Billionaire hedge fund manager Ole Andreas Halvorsen, currently Norway’s fourth richest man, has invested in Harmonychain. The company is currently developing application-specific integrated circuit (ASIC) mining chips that are allegedly 300% – 500% more energy efficient than existing chips.

Norwegian Investors Show Interest In Crypto

A report from local broadcaster, Trijo News, shows that when Harmonychain announced they would be listing on Oslo Stock Exchange’s OTC list (a marketplace for unlisted shares). It was followed by announcements that Halvorsen (currently 11th top-earning hedge fund manager in the world), former cross-country skiing star Bjørn Dæhlie, and stock trader and supercar collector Arne Fredly have invested in the crypto company.

Since Bitcoin electricity consumption has been under much scrutiny, there seems to be a call for more sustainable methods to keep blockchain technology running. And we’ve seen Ethereum move towards being 99% more eco-friendly with the introduction of PoS.

Harmonychain’s ASIC Miner to Launch Late 2022

The Harmonychain website states that:

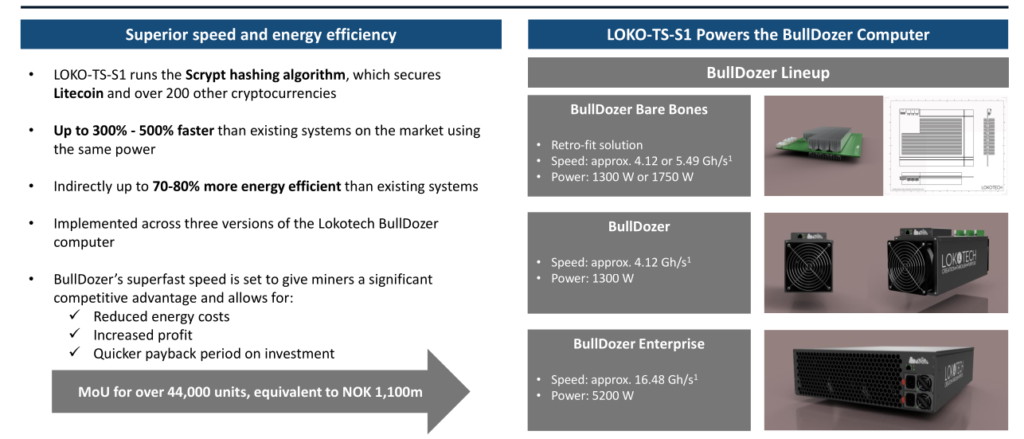

Currently, Crypto mining consumes a lot of energy. Our microchips are designed to be up to 300%-500% more efficient than current chips, reducing computer energy use by 70-80%, all other things equal.

The startup believes that their “Crypto Supercomputer miner” will be the most profitable mining hardware upon its release in 2022 and 2023.

The company is going to offer two Supercomputer chips, one tailored toward Bitcoin and the other toward Litecoin both aim to reduce energy costs of mining among other things. The Litecoin chip is Scrypt, meaning that it is dedicated to mining the digital asset Litecoin (LTC) and other Scrypt-based coins. The other focuses only on processes associated with Bitcoin.

According to industry standard, customers can expect to prepay approx. 9-12 months prior to delivery. The Supercomputer is poised to be the most profitable Crypto hardware on the market. Our Crypto Supercomputer miners have an estimated payback of less than 2 years.

With another competitor soon to be part of the blockchain specific semiconductor market, the mining industry it seems is set for a boom in research and development. And some see Halvorsen joining the fray as positive news for the crypto sphere.