The Ethereum floor price of the world’s largest NFT collection, Bored Ape Yacht Club (BAYC), dropped to its lowest level since the start of the year but has since managed to rally slightly. Yet for a brief moment, the second-largest NFT collection, CryptoPunks – also owned by Yuga Labs – saw its floor price top that of BAYC:

Debt Crisis Prompts Liquidation Fear

Many owners of BAYC and CryptoPunk NFTs, who used the collectibles as collateral to take out loans in Ether, have failed to repay their debts. The situation could trigger the NFT sector’s first massive liquidation. As BAYC struggles, CryptoPunks topped the floor price of the veteran NFT collection for the first time since March, according to NFT Price Floor.

Lending service BendDAO could liquidate up to US$55 million worth of NFTs to recover its loans, in fears that the so-called “health factor” of its debts could dip below one. (An NFT collection’s floor price is a key facet in determining a collection’s health factor.)

CryptoPunks Soldiers On

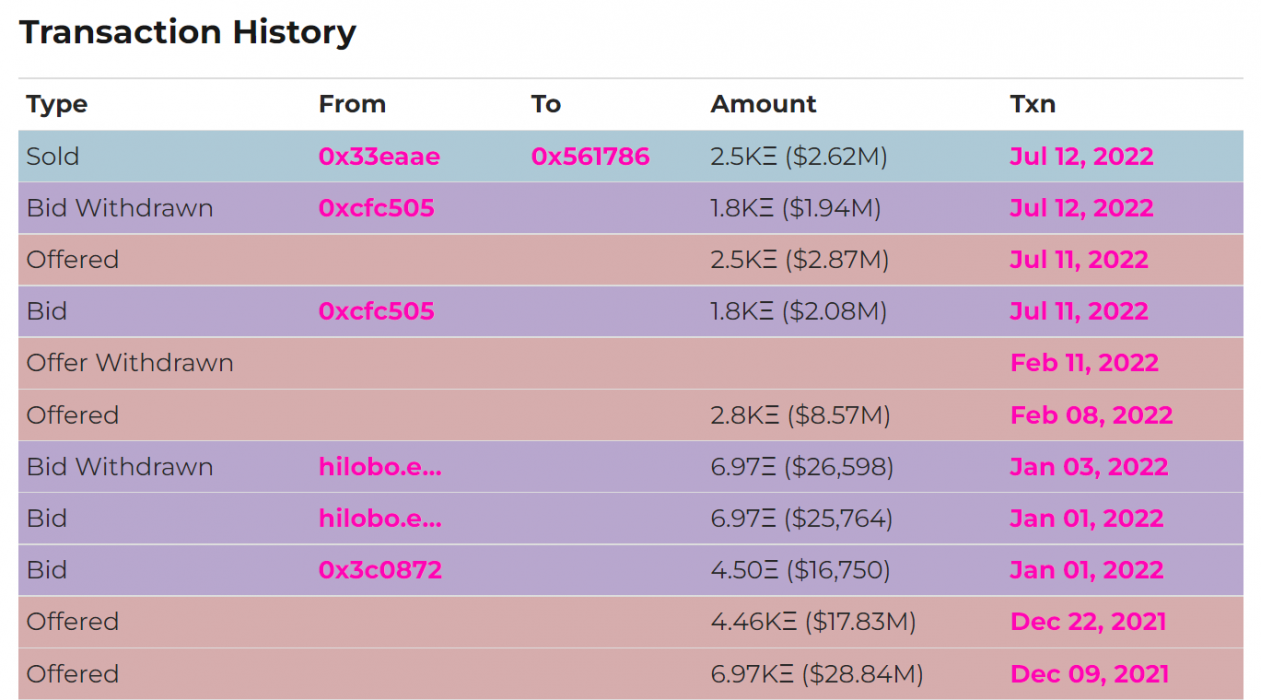

The past couple of weeks have been good for CryptoPunks, with exciting projects in its view. Early this month, famed jewellery brand Tiffany and Co announced the release of limited edition CryptoPunk pendants. In the midst of the crypto winter, a rare NFT from the collection sold for 2,500 ETH, or approximately US$2.6 million.