Following the SEC’s lawsuit against Ripple, more exchanges are delisting XRP from their trading list.

XRP — the second most preferred currency by Australians after Bitcoin – has plunged another 10 % after the U.S.-based exchange, Coinbase, decided to delist XRP from its platform following the lawsuit.

The exchange announced that the customer’s XRP wallets will remain intact, without removing the institutional custody — but will suspend the trading pair on January 19, 2021.

OkCoin And BC2C Delisting XRP

Other recent exchanges that decided to remove XRP from their trading list were Chinese-based OkCoin and B2C2 USA.

OkCoin announced today the suspension of XRP trading with tighter rules. Users who borrowed XRP/USD margins are required to return the funds till Jan 3, 2021, or face automatic liquidations in case of any delay.

Another exchanges delisting XRP are:

- OSL

- CrossTower

- Beaxy

- Bitstamp

- Galaxy Digital

- Jump Trading

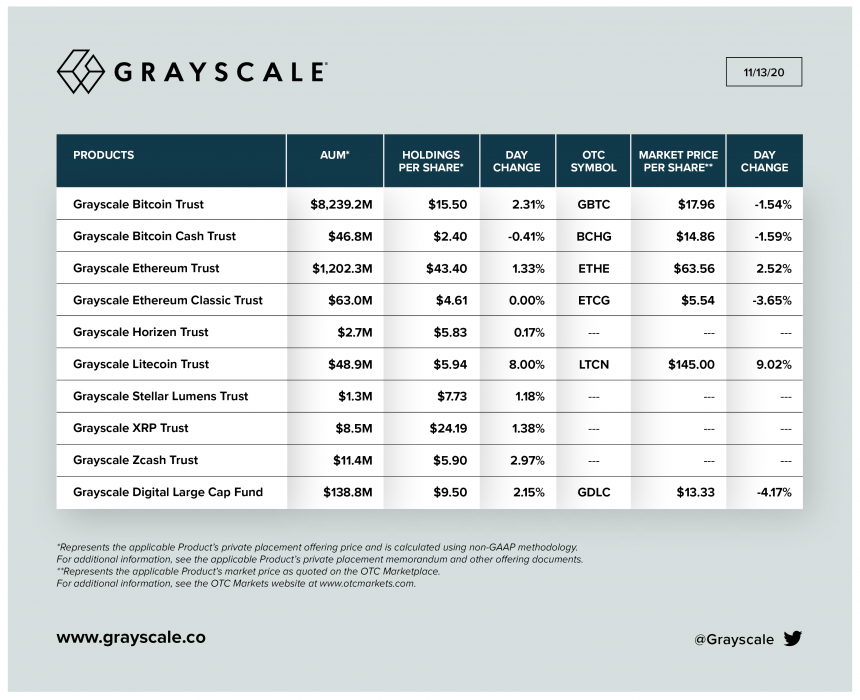

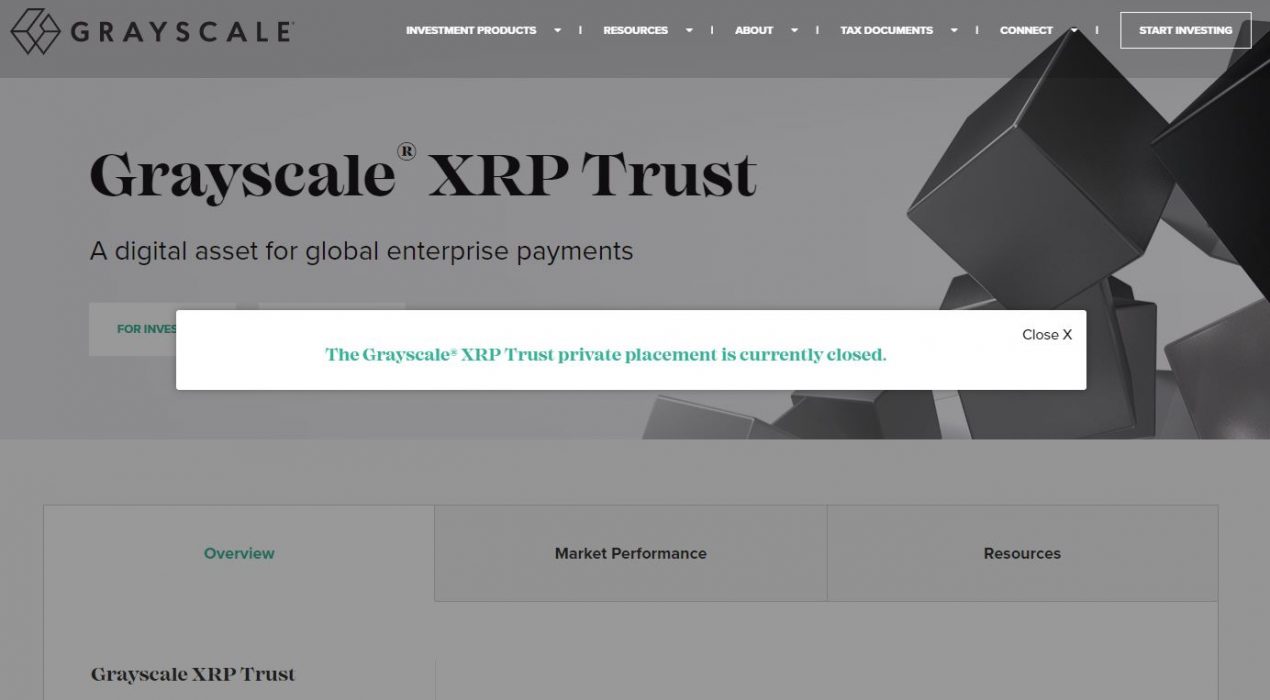

Grayscale XRP Trust Closed

Not only exchanges are turning away from XRP as the trust firm Grayscale closed the XRP Trust private placement.

Likewise, a user from Twitter posted a message that appears to be an employee from Grayscale, stating that the company is ending all XRP subscriptions.

Many people in social media argue that it may be a matter of time before other exchanges join the movement by delisting XRP from their platforms.

It should come as no surprise that XRP fell 10% following the announcement of Coinbase, now trading at 0.25 $. The price has fallen -43 % since the SEC filed a lawsuit against two Ripple executives: Brad Garlinghouse and Chris Larsen, for making profits with XRP as an “unregistered license”.