The Cryptocurrency NPXS just went up +74% in a single day by breaking a Rising wedge pattern with strong buying volume and surges over +120% in a week.

What is NPXS?

Pundi X (NPXS) aims to make the use of cryptocurrency as a form of payment, a reality for retailers and consumers alike. By applying the technology to a series of real-world use cases such as cards and the XPOS point-of-sale devices, the team has built products that could accept the NPXS token for goods and services. With the goals of supporting retail intelligence, marketing & loyalty programs as well as inventory & order management systems, the Pundi X Point-of-Sale device could help to support digital commerce worldwide.

NPXS Quick Stats

| SYMBOL: | NPXS |

| Global rank: | 74 |

| Market cap: | $1,483,133,873 AUD |

| Current price: | $0.007274 |

| All time high price: | $0.0201 AUD |

| 1 day: | +74.41% |

| 7 day: | +120.79% |

| 1 year: | +4313.95% |

NPXS Price Analysis

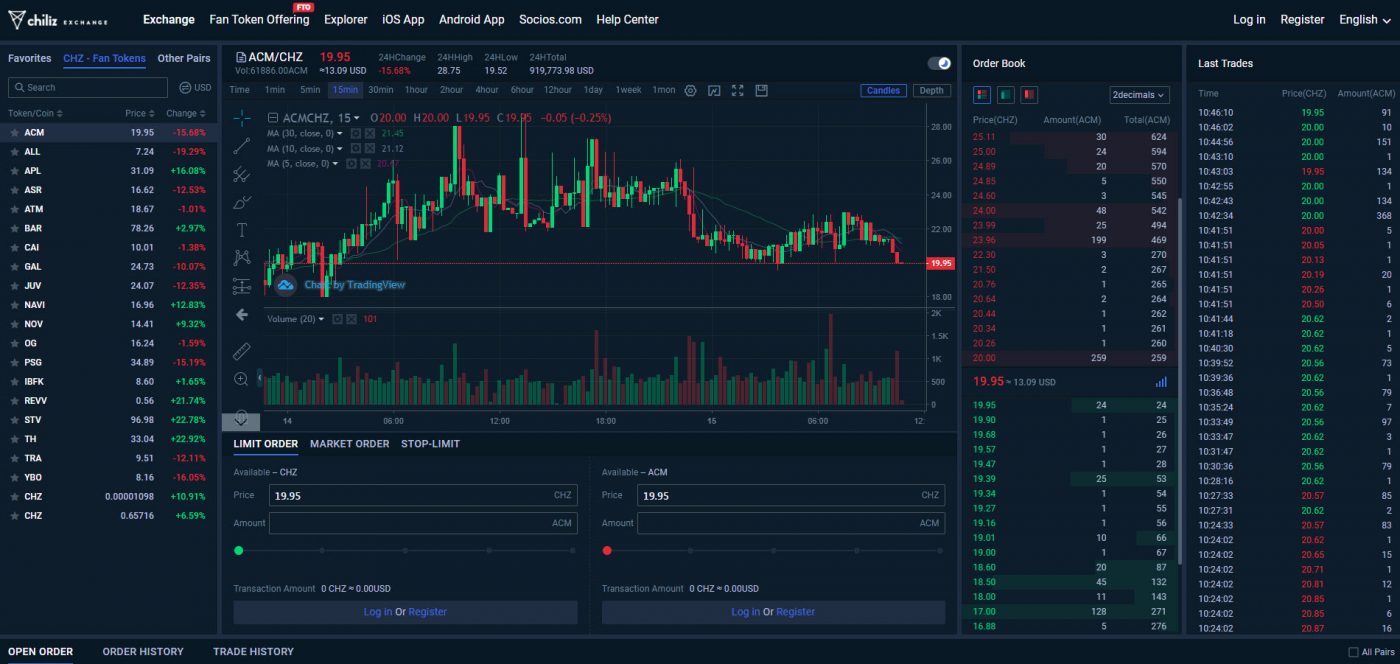

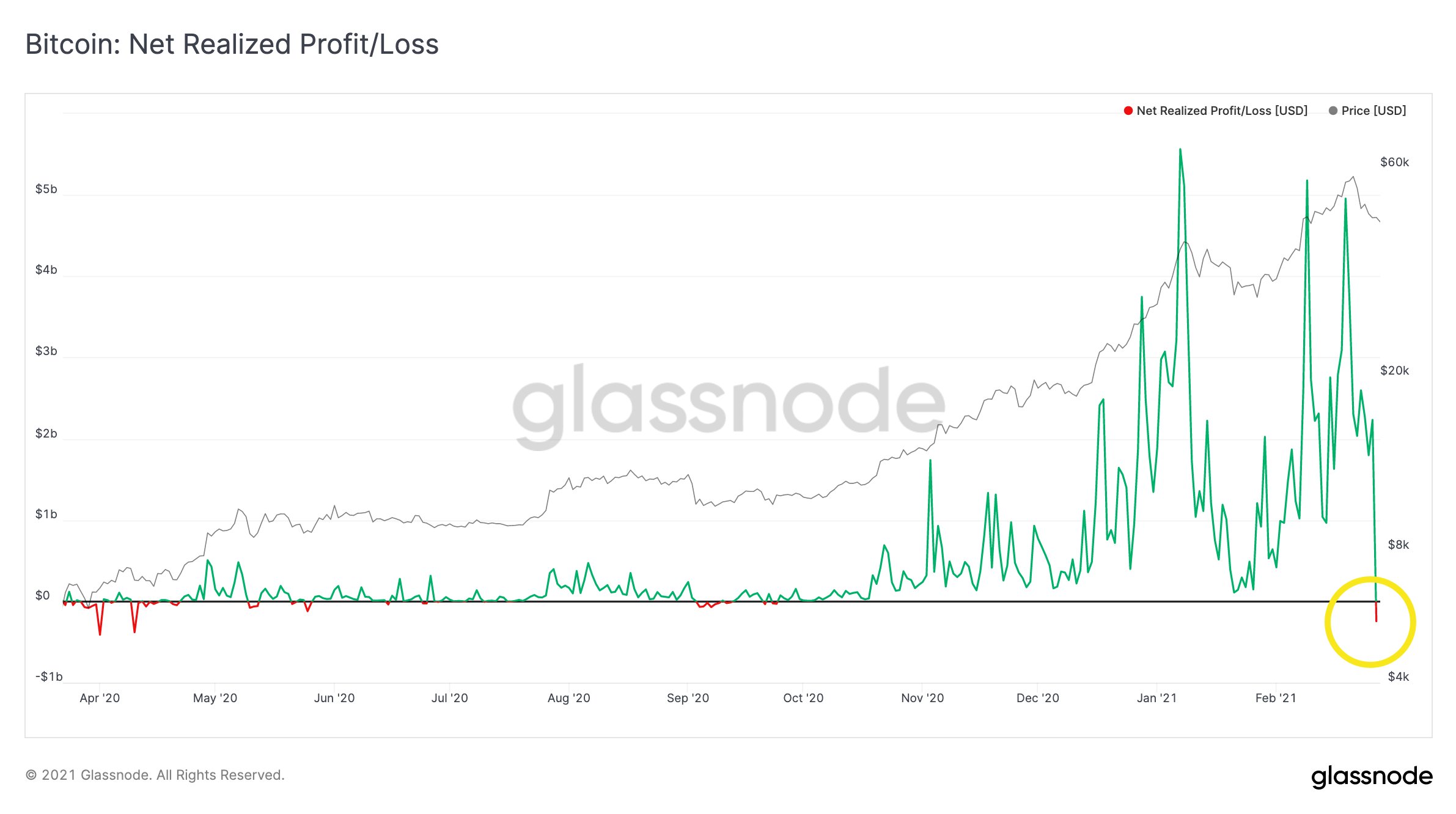

At the time of writing, NPXS is ranked 74th cryptocurrency globally and the current price is $0.007274 AUD. This is a +120.79% increase since 13th March 2021 (7 days ago) as shown in the chart below.

If we see the above 1-hour candle chart, NPXS did a strong parabolic breakout from the rising wedge pattern while trading sideways from the last few days around $0.005624 AUD price levels & is now heading towards its major resistance around $0.009588 AUD. After BTC made a new all-time high in its price and Altcoins are also rising in a bullish trend, NPXS looks well-positioned to hit the next high price levels.

