SYDNEY, AUSTRALIA – April 19, 2022: Social investing network eToro has today launched the findings of a new national survey which reveals, contrary to popular belief, that Millennials (26-41-year-olds) and Generation Zs (18-25-year-olds) are leading the charge when it comes to managing and investing in self-managed super funds (SMSFs). Among the findings are:

- Millennials and Zoomers are just as likely as Boomers to invest in self-managed super funds, according to new eToro data.

- Distrust of super funds, plus the foresight to plan for the future, is driving a new trend of young, empowered investors, most of whom are tipping up to $10K p.a. into SMSFs.

- Tech stocks and crypto are preferred over property, while CFDs, options and FX take a back seat.

The survey of 1,000 Aussies commissioned by eToro found almost half of people under 35 (47 per cent) have an SMSF. The trend is relatively new with the majority of respondents (67 per cent) indicating they have been building their fund for just 1-5 years.

More broadly, the data showed superannuation is important for 90 per cent of people under 35.

SMSFs are on the rise, with Zoomers just as likely as Boomers to self-manage, and Millennials contributing more cash annually.

Self-managing is particularly on the rise among Gen Z with 86 per cent of those who have an SMSF, noting they created it within the past five years. Zoomers are just as likely (45 per cent) to have an SMSF as their Baby Boomer counterparts approaching retirement.

Young people indicated the desire to take more control of their investments, with a third (33 per cent) believing they can get a better average return managing their own super than with a traditional superannuation fund. They also say they’re keen to invest in the future (37 per cent) as well as prepare nest eggs for retirement (40 per cent).

The research revealed at least one-third of Millennials contribute between $5,000 – $10,000 annually to their SMSF (36 per cent), while half of Gen Z investors contribute $1,000 – $5,000 per annum (50 per cent). Just 16 per cent of people under 35 will contribute over $10,000 to their fund.

Young people are more likely to invest in stocks and crypto over property, with tech stocks the top SMSF investment.

