In today’s trading news, we’re looking at three Altcoins that might breakout this week by showing bullish trends in the charts.

1. Crypto Coin (CRO)

Crypto.com Coin (CRO) is the native cryptocurrency token of Crypto.com Chain — a decentralized, open-source blockchain developed by the Crypto.com payment, trading, and financial services company. Crypto.com Chain is one of the products in Crypto.com’s lineup of solutions designed to accelerate the global adoption of cryptocurrencies as a means of increasing personal control over money, safeguarding user data, and protecting users’ identities. The CRO blockchain serves primarily as a vehicle that powers the Crypto.com Pay mobile payments app.

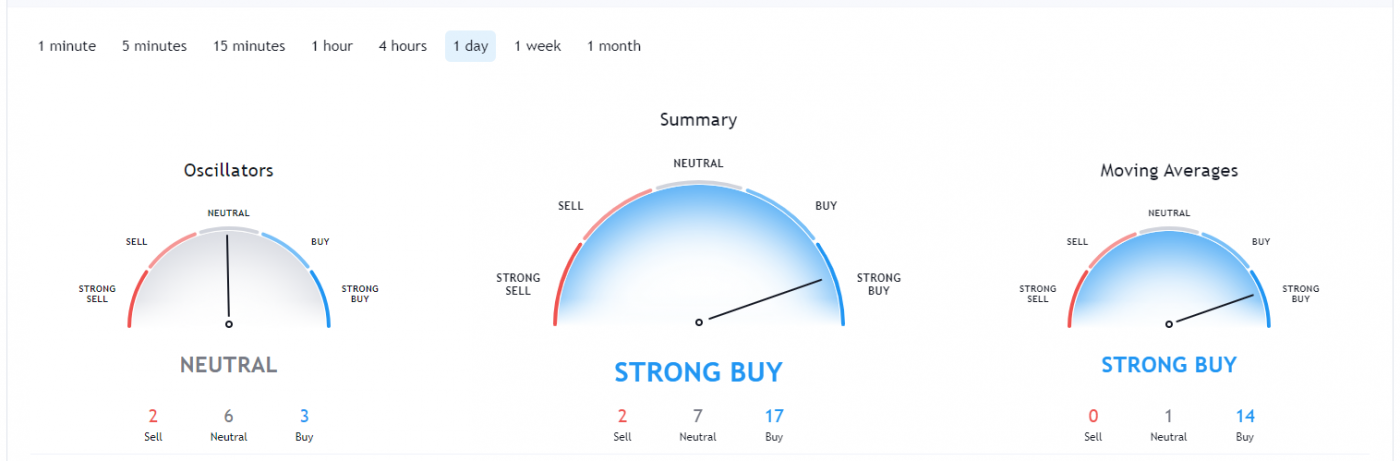

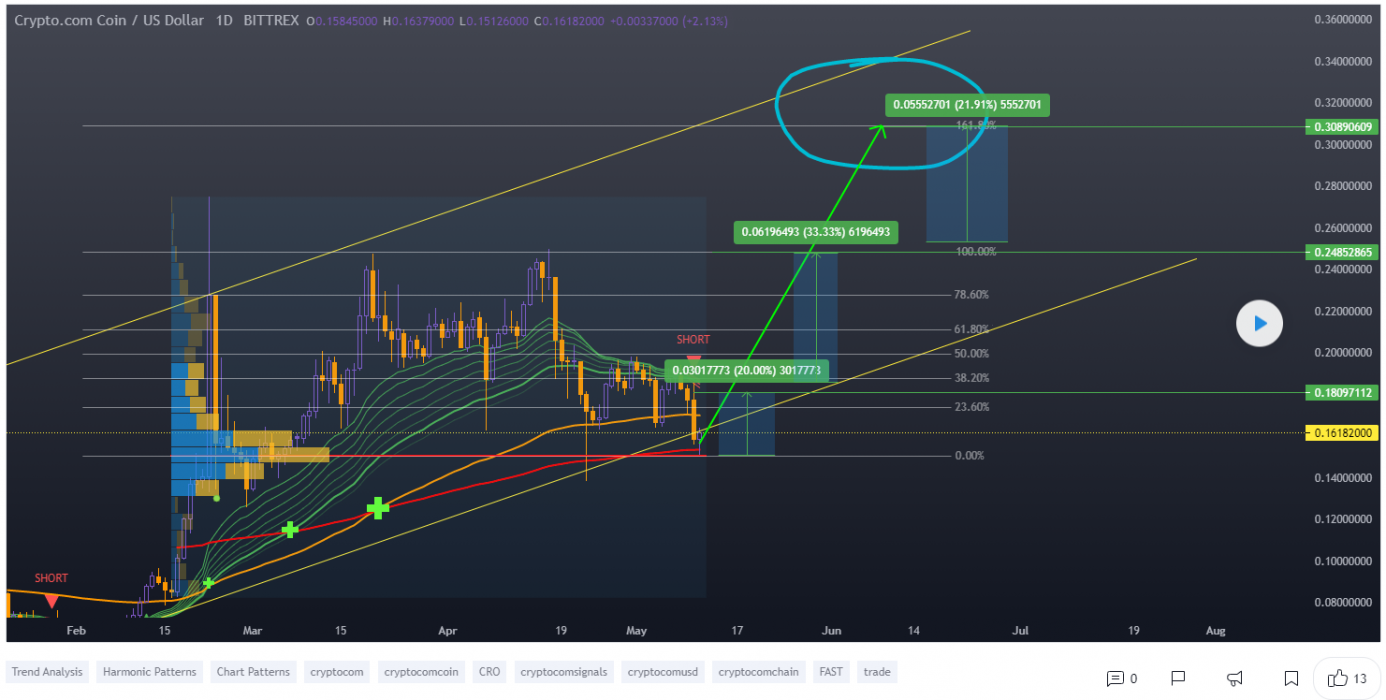

CRO Price Analysis

At the time of writing, CRO is ranked 45th cryptocurrency globally and the current price is $0.1918 AUD. Let’s take a look at the chart below for price analysis.

After climbing nearly 380% since the beginning of the year, a 115% range has trapped CRO between $0.3718 AUD and $0.1863 AUD during Q2.

A consolidation near $0.1889 AUD, visible on the weekly chart, provided support on the last touch. This level could provide support again on a stop run under the $0.1789 AUD.

A deeper run on stops at $0.1563 AUD might reach the top of a higher-timeframe gap at the same level. However, a push this low reduces the chance of a new all-time high soon. Below, little significant support exists until $0.1361 AUD.

Higher-timeframe levels overlapping with a daily gap beginning at $0.2507 AUD are likely to provide resistance, perhaps on a sweep of the equal highs near $0.2486 AUD. Breaking this resistance makes the relatively equal highs near $0.2918 AUD and the all-time high at $0.3518 AUD the next possible targets.

2. GMR Finance (GMR)

GMR Finance aims to bring the gaming community, content creators and game developers together with GMR token. Converting clips into Non-Fungible Tokens will be available with just a few clicks. A NFT is a unit of data stored on a digital ledger, called a blockchain, that certifies a digital asset to be unique and therefore not interchangeable. NFTs can be used to represent items such as photos, videos, audio, and other types of digital files.

GMR Price Analysis

