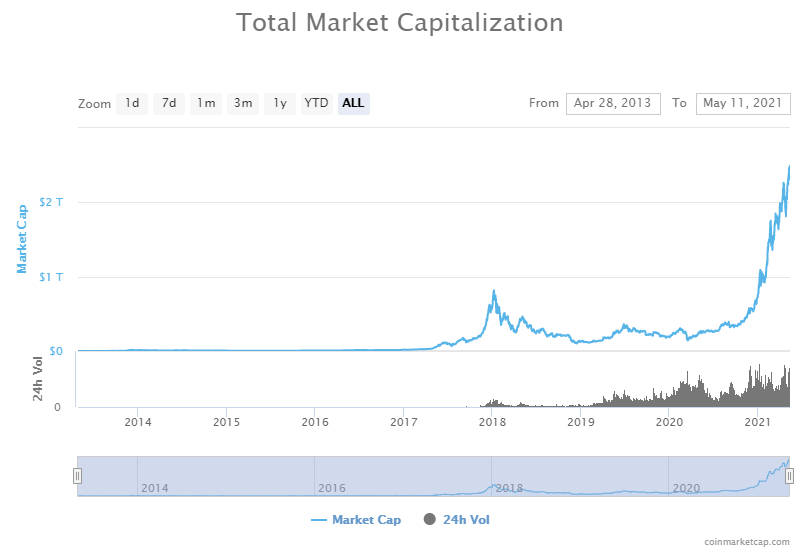

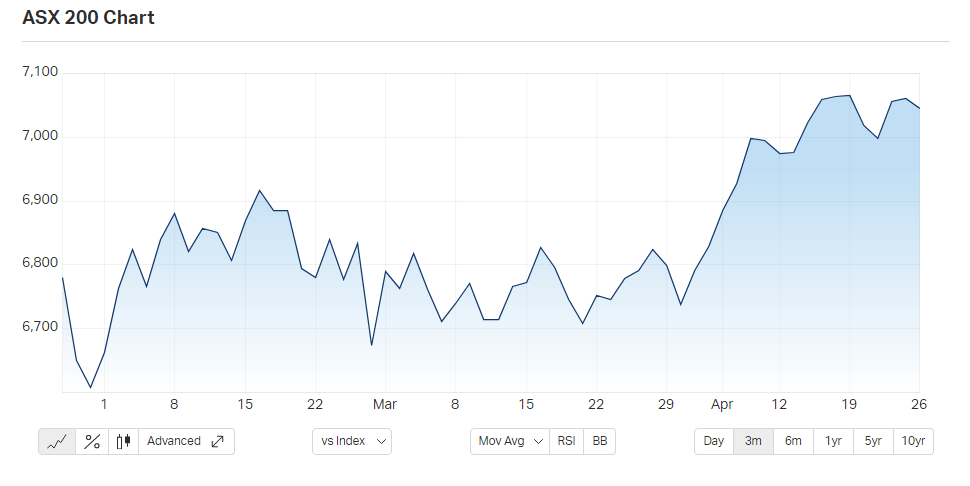

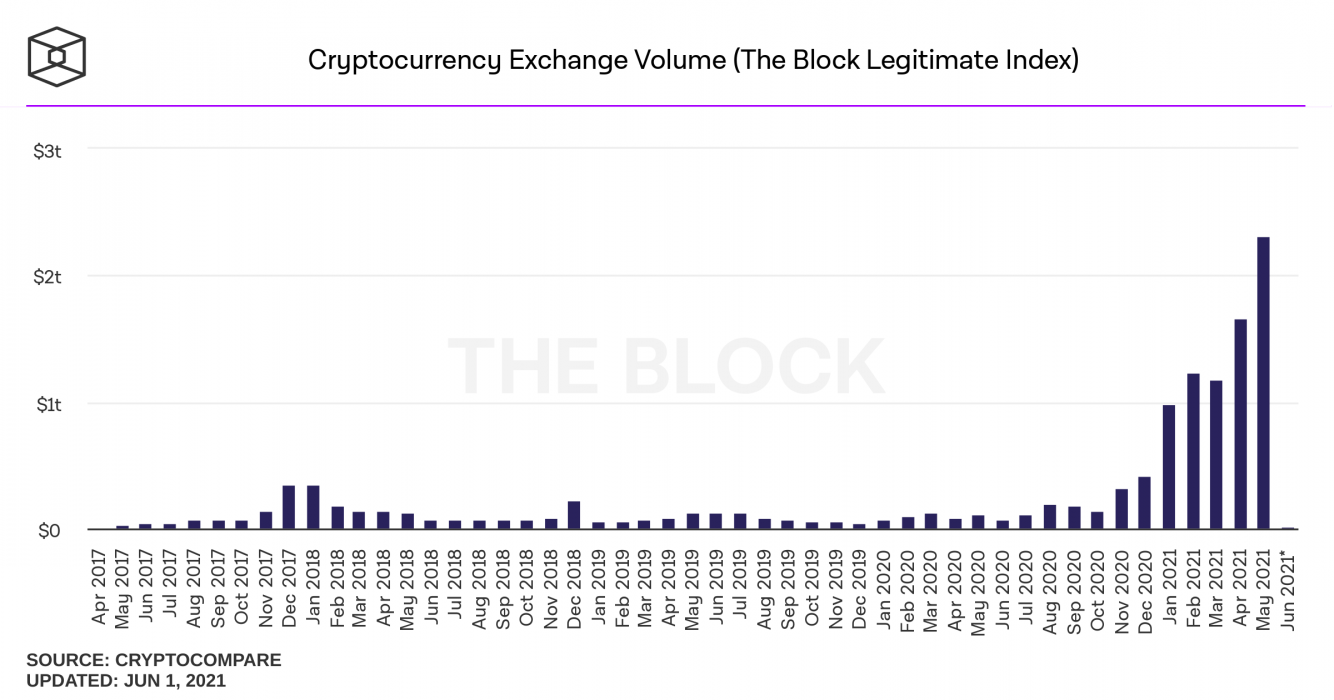

Last month, major cryptocurrency exchanges recorded a massive volume of over $2.2 trillion USD, despite the recent drops in the price of cryptocurrencies.

The volume in May represents over a 37 percent increase compared to the previous month (April – $1.66 trillion USD), according to the data from TheBlock shown below.

Crypto Exchange Volume is up 132% YTD

Following the data, crypto exchange volume has increased by 132 percent compared to the January record of $977.79 billion USD, and over 2,000 percent compared to the record of $107 billion in May last year. In February, crypto exchanges made their first +$1.2 trillion volume, which has been on the rise for four consecutive months.

