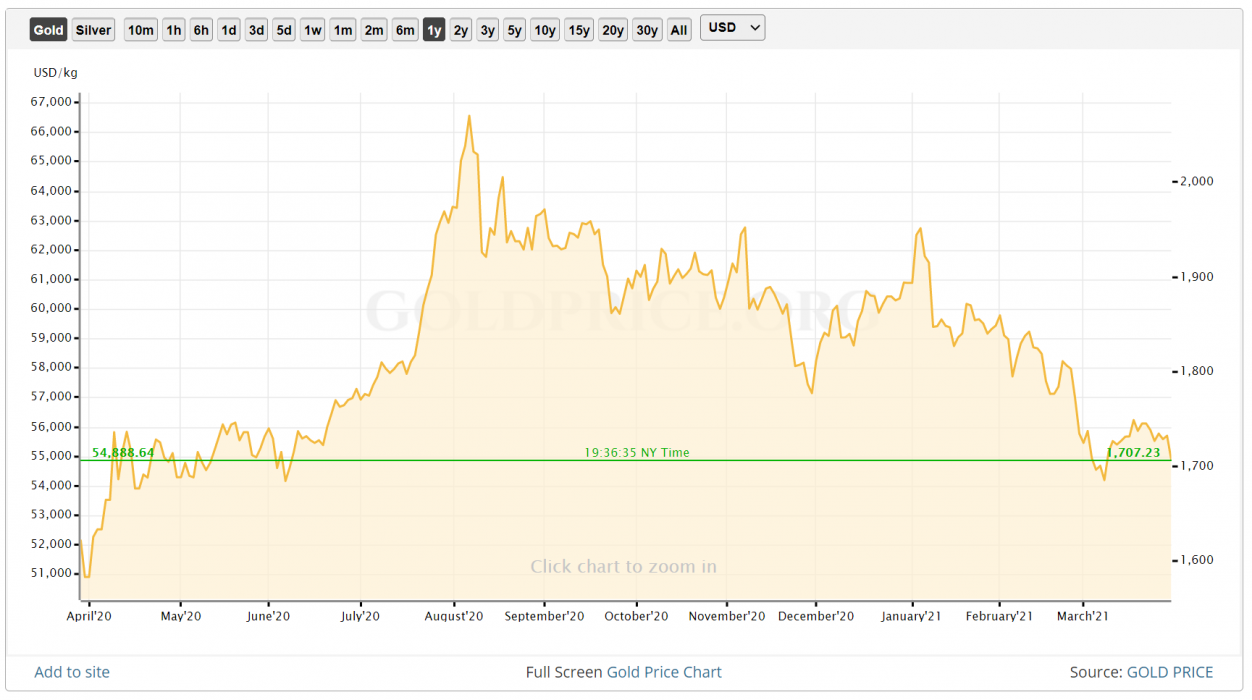

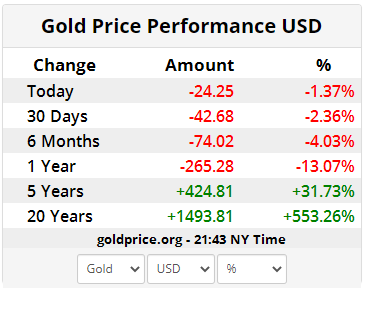

One of the most popular narratives surrounding bitcoin is that it is “digital gold”. At a time of unprecedented global fiscal and monetary expansion, one would have expected bitcoin’s physical counterpart to shine. Instead, it’s endured a rather torrid time that has left investors wondering whether it still has value in a diversified portfolio.

