Yuga Labs Inc., the company behind the wildly successful non-fungible token (NFT) collections Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) is being investigated by the US Security and Exchange Commission (SEC), according to a report from Bloomberg.

Speaking to Bloomberg, an anonymous source claims that the SEC is looking into whether Yuga Labs’ NFTs should be regulated like stocks and should therefore comply with disclosure laws applicable to traditional securities.

The SEC will apparently also be examining Yuga Labs’ governance and utility token, Ape Coin (APE), which has been distributed to holders of their NFTs.

Case to Clarify Status of NFTs

The main issue of law that the SEC is seeking to clarify in this case is whether or not NFTs should be regulated as securities.

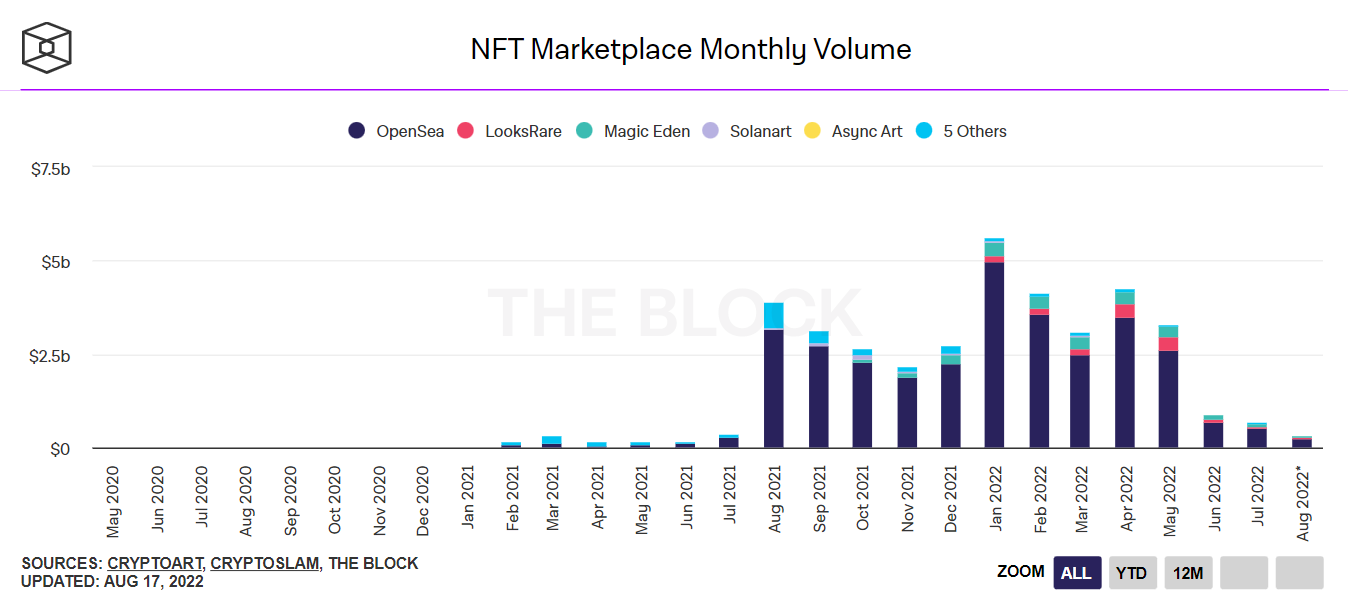

An earlier report from Bloomberg published in March of this year had previously revealed the regulator had started looking closely at the NFT market generally, so an investigation specifically into Yuga Labs, one of the most prominent market participants, is not entirely surprising.

Yuga Labs One of the Largest Players in NFT Space

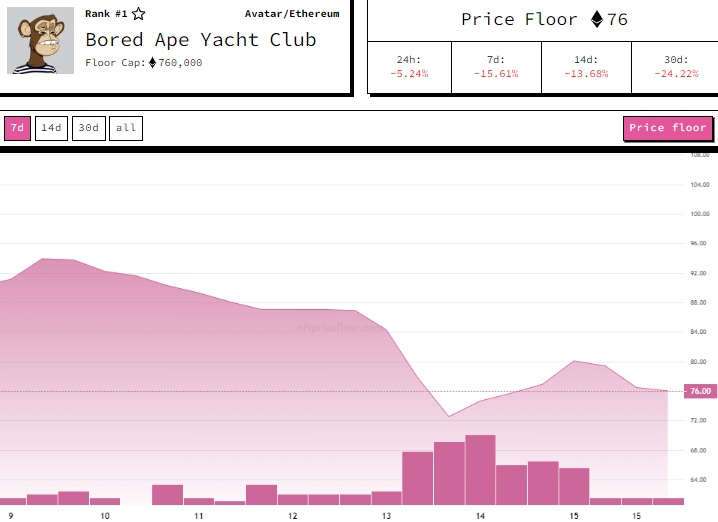

Since launching in 2021, Yuga Labs has grown to become one of the largest and most successful players in the burgeoning NFT collectibles space. The company’s Bored Ape Yacht Club (BAYC) NFT collection, which depicts cartoonish apes, soared in value following their release, hitting a record sale price of a whopping US$3.4 million dollars in October of 2021.

