Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polygon (MATIC)

Polygon MATIC is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. The MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance.

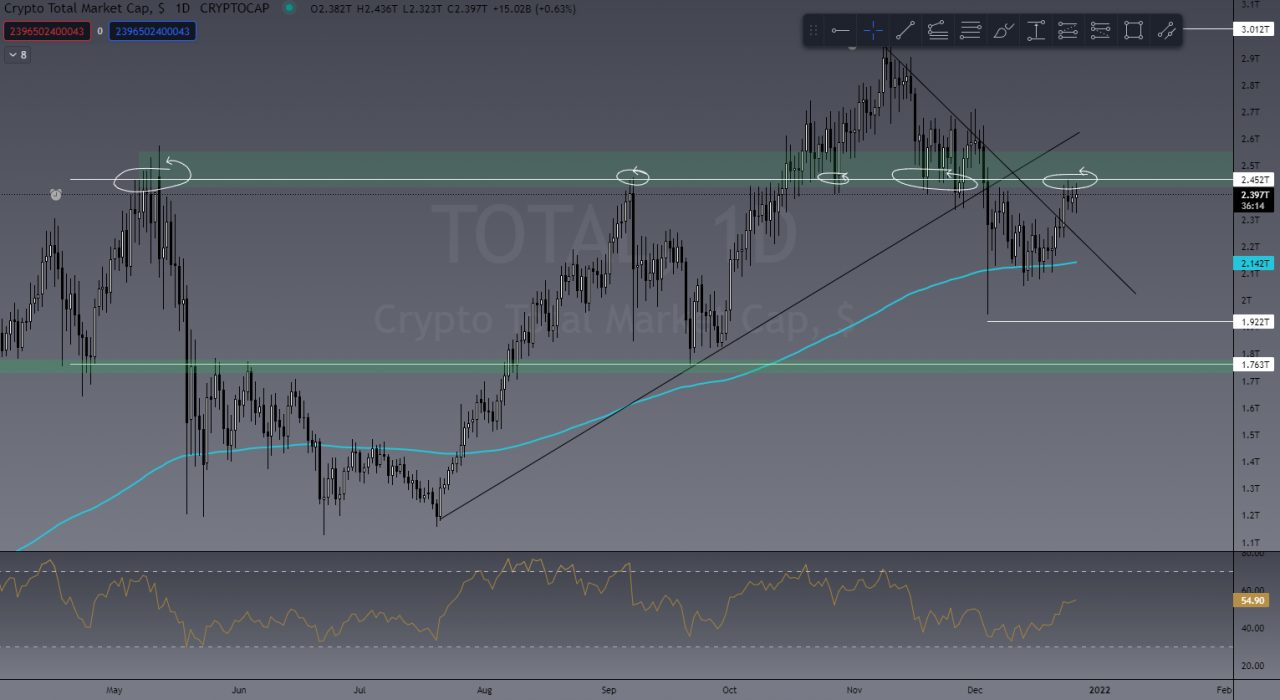

MATIC Price Analysis

At the time of writing, MATIC is ranked the 13th cryptocurrency globally and the current price is US$2.25. Let’s take a look at the chart below for price analysis:

Since its July low, MATIC has been in a steady bullish trend – printing a 370% gain by late December. The price found support near $1.991, at the 78.6% retracement level, during early January’s decline.

Last week’s sharp impulse up may have marked the start of a new bullish swing. If this is so, higher timeframes suggest that $2.1940 (near the 61.8% retracement and the 9, 18 and 40 EMAs) might see interest from bulls. The price could reach lower, near $2.0674, and still find support.

Currently, the price is contesting a region between $2.2957 and $2.4028. Closes over this level could confirm it as new support, leading to a move higher.

However, bulls are contending with probable resistance near $2.421, while $2.5251 is also likely to be sensitive with the nearest support and resistance this close together.

Breaking this resistance level might see profit-taking near $2.6214, an inefficiently traded region. However, a move this high could suggest new all-time highs are on the cards. If so, the 0.618% extension, near $3.50, and the 100% extension, near $4.00, are possible targets.

2. Stratis (STRAX)

Stratis STRAX is a blockchain-as-a-service platform that offers several products and services for enterprises, including launching private sidechains, running full nodes, developing and deploying smart contracts, an initial coin offering platform, and a proof-of-identity application. The company also provides cryptocurrency wallets and blockchain consulting services. Stratis operates its own blockchain powered by a native token, STRAX.

