After the launch of UNFI Protocol DAO on Binance Launchpool last week, UNFI was trading sideways & took a strong Breakout with +45% gains in a single day. Let’s take a quick look at UNFI, price analysis, and possible reasons for the recent breakout.

What is Unifi?

Unifi Protocol DAO is a group of non-custodial, interoperable, decentralized, multi-chain smart contracts providing the building blocks for DeFi development. The project provides a bridge to connect the economy of Ethereum-based DeFi products to the growing DeFi markets on other blockchains. uTrade, a decentralized Automated Market Maker (AMM) and token exchange, is the first product built on the Unifi Protocol DAO smart contracts.

Unifi Quick Stats

| SYMBOL: | UNFI |

| Global rank: | 460 |

| Market cap: | $16,695,896 AUD |

| Current price: | $6.95 AUD |

| All time high price: | $8.12 AUD |

| 1 day: | +45.4% |

| 7 day: | +150.70% |

| 1 year: | +150.74% |

Unifi Price Analysis

At the time of writing, UNFI is ranked 460th cryptocurrency globally and the current price is $6.95 AUD. This is a +150.70% increase since the launch of its ICO at Binance Launchpool on 19 November 2020 as shown in the chart below.

After the launch of Unifi on Binance Launchpool, It pumped up to $8.12 AUD having +300% gains in few hours and the initial opening price of UNFI was $2.1 AUD at Binance Exchange with many different trading pairs like UNFI/BTC, UNFI/USDT, and UNFI/BUSD.

Currently, UNFI is trading at $6.95 AUD price levels after breaking out the squeeze resistance in its sideways trend & now heading towards its all-time high price.

What do the technical indicators say?

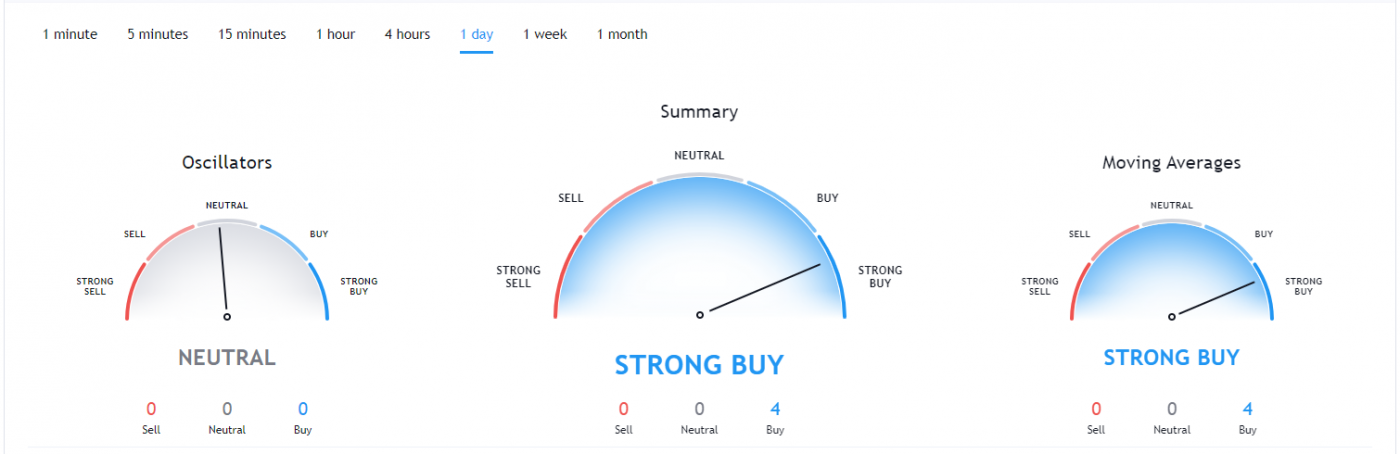

The Unifi TradingView indicators (on the 1 day) mainly indicate UNFI as a strong buy, except the Oscillators which indicate UNFI as a neutral.

So Why did UNFI Breakout?

The recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. It could also be contributed to some recent news where UNFI is about to launch on Ethereum Network with uTrade.

Recent UNFI News & Events:

- 26 Nov 2020 – Protocol Launches

- 31 Dec 2020 – Blockchain Expansion

Where to Buy or Trade UNFI?

UNFI has the highest liquidity on Binance Exchange so that would help for trading UNFI/USDT or UNFI/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.