Switching the Physical for Digital

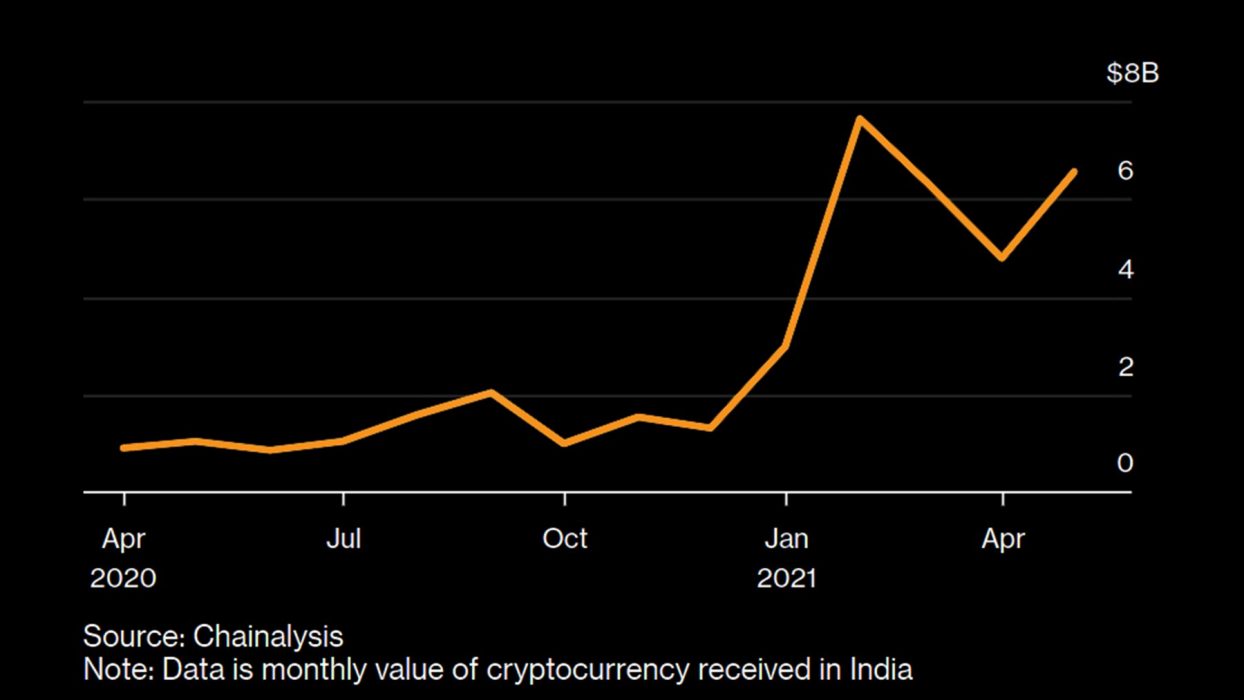

It’s well-documented by now that younger generations around the world are showing a distinct preference for all things digital. From India to Australia, millennials are choosing to invest in bitcoin over gold.

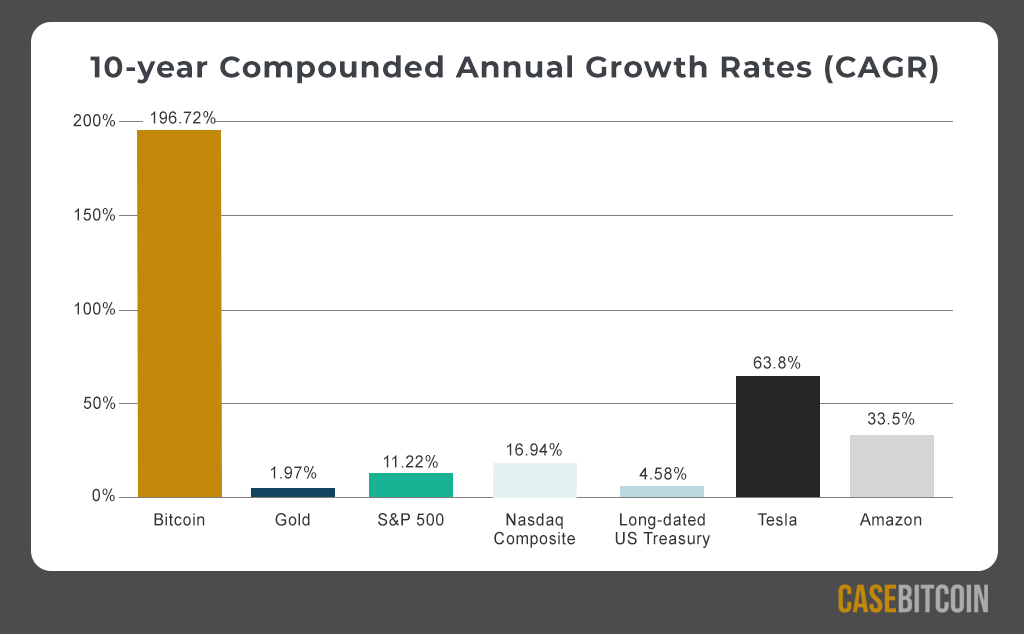

Gold has traditionally been considered a hedge against inflation, but over the past 18 months, gold bugs have had difficulty explaining its underperformance relative to almost all other assets, especially against bitcoin.

