For today’s trading news, we’re looking at three Altcoins that might breakout this week by showing bullish trends in the charts.

1. Avalanche (AVAX)

Avalanche is an umbrella platform for launching decentralized finance (DeFi) applications, financial assets, trading, and other services.

It aims to be something of a global assets exchange, allowing anyone to launch or trade any form of asset and control it in a decentralized manner using smart contracts and other cutting-edge technologies.

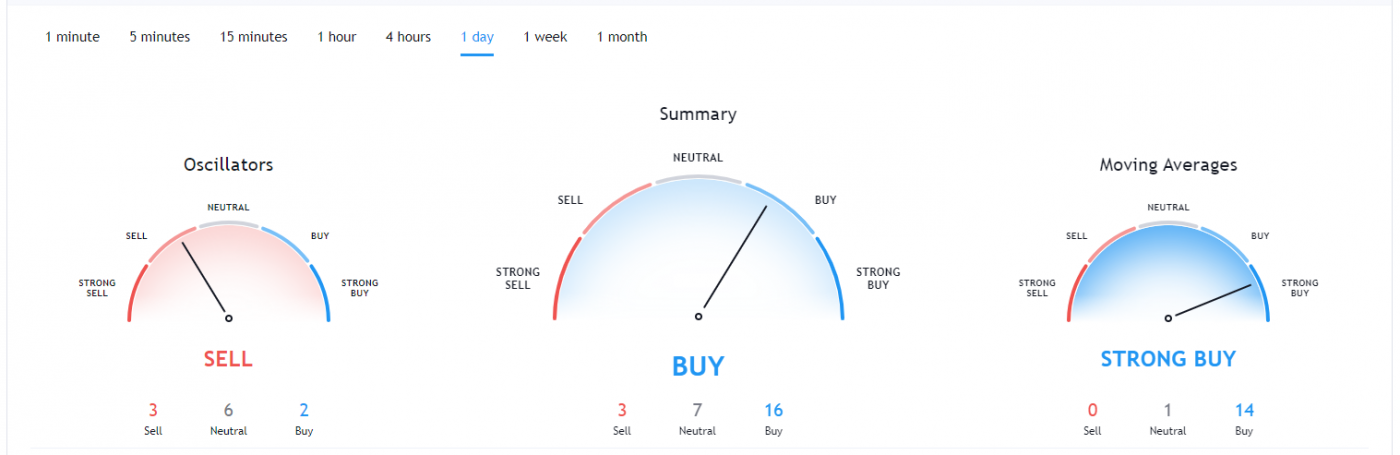

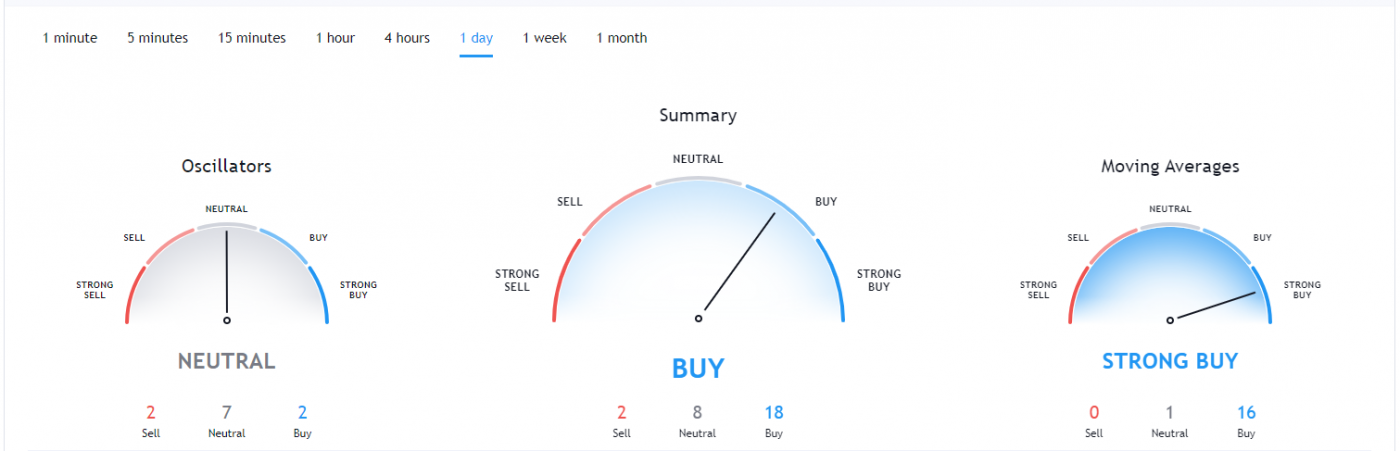

AVAX Price Analysis

At the time of writing, AVAX is ranked 44th cryptocurrency globally and the current price is $15.09 AUD. Let’s take a look at the chart below for price analysis.

January saw a nearly +430% rise in AVAX’s price, but the bulls might have more room to run.

Last week, the price ran into resistance at $13.69 AUD before sweeping lows and dropping near the four-hour chart’s 62% retracement level near $11.70 AUD.

This move created potential support beginning near $11.32 AUD, with a lower time frame support possibly forming at $12.28 AUD to give aggressive bulls an entry.

The highs near $15 AUD and $15.69 AUD provide two first probable targets. If the support beginning near $10.89 AUD continues to hold, bulls could use this retracement’s extensions to anticipate take-profit zones near $20.81 AUD and $26.93 AUD. The extensions near $18.85 AUD, $24.97AUD, and $28.58 AUD are also likely to provide intermediate-term targets.

2. Elrond (EGLD)

Elrond is a blockchain protocol that seeks to offer extremely fast transaction speeds by using sharding. The project describes itself as a technology ecosystem for the new internet, which includes fintech, decentralized finance, and the Internet of Things. Its smart contracts execution platform is reportedly capable of 15,000 transactions per second, six-second latency, and a $0.001 transaction cost.