To support Yuga Labs’ growing NFT ecosystem, the Ethereum-based Ape Coin governance token was released and distributed to NFT holders earlier this year through a separate body known as the Ape Foundation. Ape Coin was released by this foundation rather than by Yuga Labs due to regulatory concerns.

Around 62 percent of Ape Coin was distributed to community members, with 15 percent going to NFT holders. A sizeable percentage also went to Yuga Labs and the founders of BAYC.

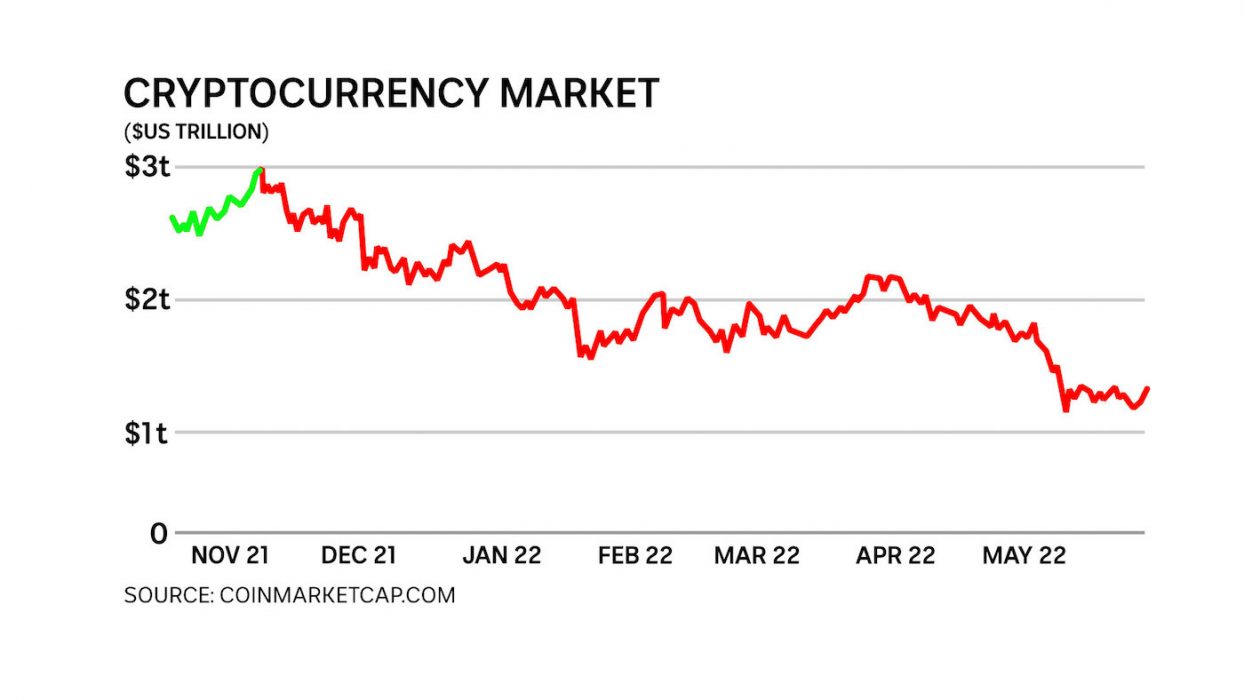

At the time of writing, data from Coin Gecko showed Ape Coin was down around four percent on the news of the investigation.

Yuga Labs “Happy to Cooperate“

Yuga Labs claims it’s happy to cooperate with the SEC’s investigation and understands the regulator is keen to learn more about the booming crypto industry:

“It’s well-known that policymakers and regulators have sought to learn more about the novel world of Web3. We hope to partner with the rest of the industry and regulators to define and shape the burgeoning ecosystem. As a leader in the space, Yuga is committed to fully cooperating with any inquiries along the way.”

Yuga Labs Spokesperson, speaking to Bloomberg

The SEC hasn’t spoken publicly about this case, but based on other cases it’s clear the regulator believes virtually all crypto assets should be viewed as securities and adhere to relevant securities law.

SEC Chair, Gary Gensler, has repeatedly stated that he believes many forms of crypto could pass the Howey Test — the standard under US law used to determine if an asset is a security, which centres around an investor pledging money to an enterprise with the intention of making profits from its efforts.