“A rising wedge is a technical indicator, suggesting a reversal pattern frequently seen in bear markets. This pattern shows up in charts when the price moves upward with pivot highs and lows converging toward a single point known as the apex.”

What do the technical indicators say?

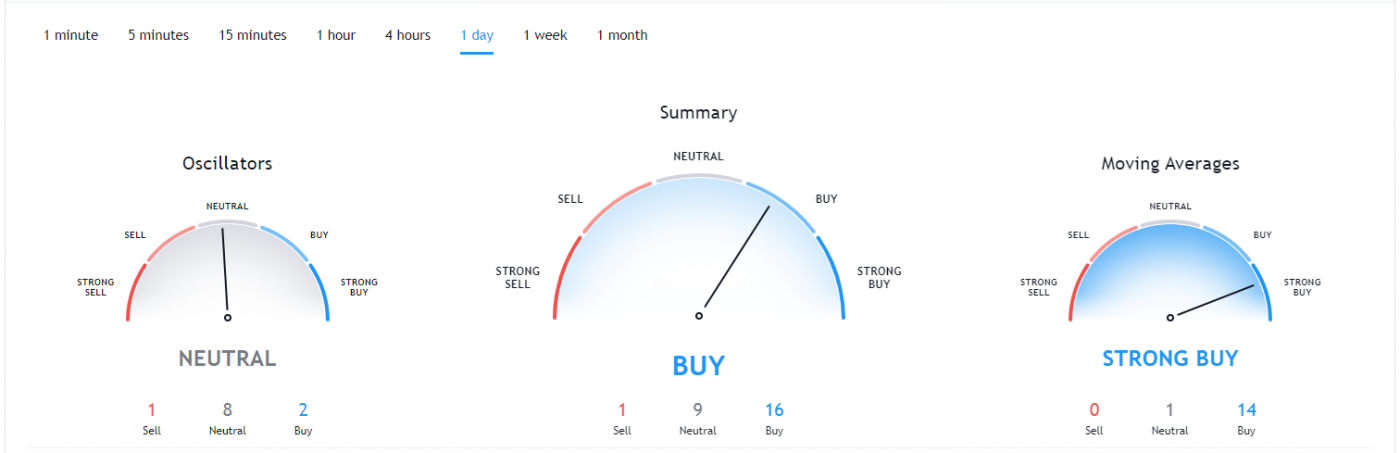

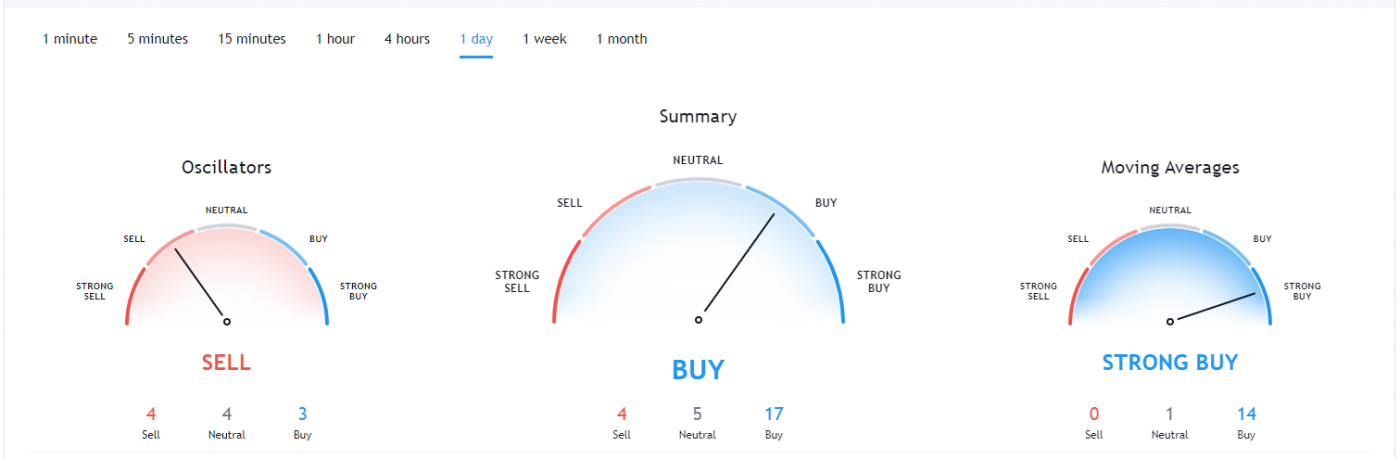

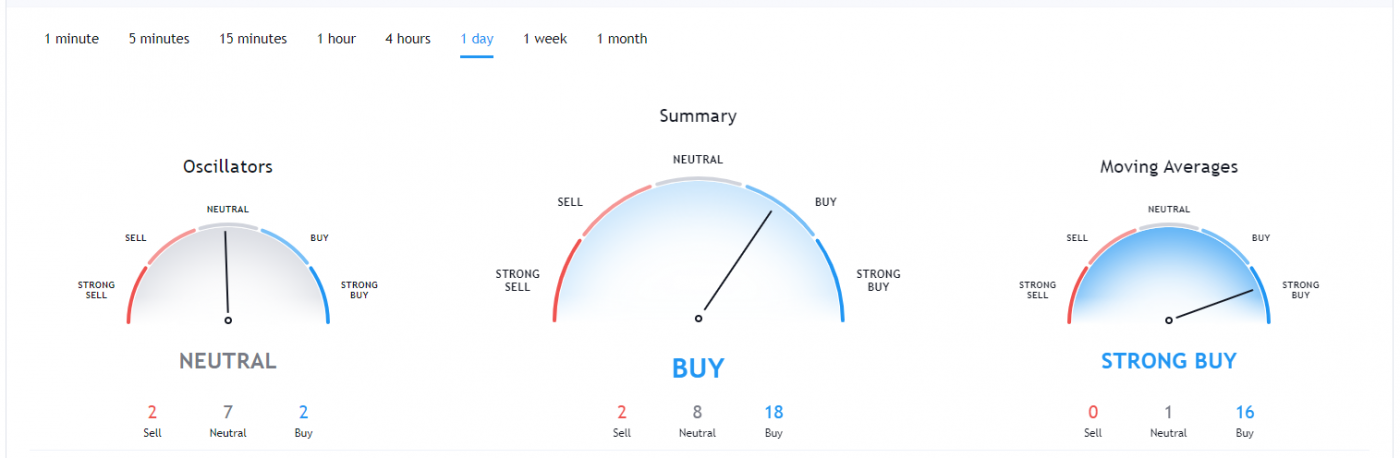

The NPXS TradingView indicators (on the 1 day) mainly indicate NPXS as a buy, except the Oscillators which indicate NPXS as a neutral.

So Why did NPXS Breakout?