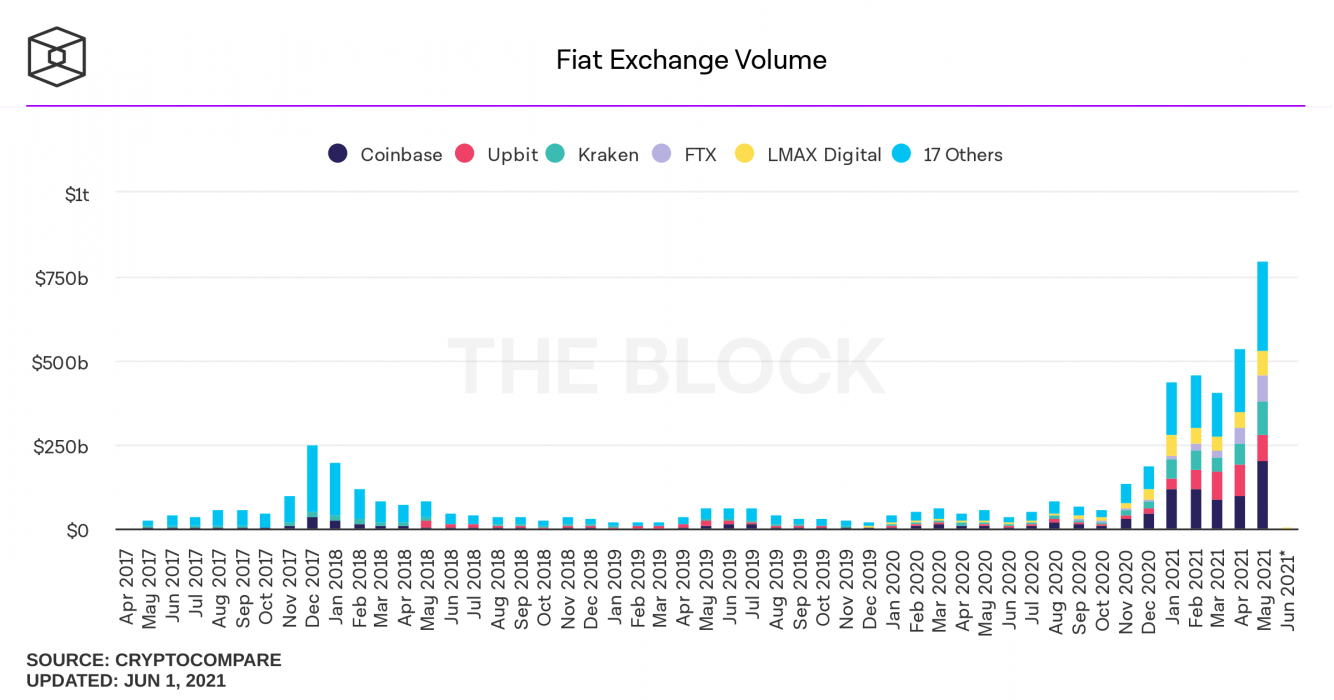

The leading crypto-to-crypto exchange, Binance, recorded over $1.5 trillion volume, which is about 66 percent of the total volume in May. Coinbase recorded the largest volume amongst fiat-to-crypto exchanges. Coinbase gained about $201 billion USD, which is approximately nine percent of the entire volume last month.

Judging by the growing trend, exchange volume is likely to increase further this month.