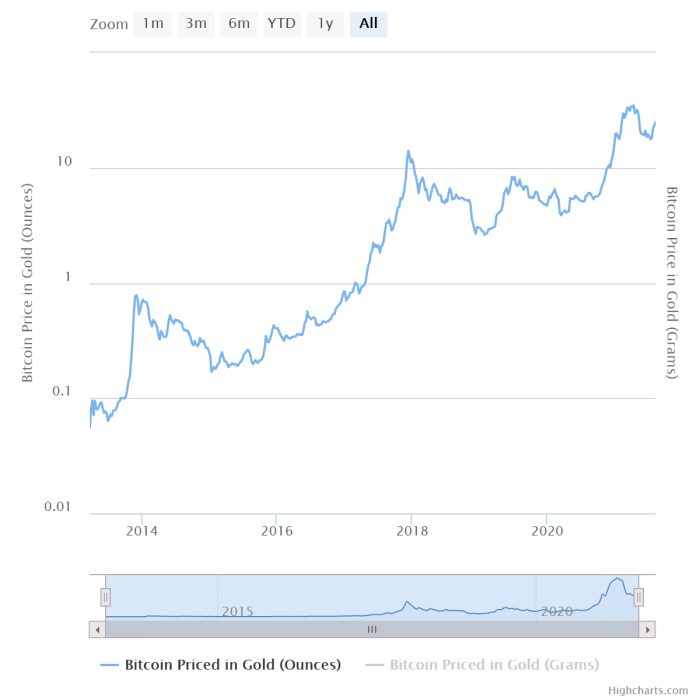

Bitcoin Priced in Gold

In considering the relative performance of bitcoin and gold, it is also useful to consider the performance of bitcoin priced in gold. Unfortunately for gold enthusiasts, this metric doesn’t paint a pretty picture either.

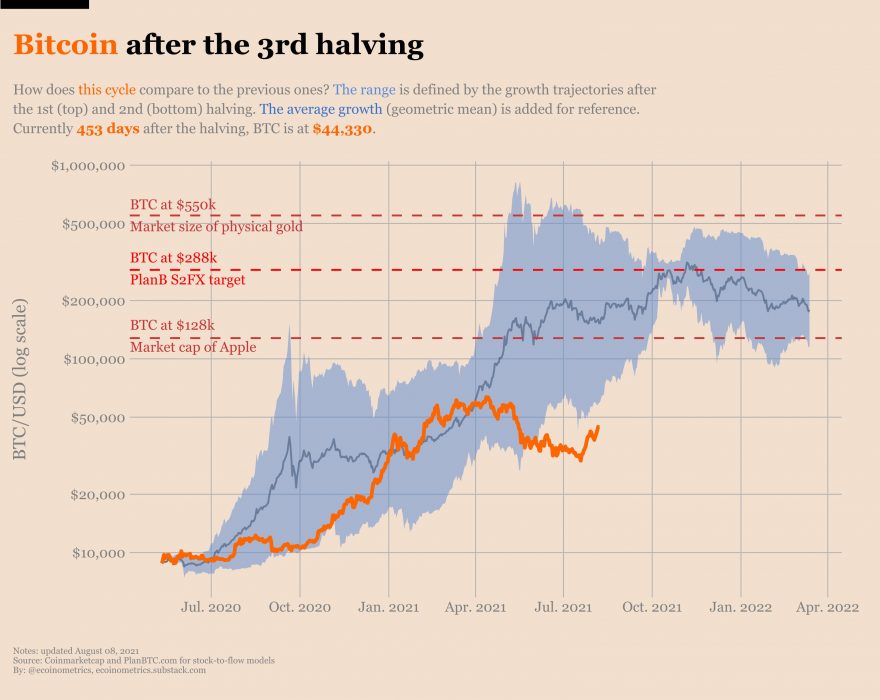

Will Bitcoin Flip Gold?

With a current bitcoin price of US$43,121, bitcoin’s market cap is around US$809 billion. This is dwarfed by physical gold’s market cap, estimated to be around US$10 trillion. Commentators have long opined about when bitcoin would overtake gold’s market cap – the so-called “flippening”.

Based on the chart above, that may be out of reach for the foreseeable future, however given the surprises we’ve seen over the past 18 months, anything is possible.