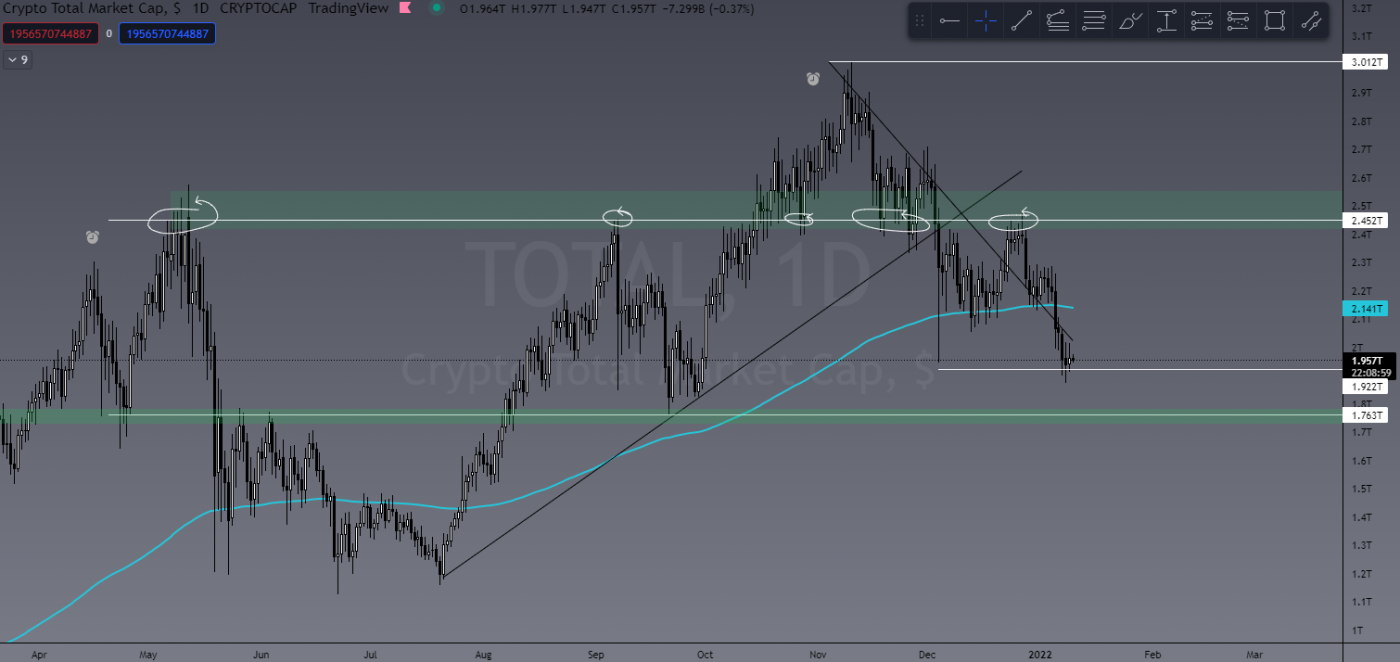

STRAX Price Analysis

At the time of writing, STRAX is ranked the 300th cryptocurrency globally and the current price is US$1.36. Let’s take a look at the chart below for price analysis:

Since its 1,020% move in H1 2021, STRAX has been in a massive range between approximately $2.70 and $1.25. Long upper wicks during the second half of 2021 show distribution, while the daily chart shows a bearish trend since September.

The price is currently around the 78.6% retracement, near $2.4028. This level has seen interest from bulls since July and might provide support again for a short-term bounce.

The closest resistance may be at $1.428, near the 9, 18 and 40 EMAs. If the price breaks this level, bulls might target the old swing low near $1.660, another old swing low and inefficiently traded area near $1.823, and the consolidation around $1.960.

However, repeated tests of a level, plus the higher-timeframe downtrend, may cause an eventual breakdown of the current support near $1.379. If this occurs, old swing lows near $1.080 – particularly an inefficient region starting near $0.982 – may be the bearish target and the subsequent support.

3. Ripple (XRP)

Ripple XRP is the currency that runs on a digital payment platform called RippleNet, on top of a distributed ledger database called XRP Ledger. While RippleNet is run by a company called Ripple, the XRP Ledger is open-source and is not based on a blockchain, but rather the previously mentioned distributed ledger database.

XRP Price Analysis

At the time of writing, XRP is ranked the 8th cryptocurrency globally and the current price is US$0.7548. Let’s take a look at the chart below for price analysis:

XRP also printed massive gains in H1 2021 before moving sideways for the rest of the year.

The price is in a downtrend, with the 9, 18 and 40 EMAs providing resistance on each attempt to rally. However, bulls are showing some interest at the 78.6% retracement, near $0.6952. If this level breaks, a move into possible support – just below the June and July lows near $0.4952 – seems likely.

If the price does rally through the swing high at $0.8160 – perhaps triggered by a sudden surge in Bitcoin – bulls might find some resistance at the 61.8% retracement level near $0.8350.

Overlapping swing highs and lows near $0.9436 might provide the next target, where bears forced the price down in late December immediately.

More bullish market conditions could shift targets up near the midpoint of Q3’s consolidation, near $1.0735, where higher timeframes show an inefficiently traded zone.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.