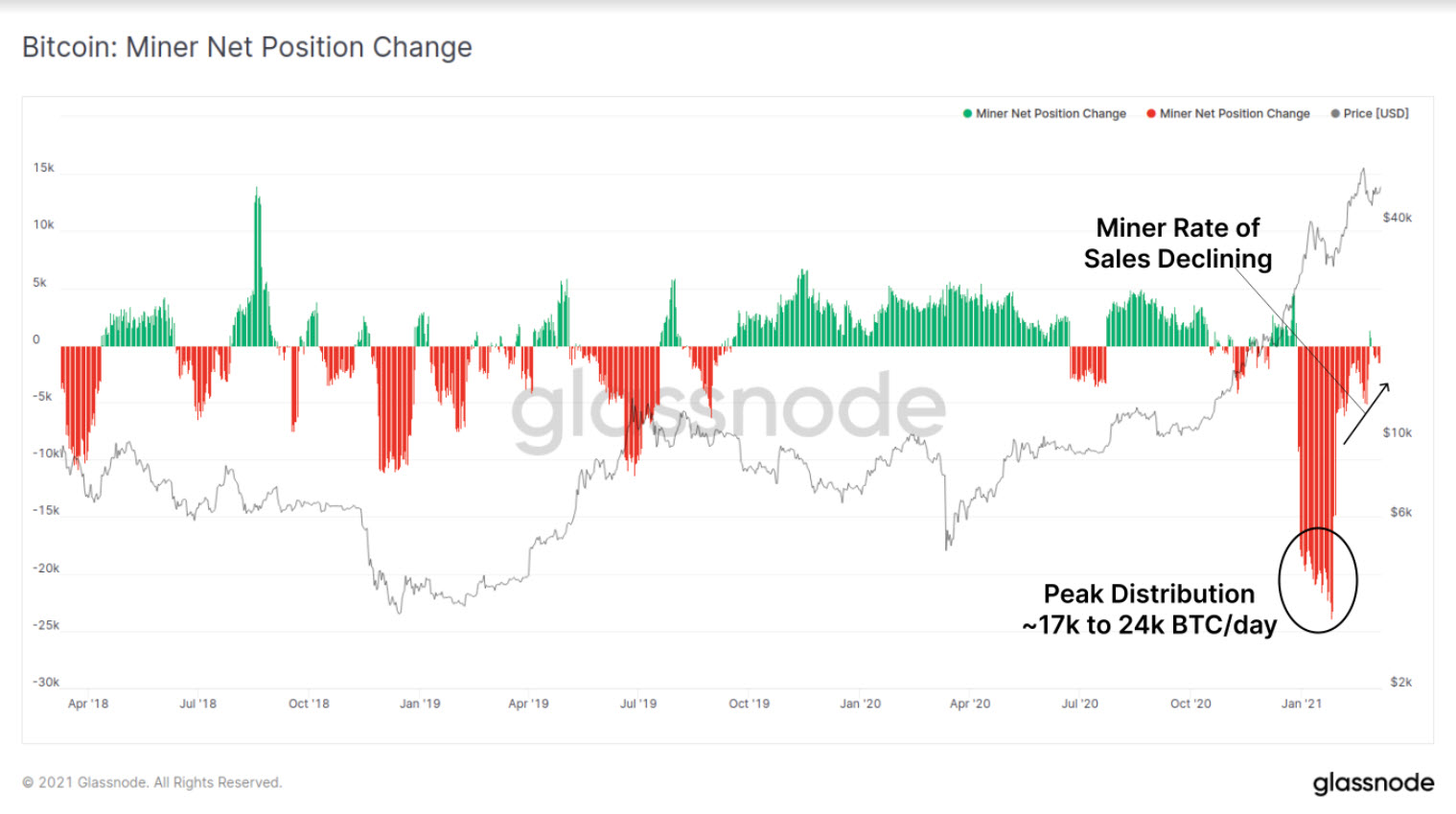

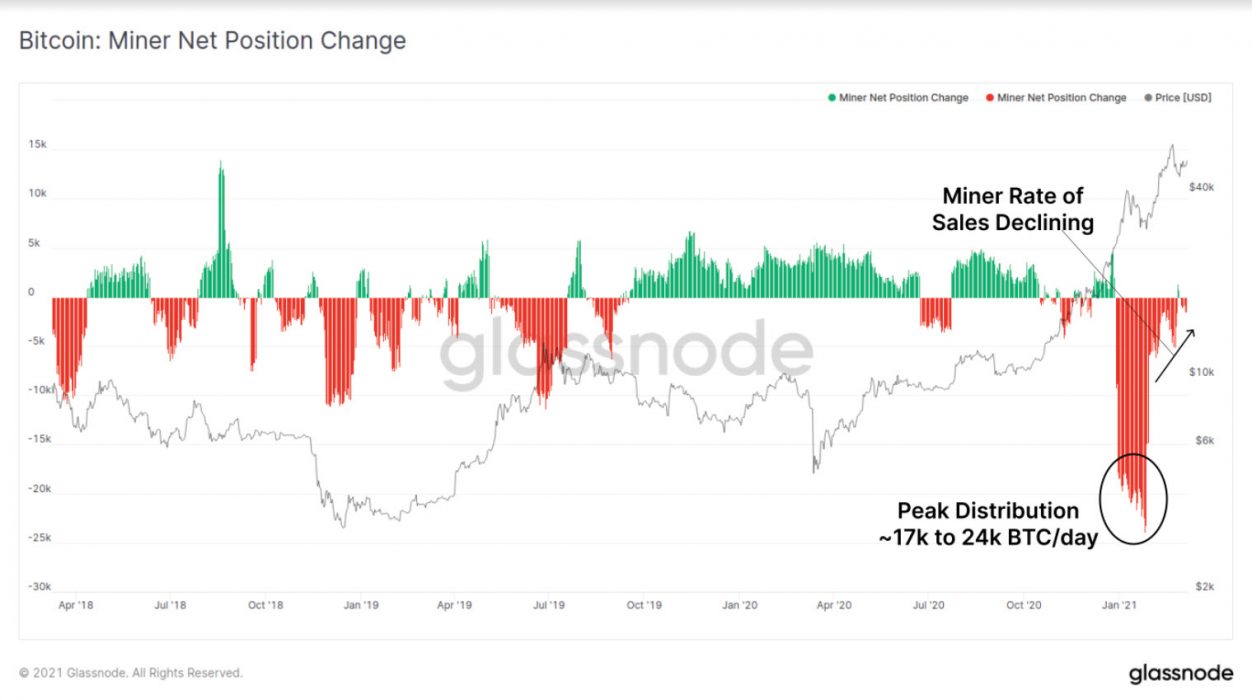

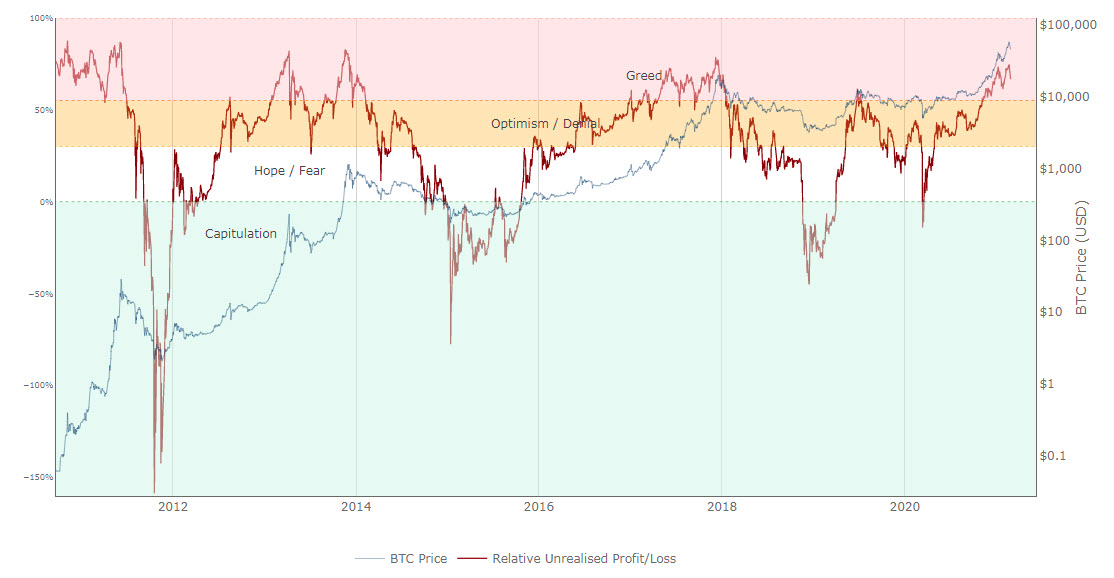

General market sentiment suggests we are in the middle of the bull run season which could have contributed to the recent breakout. Another reason for this sudden pump in price could be the whales secretly buying NPXS for the next Altcoins rally & it could also be contributed to some of the recent news of the token redenomination swap on 30th March 2021.

Recent NPXS News & Events:

- 03 October 2020 – Q3 Report

- 31 December 2020 – Coin & Token Integrations

- 31 December 2020 – LATAM Marketing Campaigns

- 31 March 2021 – XPOS Expansion to MPOS

Where to Buy or Trade NPXS?

PundiX NPXS has the highest liquidity on Binance Exchange so that would help for trading NPXS/USDT or NPXS/ETH pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.