At the time of writing, GMR is ranked 2949th cryptocurrency globally and the current price is 0.0000004739 AUD. Let’s take a look at the chart below for price analysis. NOTE: This is a 4h chart of GMR paired against BNB.

GMR’s euphoric early-May pump turned into a late-May dump, with little higher-timeframe support for bulls to justify entries.

Currently, the price is distributing at the 62% retracement level. A small consolidation near 0.0000004522 AUD is visible on the daily chart, with a clearer consolidation on the 4h chart. This area does have some confluence with the 79% retracement level and could offer some support in the future.

The daily gap’s midpoint near 0.0000003933 AUD has suppressed the price, although a push through this level could fill the daily gap up to 0.0000006194 AUD. A lack of sensitivity at this resistance could suggest a minor retracement before a possible move to new all-time highs.

3. Hedera Hashgraph (HBAR)

Hedera Hashgraph is a public network that allows individuals and businesses to create powerful decentralized applications (DApps). It has been called “trust layer of the internet” and it is designed to be a fairer, more efficient system that eliminates some of the limitations that older blockchain-based platforms face — such as slow performance and instability.

HBAR Price Analysis

At the time of writing, HBAR is ranked 55th cryptocurrency globally and the current price is $0.393 AUD. Let’s take a look at the chart below for price analysis.

HBAR‘s 1400% pump during Q1 ran into resistance near $0.5509 AUD on March 15th. Since then, the price has been consolidating in a 120% range between $0.3143 AUD and $0.4709 AUD.

Just below the May open, $0.3229 AUD is the first level that could provide substantial support. If the price breaks down through that, overlapping levels near $0.2281 AUD might cap a run on the lows near $0.2543 AUD and $0.2682 AUD.

The higher-timeframe analysis points to the area near $0.4306 AUD as the next substantial resistance. Significant selling has been occurring here on the daily chart. If this level breaks, the swing highs near $0.5202 AUD and $0.6109 AUD may be the next targets.

Where to Buy or Trade Altcoins?

These 3 Altcoins have high liquidity on Binance Exchange so that could help with trading. Instead, if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is a popular choice in Australia.