US Securities and Exchange Commission (SEC) chairman Gary Gensler has confirmed the regulator has no intention of banning digital currencies and adopting a policy akin to the Chinese government’s, instead stating that any such ban “would be up to Congress”.

Gensler was appointed earlier this year, much to the joy of the crypto industry for his pro-blockchain and Bitcoin stance. Until recently he has been quiet regarding his stance on cryptos but has since broken his silence.

CBDC Looking Unlikely

At a hearing before the US House Committee on Financial Services on October 5, Gensler was questioned about whether the regulatory body had any intention of banning cryptos in favour of a prospective central bank digital currency (CBDC).

The chairman indicated that it would be up to Congress to enact such a ban. He added that the focus of the government was to ensure the crypto industry complies with investor and consumer protection, anti-money laundering and tax laws.

It’s a matter of how we get this field within the investor consumer protection that we have, and also working with bank regulators and others. How do we ensure the Treasury department has it within anti-money laundering, tax compliance? Many of these tokens do meet the test of being an investment contract, or a note, or security.

Gary Gensler, SEC chairman

Last month, the SEC issued threats to sue the crypto exchange Coinbase if it were to proceed with launching its Lend program, on the basis that Lend is a security.

Jerome Powell, chairman of the Federal Reserve, similarly stated it had no intention to limit or ban the use of the US$2.2. trillion asset class.

During the house committee hearing, Gensler further addressed questions regarding cryptos, stablecoins, and the regulation of exchanges and decentralised finance (DeFi). The requirement for digital asset firms to sign up with the regulatory body was also discussed, with Gensler hinting that decentralised exchanges (DEXs) could be required to comply with the same rules.

Even in decentralised platforms – so-called DeFi platforms – there is a centralised protocol. And though they don’t take custody in the same way [as centralised exchanges], I think those are the places that we can get the maximum amount of public policy.

Gary Gensler, SEC chairman

The SEC has been “actively investigating” Uniswap Labs, the parent company of the leading DEX, Uniswap.

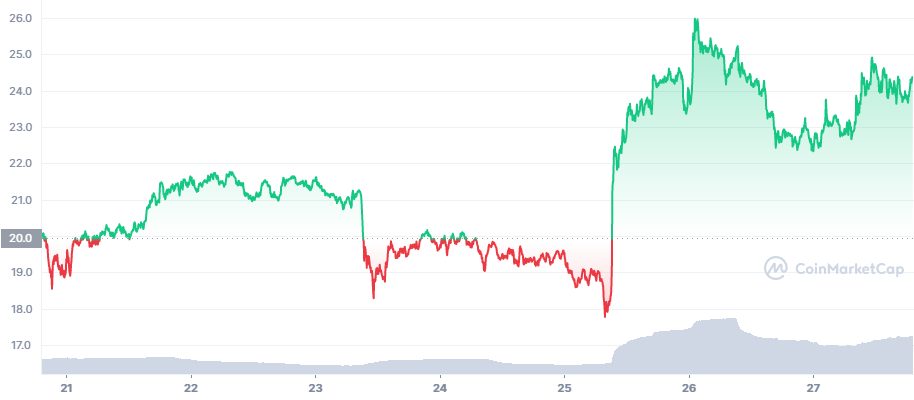

Stablecoins Are Like “Poker Chips” at the Casino

Gensler consolidated his position on stablecoins, indicating they may prove to be a risk for the economic system. With an estimated US$125 billion tied up in stablecoins, Gensler has described them as “poker chips” in the crypto casino, raising concerns that the market, which has grown tenfold in the past year, might be creating a system-wide risk.