Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Hedera (HBAR)

Hedera Hashgraph HBAR is a public network that allows individuals and businesses to create powerful decentralised applications (DApps). It is designed to be a fairer, more efficient system that eliminates some of the limitations older blockchain-based platforms face, such as slow performance and instability. The HBAR token has a dual role within the Hedera public network.

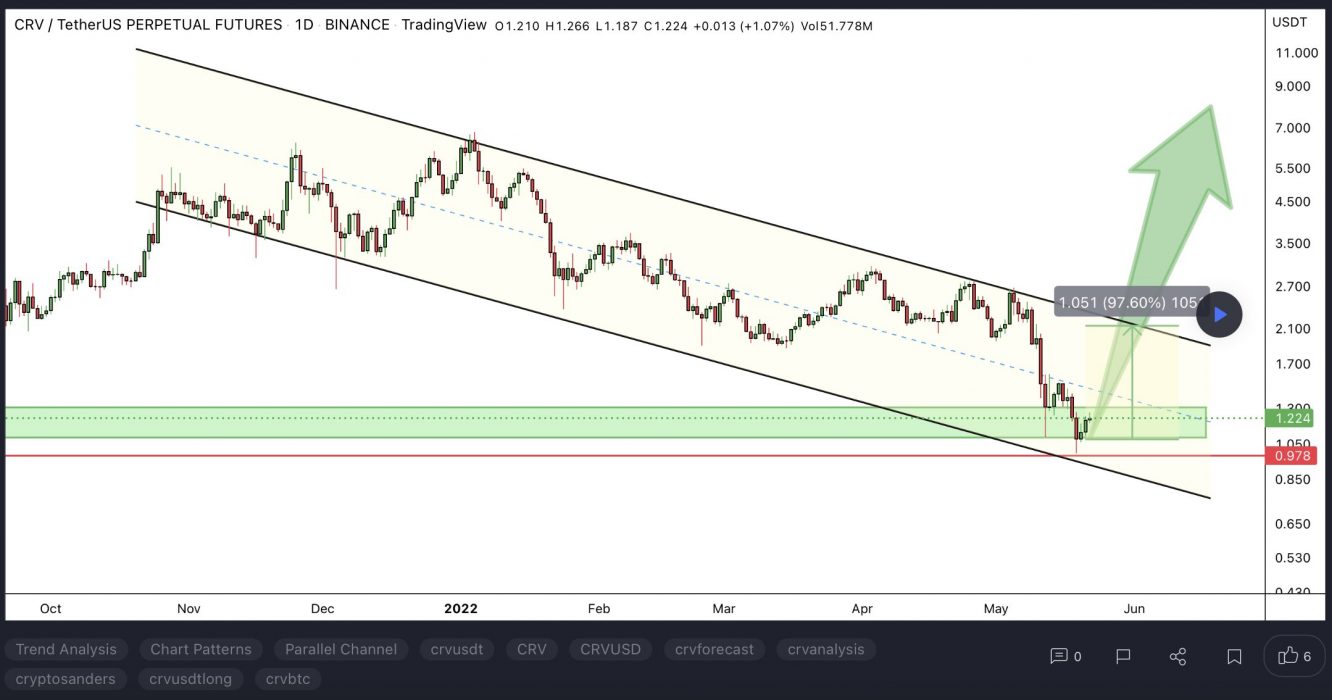

HBAR Price Analysis

At the time of writing, HBAR is ranked the 38th cryptocurrency globally and the current price is US$0.07122. Let’s take a look at the chart below for price analysis:

HBAR‘s 60% Q1 run retraced almost to its origin, narrowly missing probable support near $0.5980 before bears swatted down the bounce near resistance around $0.07689.

With the daily gap between $0.06312 and $0.06054 almost filled in a single wick, the price may not need to revisit areas below this level. However, the safer entry is still in probable support between $0.05923 and $0.05573, which would also sweep the lows of last week’s bounce.

The relatively equal highs near $0.07824 provide a likely first target on lower timeframes. However, the resistance beginning at $0.08215 may initially suppress a further move up.

A clean break through this resistance will need to contend with the next resistance near $0.08692, under the last swing high. This swing high at $0.08950 gives a reasonable take-profit area before a possible move to the 1.0 extension near $0.09546.

2. Curve DAO Token (CRV)

Curve CRV is a decentralised exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity. Curve has gained considerable attention by following its remit as an AMM specifically for stablecoin trading. The launch of the DAO and CRV token brought in further profitability, given CRV’s use for governance, as it is awarded to users based on liquidity commitment and length of ownership. The explosion in DeFi trading has ensured Curve’s longevity, with AMMs turning over huge amounts of liquidity and associated user profits.