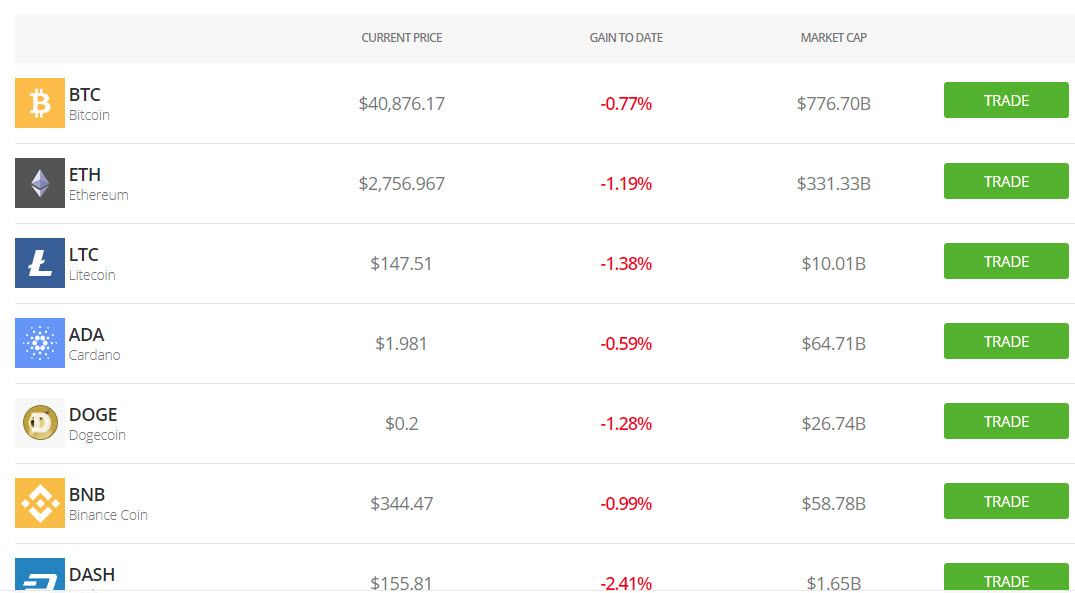

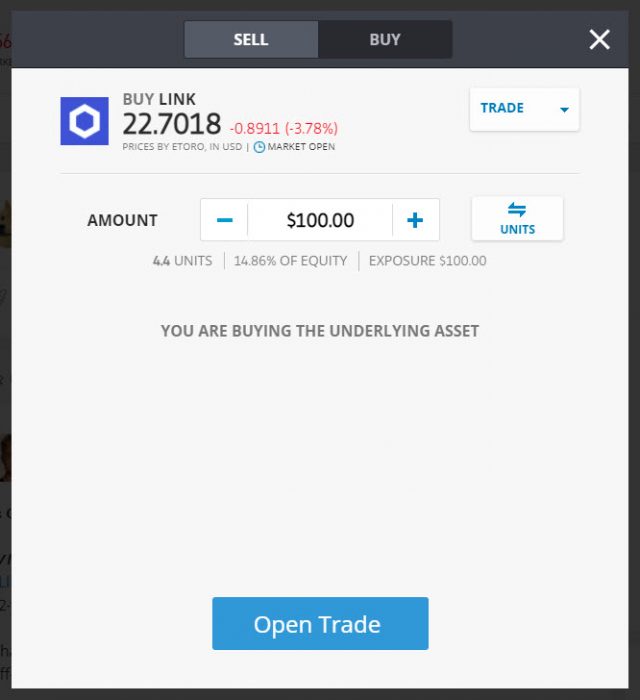

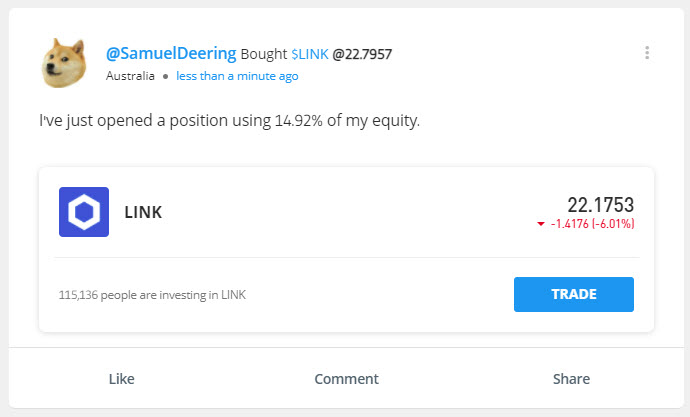

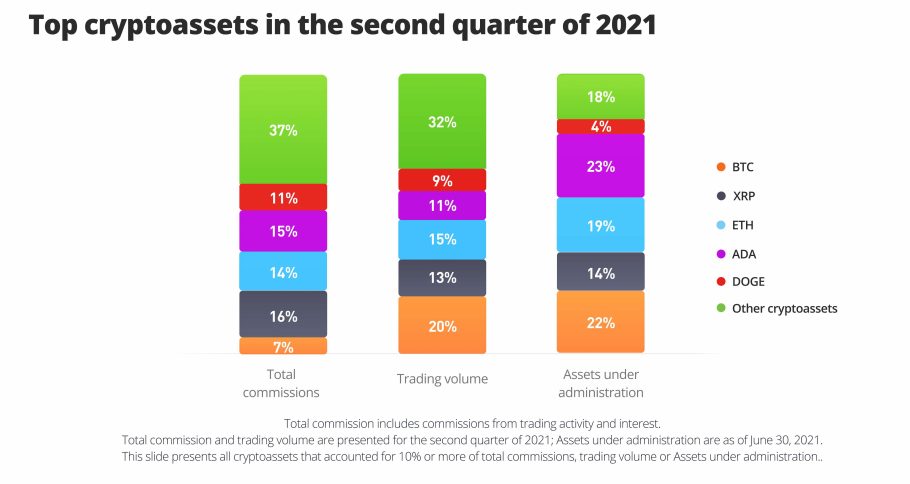

The data indicated a large majority of Millennials and Gen Zs with an SMSF are focused on generating a diversified SMSF portfolio (84 per cent Millennials, 75 per cent Gen Z), filled predominantly with stocks (60 per cent Millennials, 72 per cent Gen Z), crypto (43 per cent Millennials, 64 per cent Gen Z), and property (41 per cent Millennials, 50 per cent Gen Z). By contrast, more than half (54 per cent) of respondents aged over 45 have at least one property in their SMSF.

Of Millennials invested in stocks, 45 per cent prefer the ASX market and 32 per cent opt for US markets, while the opposite is true for Gen Zs, who favour US markets (47 per cent) over the ASX (29 per cent).

Tech, energy, real estate and financial were the industries of choice for both cohorts, with healthcare a priority sector for Millennials and materials sectors a focus for Gen Zs.

Conversely, young investors shy from instruments with higher perceived risk, such as CFDs, options and FX.

Influenced by long-term returns and expert industry sources, Millennial and Gen Z Aussies tend to rebalance their SMSF portfolios once a fortnight (28 per cent Millennials, 35 per cent Gen Zs).

Despite appetite, lack of information and education are the biggest barriers to self-managing.

Although 27 per cent of young people who don’t have an SMSF plan to organise one, there are barriers to entry that are holding back those who aren’t self-managing:

- They don’t know where to begin (42 per cent Millennials, 40 per cent Gen Z).

- They don’t know how an SMSF works (36 per cent Millennials, 38 per cent Gen Z).

- They prefer someone else to manage their super on their behalf (33 per cent Millennials, 29 per cent Gen Z).

eToro Australia’s Managing Director Robert Francis said: “Despite stereotypical perceptions, Millennials and Gen Z Aussies are increasingly taking their superannuation and finances into their own hands. They are realising the importance of investing younger than their parents – many as early as 18 – in order to put themselves in an advantageous position for a comfortable retirement.

“For those unsure about whether to invest in an SMSF, eToro has tools and support teams available to help guide them through the process, and we encourage them to gain the knowledge they need to make the decisions that suit their personal situation and risk tolerance,” concluded Francis.