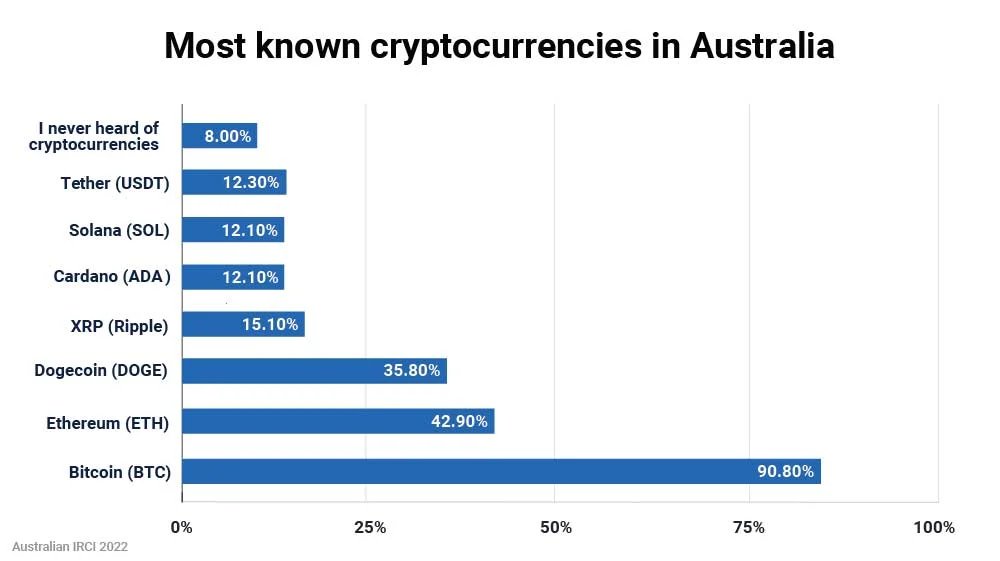

Bitcoin (BTC) is far and away the most well known cryptocurrency, with over 90 percent of Australians having heard of the OG crypto, according to a 2022 survey by Australian cryptocurrency exchange Independent Reserve.

The Independent Reserve Cryptocurrency Index (IRCI) is an annual cross-sectional survey of the attitudes of 2,000 Australians towards cryptocurrency and is designed to reflect the age, gender and demographics of the broader Australian population.

Aussies Consider Bitcoin an Investment

This year’s IRCI found that more Aussies than ever before consider Bitcoin an investment asset, at just under 30 percent. This rise coincides with a downward trend since 2019 in the number of people who consider Bitcoin a form of money, a scam, or had simply not thought about it enough to answer.

The survey also found that plenty of Aussies knew about crypto other than Bitcoin, with 42.9 percent having heard of Ethereum, 35.8 percent aware of Dogecoin, and 15.1 percent familiar with XRP.

Short-Term Sentiment Falls

While awareness of crypto is high, sentiment has fallen compared to last year’s survey, with Independent Reserve’s overall index dropping from 54 to 45. According to Independent Reserve, a score of 100 would “indicate complete awareness, optimism, trust and adoption” while 0 would indicate the opposite.

Independent Reserve said a more negative sentiment in 2022 reflected lower crypto ownership rates and a fall in short term confidence in crypto. Despite this drop in sentiment since 2021, overall ownership rates remain up in 2020.

The steepest drop in crypto ownership occurred in the 18-24 age group where it dropped from 56 percent in 2021 to just 33.3 percent this year. In other age groups, ownership rates actually held steady or grew.

Long Confidence Remains Strong

Despite the drop in short-term sentiment, the survey found Aussie’s longer term confidence in crypto remains strong:

- Only eight percent of respondents said they plan to get out of crypto entirely;

- 44 percent said they plan to increase or diversify their crypto holdings;

- 45 percent said they would hold.

When asked what they thought Bitcoin’s price would be in 2030, the most popular response from both crypto owners and non-owners was between $30,000 and $100,000, indicating many believe Bitcoin’s value will grow considerably from where it sits today.

The prospect of crypto eventually being widely accepted by people and businesses was highly correlated with age, with all age groups under 44 strongly believing it was likely. People aged between 45 and 54 years old were fairly evenly split between likely and unlikely, while those over 54 considered it unlikely.