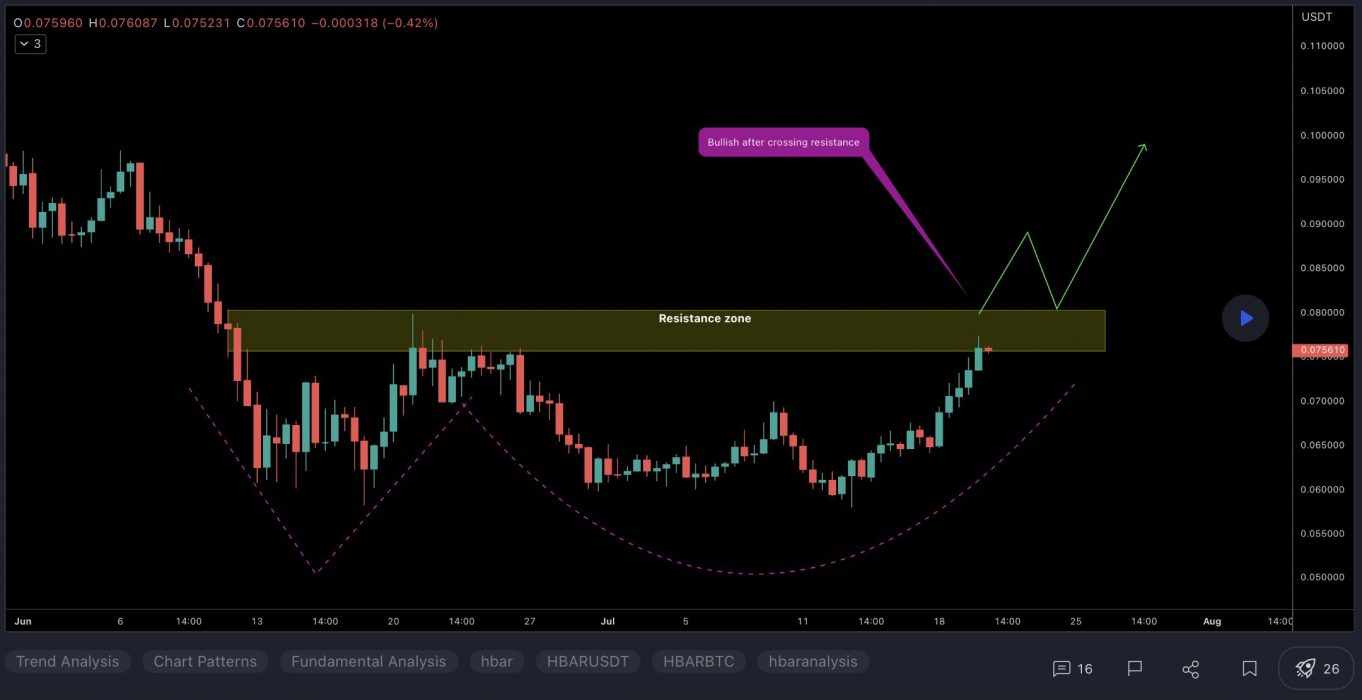

CRV Price Analysis

At the time of writing, CRV is ranked the 63rd cryptocurrency globally and the current price is US$1.36. Let’s take a look at the chart below for price analysis:

This month, traders enjoyed 28% gains at CRV‘s peak before the price confirmed stiff resistance beginning at $1.40.

The 4-Hour chart shows that support may be forming between $1.25 and $1.15, near the weekly open. Aggressive bulls could enter in this area, although safer entries may be found much further below near $1.12 and $1.02 after a sweep of the current consolidation’s swing lows.

The last swing high near $1.50 provides a likely first target if the price does bounce from this region. Beyond this swing high, the 1.0 extension near $1.60 and the 2.0 extension near $1.75 and $1.83 may provide the next major targets.

3. Chromia (CHR)

Chromia CHR is an open-source public blockchain conceived by Swedish company Chromaway AB. The Chroma token CHR was launched in May 2019. The technology behind the Chromia blockchain is adapted from an earlier technology called ‘Postchain’, a solution provided by Chromaway AB for enterprise clients. Chromia is a standalone Layer-1 blockchain and EVM compatible Layer-2 enhancement for Binance Smart Chain and Ethereum. It is designed to enhance existing dApps and allow for the creation of next-generation dApps by providing scalability, improved data handling, and customisable fee structures.

CHR Price Analysis

At the time of writing, CHR is ranked the 178th cryptocurrency globally and the current price is US$0.2143. Let’s take a look at the chart below for price analysis:

CHR‘s chart paints a different picture than those of many other altcoins, with the Q2 high leading to a massive range before setting a low near $0.1544 in June.

The beginning of July makes immediate bids questionable. However, the price may be finding support near $0.1962 and possibly near $0.1721. Since the price swept the impulse’s high at $0.2459, bulls might be waiting to enter near the swing low and gap near $0.1645, or slightly lower near $0.1598.

Little resistance lies overhead, although there may be some between $0.2573 and approximately $0.2622, just above the current price. A sweep and rejection of the high near $0.3057 would make most areas of possible support highly suspect and could mark the end of the bullish trend.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.