The world’s first combined Bitcoin and Gold exchange traded fund (ETF) has been launched this week in Switzerland. The product has been developed by ETP issuer 21Shares and cryptocurrency data provider ByteTree Asset Management.

The first ETF product to combine gold and and what has now become known as digital gold – bitcoin – in a single fund was launched on the SIX Swiss Exchange. As Charlie Morris, chief investment officer at ByteTree Asset Management, has said, “We are making bitcoin an acceptable asset to hold and bringing gold into the 21st century.”

ByteTree and 21Shares Make BOLD Move

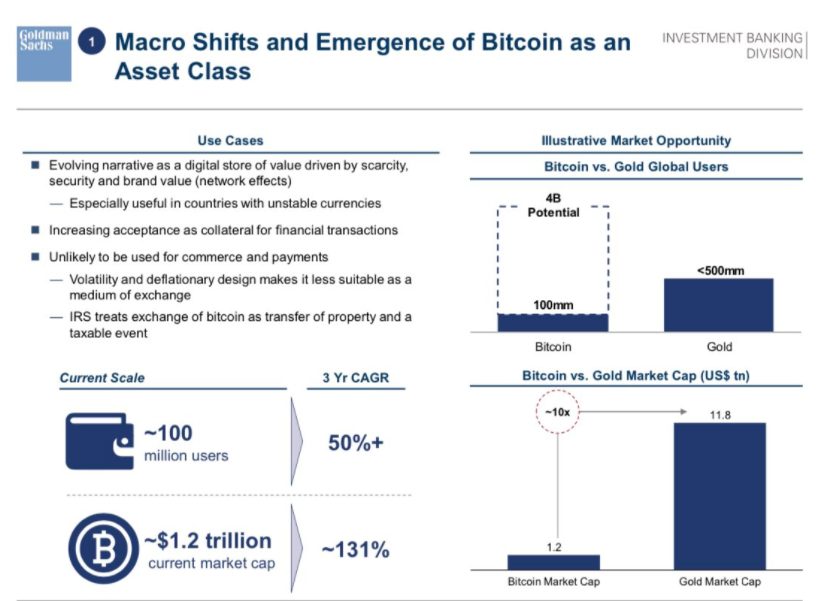

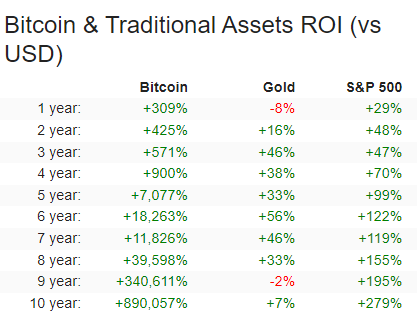

ByteTree Asset Management BOLD ETP will track a customised benchmark index comprising bitcoin and gold, which rebalances monthly according to the comparative volatility of the two assets. Whichever of the two has been less volatile over the previous 360 days will be given the higher weighting. At launch, the weighting will be 18.5 percent bitcoin and 81.5 percent gold.

While gold ETPs and spot bitcoin ETPs are both widely available independently, at least in continental Europe, Morris claimed that ByteTree’s active rebalancing strategy had improved returns by seven to eight percentage points a year in backtesting. Morris added: “It struck me that bitcoin and gold were always counter-cyclical. It’s obvious to me that bitcoin has always been correlated to the stock market, or to risk assets in general.”

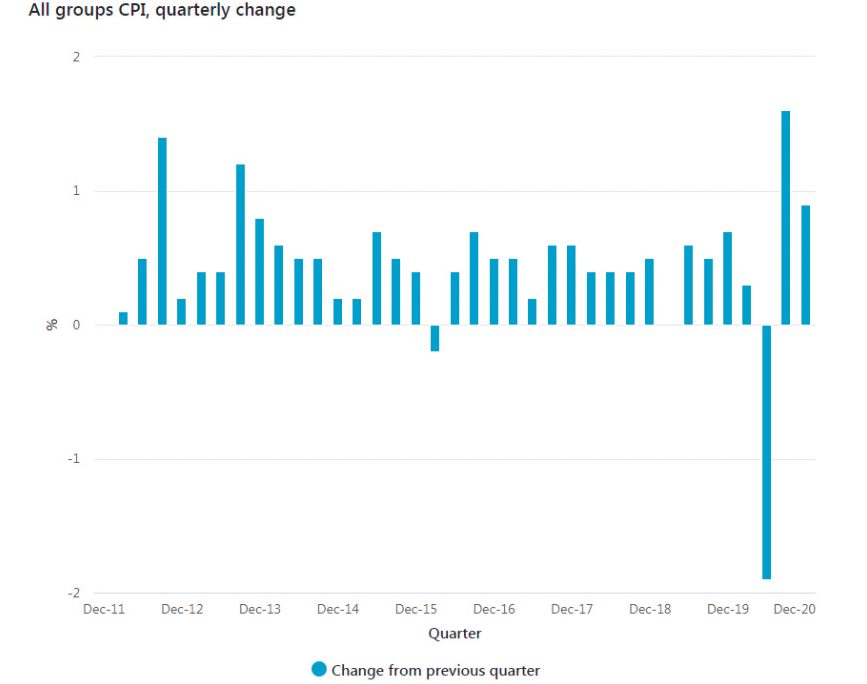

According to Charlie Erith, CEO of ByteTree Asset Management, the investment strategy is “a unique approach to blending a high return digital asset with a traditional store of value, with a low correlation to equities and bonds”. He added:

Gold has historically delivered portfolio protection in inflationary environments, while bitcoin is the digital equivalent of gold with growing adoption by investors as a distinct asset class and a core store of wealth … In a time of rising structural inflation and heightened geopolitical risk, we believe this can act as an important risk and return diversifier in a balanced portfolio.

Charlie Erith, CEO, ByteTree Asset Management

21Shares Has Form in ETF Space

21Shares has been very active in launching ETFs, after releasing a product in December 2021 that provided Australian investors with access to the country’s first direct Bitcoin and Ethereum ETFs.