Zipmex, one of the major established and regulated Australian digital asset exchanges, has recently launched a new product offering in Australia called ZipUp which offers attractive crypto yield returns.

Along with your regular cryptocurrency buying and selling, with Zipmex you can now use a “ZipUp” crypto staking account that gives daily rewards on your crypto. One of the attractive features of this account is having the flexibility of being able to withdraw and deposit any amount, anytime – with no lock-in period.

Zipmex’s Crypto Staking Rewards

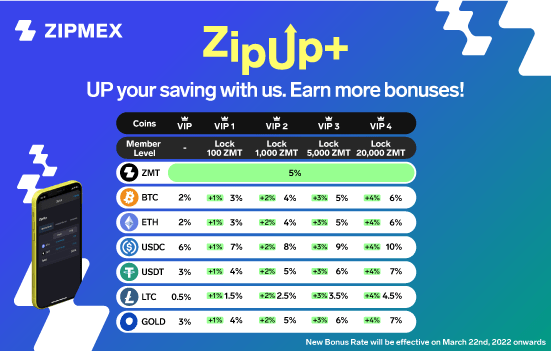

Following December’s successful launch of its “ZLaunch” token reward program, Zipmex is now offering users interest rates of up to 10 percent on some digital assets on its ZipUp+ program.

ZipUp+ allows users to enjoy daily crypto bonuses on Bitcoin (BTC), Zipmex Token (ZMT), Ethereum (ETH), US Dollar Coin (USDC), Tether Coin (USDT), and Litecoin (LTC). The rewards are calculated based on the user’s VIP level, and higher rates are on offer for those who lock up their Zipmex Tokens (ZMT).

The full rewards table is outlined below and available on Zipmex’s website.

Given that banks are currently offering little interest on savings accounts, the demand for interest on crypto is high, despite some crypto exchanges dropping interest rates.

What makes Zipmex+ attractive to users in search of a yield is that there is no minimum deposit amount and no lock-in period. Through Zipmex’s easy-to-use app interface, users can withdraw, trade or deposit anytime while enjoying daily crypto rewards.

Read our guide on how to stake your crypto with Zipmex.

How to Participate

Users interested in earning daily rewards on their crypto can sign up and get A$20 free in ZMT and then start staking their crypto to earn daily rewards.

About Zipmex

Zipmex is a trusted AUSTRAC-registered exchange with millions of users across Australia and Asia who enjoy 24/7 customer support, and instant trades, withdrawals and deposits.

With transaction fees as low as 0.1 percent per transaction, the platform is well suited for traders and HODLers alike.

The company is also duly registered with Blockchain Australia and backed by subsidiaries of the Mitsubishi Financial Group, a leading global financial services group and one of the largest banking institutions in Japan.

Read our full review on Zipmex here.