Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Kava.io (KAVA)

KAVA is a cross-chain DeFi lending platform that allows users to borrow USDX stablecoins and deposit a variety of cryptocurrencies to begin earning a yield. The Kava DeFi hub operates as a decentralised bank for digital assets, allowing users to access a range of decentralised financial services, including its native USD-pegged stablecoin, USDX, as well as synthetics and derivatives. Through Kava, users are able to borrow USDX tokens by depositing collateral, effectively leveraging their exposure to crypto-assets.

KAVA Price Analysis

At the time of writing, KAVA is ranked the 85th cryptocurrency globally and the current price is US$2.83. Let’s take a look at the chart below for price analysis:

KAVA dropped 75% during the May crash, running bulls’ stops below a significant swing low at $2.109 and almost reaching bulls’ stops near $1.123.

The price has bounced and might have created support near $2.611. This level is near the upper portion of last week’s consolidation and the 9 EMA.

If this level breaks, bulls might look to $2.039 as the next possible support. The monthly chart shows inefficient trading at this level, which is at the base of the recent rally and could require another test.

An inefficiently traded area on the daily chart from $3.020 to $3.342 may offer some resistance. This area overlaps with the February and March consolidation low and contains the 40 EMA.

If bulls break through this level, $3.528 to $4.066 may be the next target. This zone is inefficiently traded on the weekly chart, overlaps with the 2022 yearly open, and borders the bottom of April’s last rally before the price plunged.

A more bullish market might target bears’ stops at relatively equal swing highs and an old area of monthly rejection near $5.655.

However, the market is currently bearish. This bearishness increases the odds that the price could first visit possible support near $1.292. Here, bulls have stops under a significant swing low, and the monthly chart shows inefficient trading.

2. UFO Gaming (UFO)

UFO Gaming UFO is a decentralised gaming platform with play-to-earn elements, NFTs, and DeFi functionality such as staking. Its first game is Super Galactic, an RPG/arcade action game with its own NFT collection combined with an auto battler. UFO Gaming is built on Ethereum, but its games are integrated with Immutable X, a layer-two scaling solution for NFT projects on Ethereum. UFO Gaming has sealed several high-impact partnerships with projects such as Kadena, Merit Circle, Citizen X, Polygon and ShibaSwap.

UFO Price Analysis

At the time of writing, UFO is ranked the 350th cryptocurrency globally and the current price is US$0.000002829. Let’s take a look at the chart below for price analysis:

UFO has dropped 84% from its April high, running bulls’ stops below relatively equal lows near $0.000002088.

An inefficiently traded area on the daily chart, from $0.000002458 to $0.000002178, might provide support during a retest. Bulls may see a retest of this level around May 25’s staking dApp launch as traders take profits with the news.

However, the strong bearish trend might make bulls wary of a run under the recent swing low. Bulls could watch for signs of support down to approximately $0.000001557, which saw accumulation before a strong rally in August 2021.

Below this level, $0.000001030 may provide the next notable support. This level saw significant buying in June before 2021’s bull run.

The price might find its first high probability resistance between $0.000003775 and $0.000004023. This area is in the upper half of the most recent swing and shows inefficient trading on the daily chart.

Above this resistance, April’s fast drop may require re-trading. Price action varies across exchanges, making accurate prices impossible to determine. Traders could watch for resistance in an area that shows inefficient trading from near the $0.000007120 swing low up to approximately $0.000008786.

3. Victoria VR (VR)

Victoria VR is a blockchain-based MMORPG in Virtual Reality with Realistic Graphics built on Unreal Engine, created and owned by its users. The whole world is built to be a universal platform for all virtual realities, games, and decentralised applications, collectively creating a Metaverse – a shared virtual realm, the 3D internet. In the Victoria VR World, there will be games, quests, never-ending adventure, virtual galleries, and The Big Market VR where you can exchange NFTs in 3D! In addition, users will be rewarded for each of their activities in the VR world.