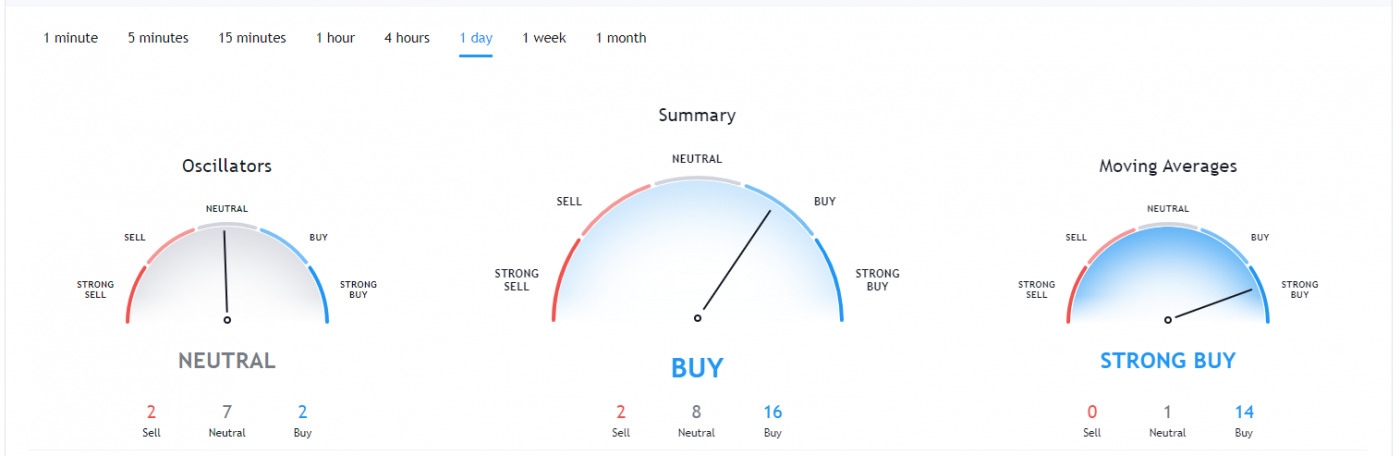

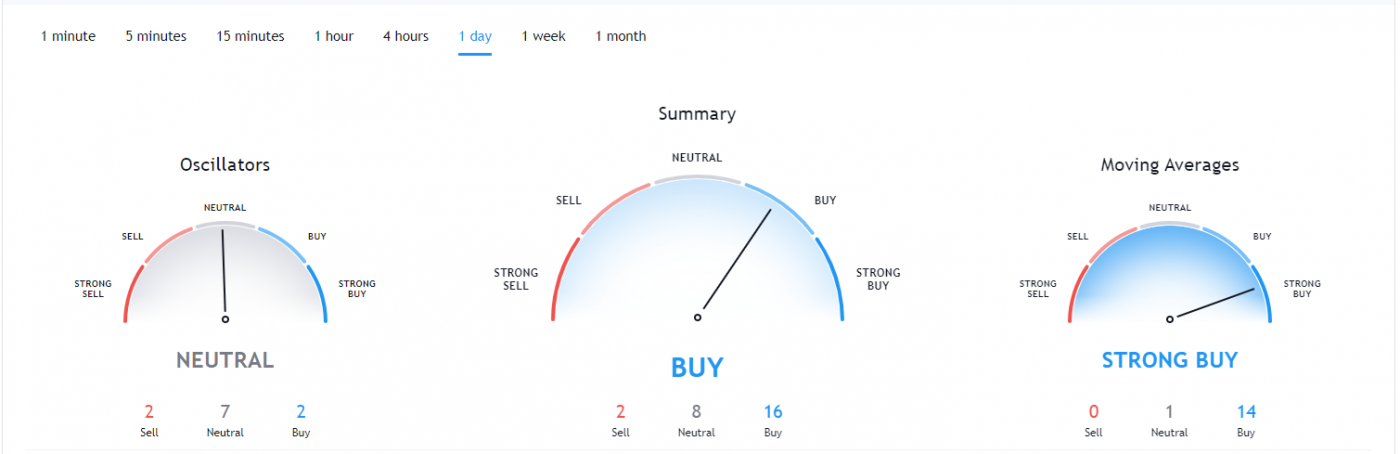

EGLD Price Analysis

At the time of writing, EGLD is ranked 48th cryptocurrency globally and the current price is $61.09 AUD. Let’s take a look at the chart below for price analysis.

EGLD has been in a strong bull trend since the beginning of Q4 2020, giving bottom-buyers nearly +660% returns to date.

This Monday, the price broke out from the accumulation range high at $60 AUD after sweeping lows near $45.64 AUD, potentially signaling the start of the next significant move upward.

Bulls could wait for a retracement near probable support beginning at $48.90 AUD, with the daily gap’s midpoint near $39.72 AUD providing a higher risk-reward entry. The relatively equal daily lows near $35 AUD could also attract a stop run, providing an attractive entry area in the broad support region between $36.34 AUD and $31.67 AUD.

The extensions near $68.35 AUD and $74.70 AUD provide probable targets, with the minor extensions near $86.47 AUD, and $98.46 AUD providing intermediate take-profit zones.

3. Verge (XVG)

Verge is a privacy-focused cryptocurrency and blockchain that seeks to offer a fast, efficient, decentralized payments network that improves upon the original Bitcoin (BTC) blockchain. It includes additional privacy features including integrating the anonymity network Tor into its wallet, called vergePay, and providing the option of sending transactions to stealth addresses.

