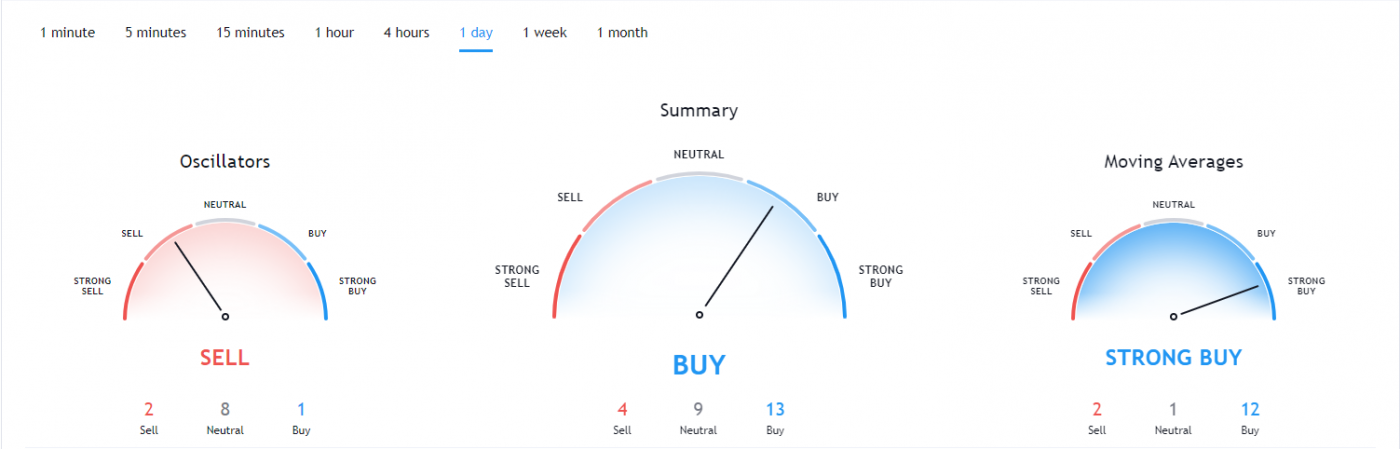

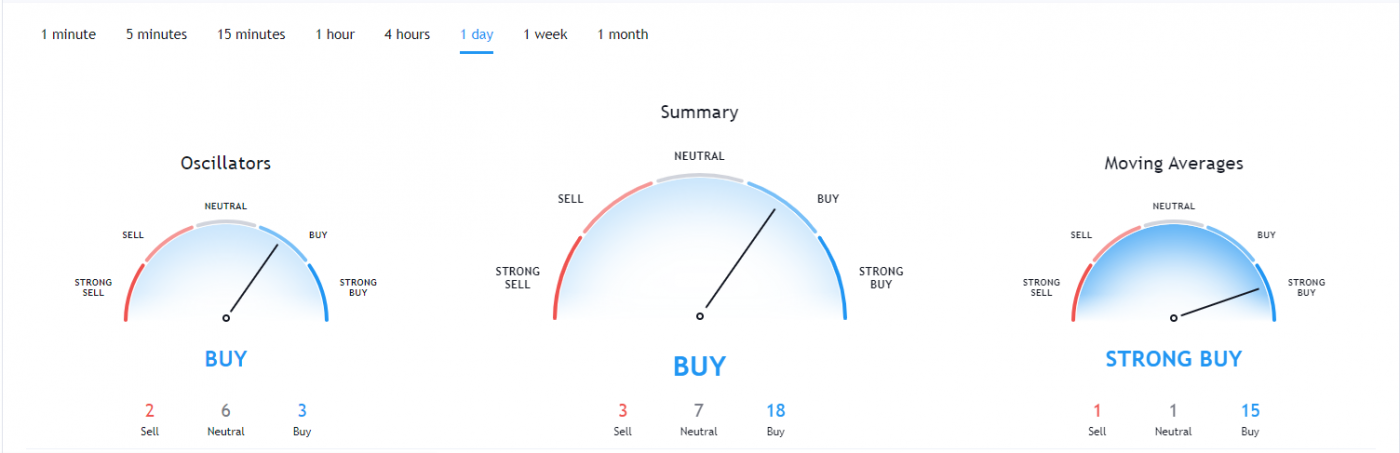

The Ontology ONG TradingView indicators (on the 1 day) mainly indicate ONG as a buy, except the Moving Averages which indicate ONG as a strong buy.

So Why did ONG Breakout?

The recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. Another big reason could be the whales secretly buying this coin for their portfolio which might give them huge profits in the next Altcoin rally. It could also be contributed to some of the recent events & news.

Recent Ontology News & Events:

- 11 May 2020 – AMA with ChangeNOW

- 09 September 2020 – Bithumb Listing

Where to Buy or Trade Ontology?

ONG has the highest liquidity on Binance Exchange so that would help for trading ONG/USDT or ONG/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.