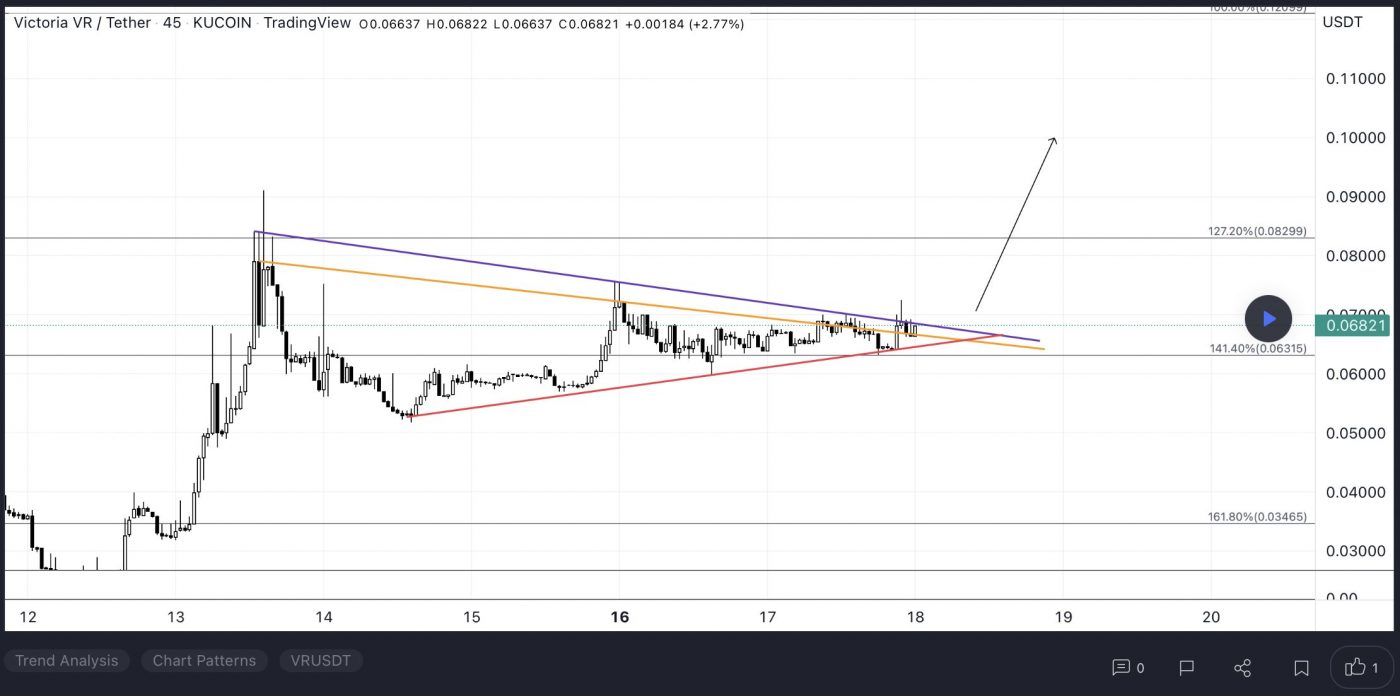

VR Price Analysis

At the time of writing, VR is ranked the 443rd cryptocurrency globally and the current price is US$0.05974. Let’s take a look at the chart below for price analysis:

VR has dropped 91% from its March high as it searches for a bottom.

A test of $0.02232 led to a sharp 308% rally over two days. This rally may have created support between $0.05500 and $0.03990, where the daily chart shows inefficient trading.

However, the chart shows a strong bearish bias on higher timeframes. Bulls might be cautious, concerned about a run under the recent swing low at $0.02232. Under this low, there is no historical price action to give precise support levels.

An inefficiently traded area on the daily chart near $0.08764 rejected the price and might provide resistance again. This level has confluence with the 40 EMA.

A rally through this high may reach the next inefficiently traded area, near $0.10109. This level is near the May monthly open.

If the market turns significantly more bullish, the price could reach the late-April consolidation near $0.14148. A rally to this level might try to test inefficient trading on the weekly chart, near $0.16752. The upper portion of this zone has confluence with March-to-May’s 61.8% retracement.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.