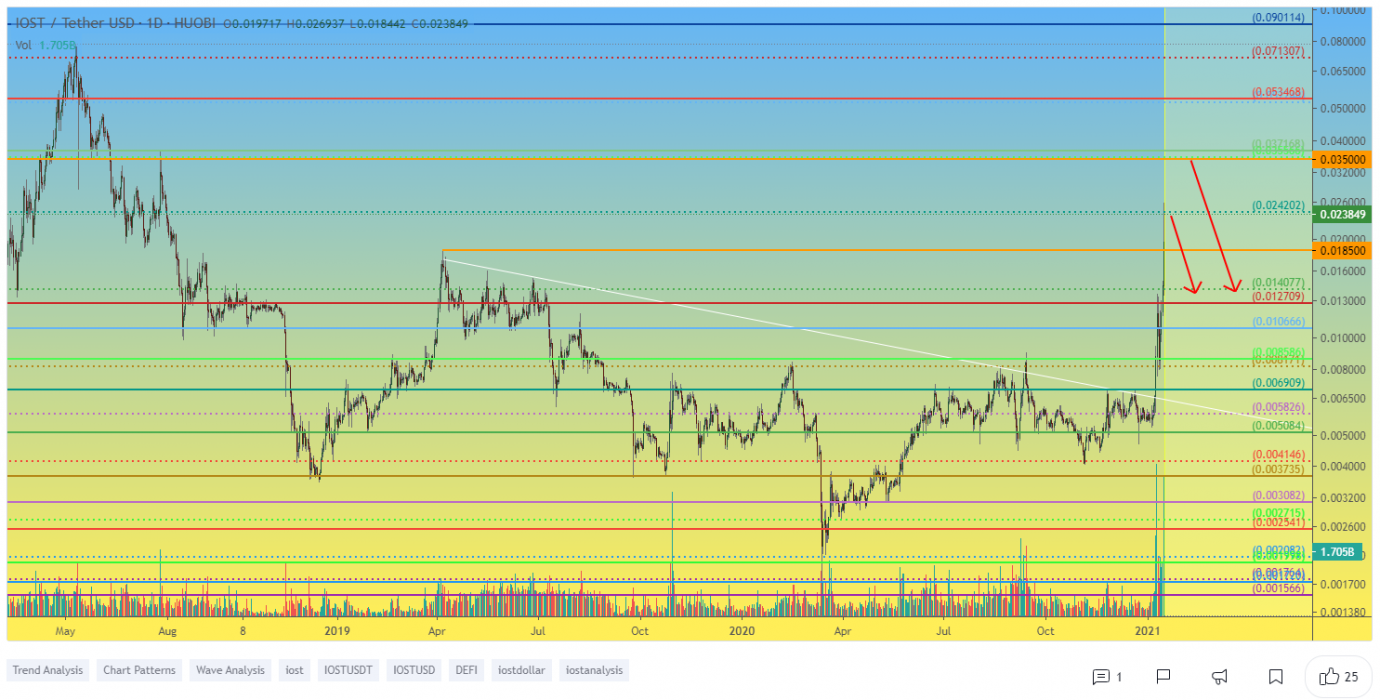

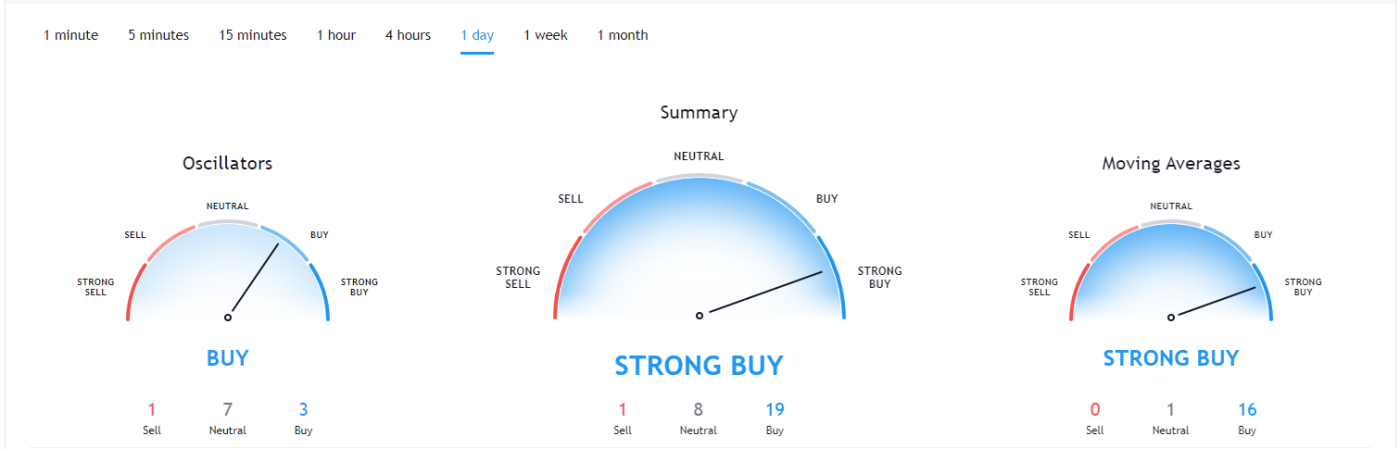

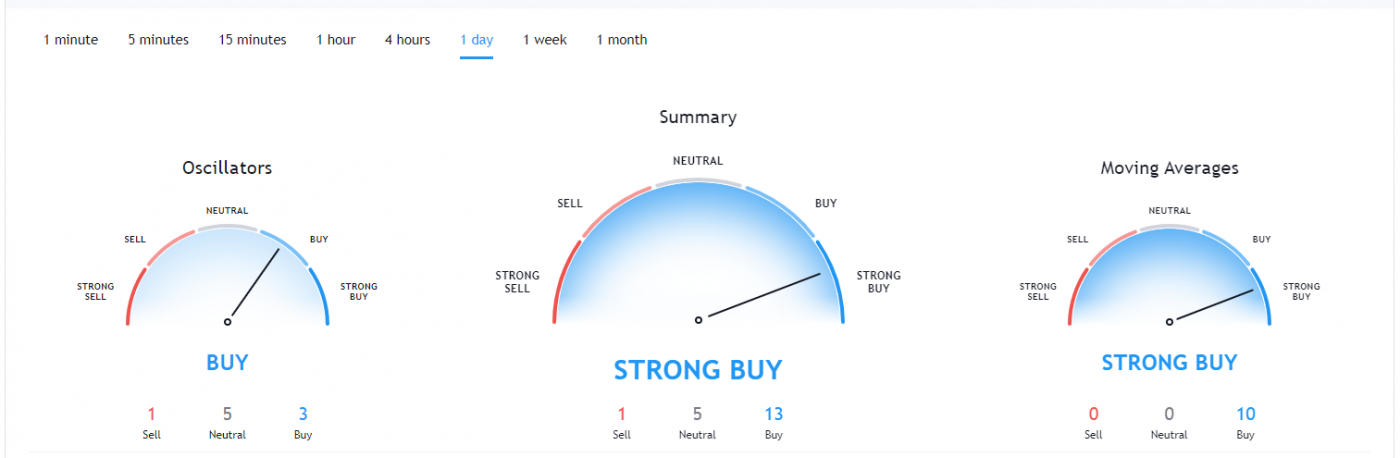

XVG Price Analysis

At the time of writing, XVG is ranked 96th cryptocurrency globally and the current price is $0.0154 AUD. Let’s take a look at the chart below for price analysis.

XVG’s +172% January rally has retraced to the move’s 70.5% retracement before spending the second half of the month accumulating above support beginning near $0.01 AUD.

Last week’s dip to retest the 70.5% retracement created potential support near $0.0117 AUD, with the early part of this week testing the weekly level at $0.0122 AUD as support. A quick dip in this region could give bulls an excellent entry targeting the first probable resistance at $0.0165 AUD.

A break of this level might run to the resistance and last swing high at $0.0182 AUD. If the swing high breaks, monthly highs at $0.0202 AUD and $0.0284 AUD provide the next likely targets. Beyond $0.0284 AUD, the price could see a parabolic move to the next monthly high near $0.0437 AUD.

Traders taking regular profits could use the extensions at $0.0271 AUD, $0.0371 AUD, and $0.0407 AUD for probable intermediate resistance zones.