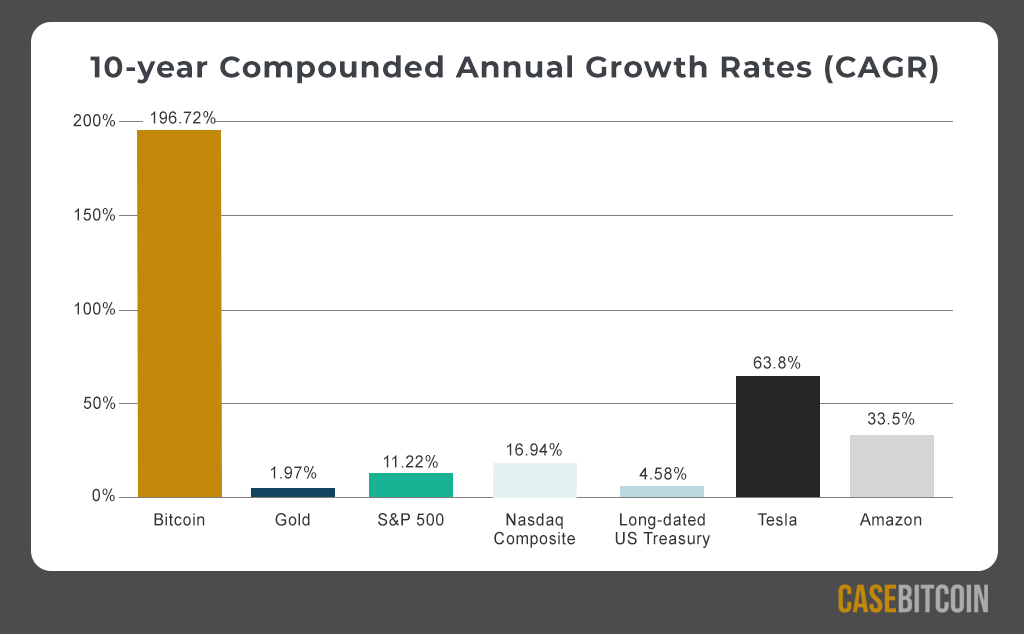

A chart published by Case Bitcoin shows Bitcoin’s 10-year Compound Annual Growth Rate (CAGR) is 196% compared to Gold which is only 2%.

The CAGR metric is calculated by taking an asset’s ROI between two dates, and works out the average compounded annual return.

Obviously the Bitcoin returns look staggering compared to the other markets as Bitcoin would have tripled your money every year since it was created.

The results are even more impressive when you compare the recent years due to the consistent returns even as the marketcap grows larger.

This shows bitcoin’s Compound Annual Growth Rate (CAGR) vs other assets over various timeframes. For example this is showing that bitcoin has returned 155% on average, every year, for the past 5 years, while gold has returned 7% on average each year over the same period.