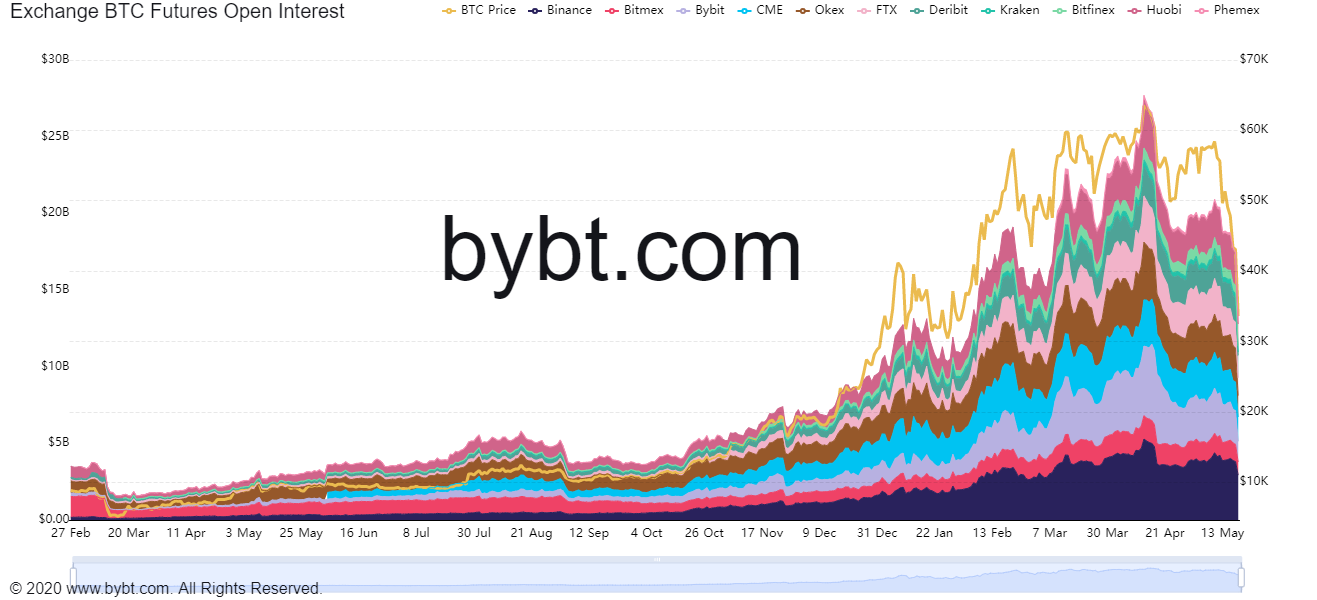

Bitcoin Futures Volumes Also On The Rise

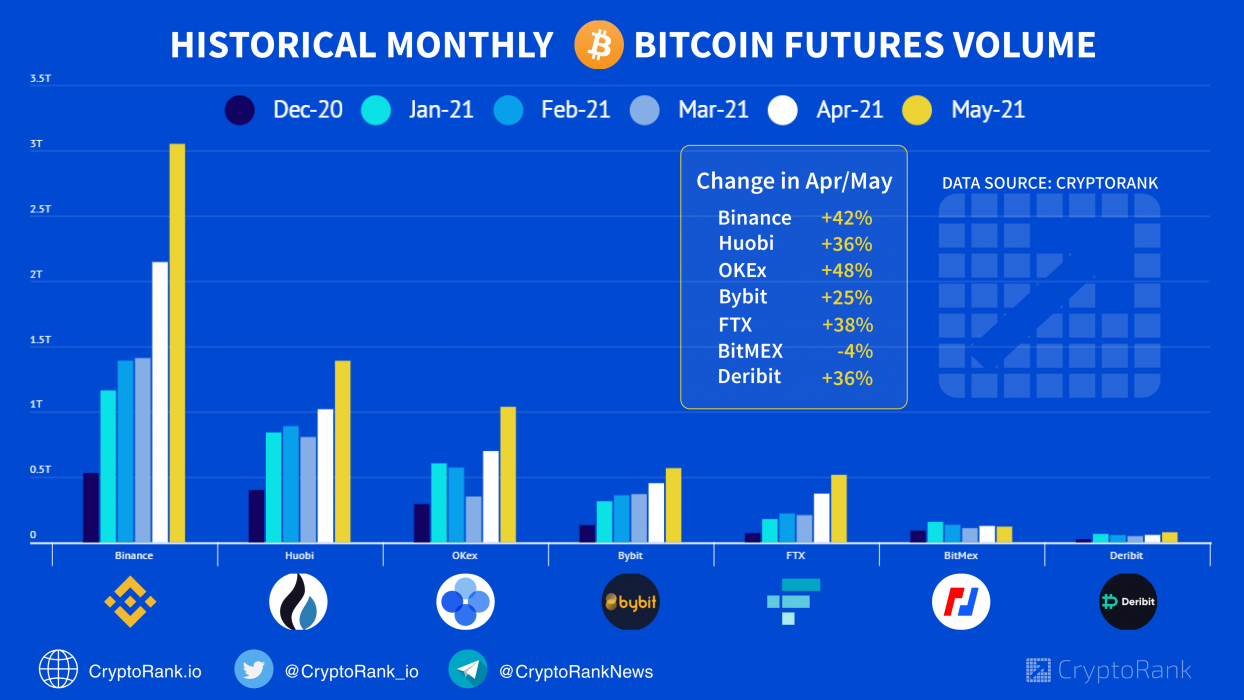

Likewise, derivative exchanges also recorded an increase in Bitcoin Futures trading volume for the past month. The volume precisely increased by 48 percent in May, led by OKEx, which gained over 48 percent in BTC Futures volume, followed by Binance (+42%), FTX (+38%).

Huobi and Deribit gained about 36 percent in volume, while BitMEX lost four percent.

At the time of writing, open interest in Bitcoin Futures totaled $11.25 billion USD, with the price of the underlying asset at $35,962 USD.